When you decide to invest in a mutual fund, you often encounter an intermediary known as a mutual fund agent, distributor, or advisor. This individual or firm helps you navigate through various fund options, advises you on the best funds for your financial goals, and facilitates the investment process. In return for these services, the agent earns a commission. This article will explore the various commission structures in detail, how agents earn, and the pros and cons of investing through an agent. So, see below the mutual fund agent commission chart.

What is a Mutual Fund Agent?

Table of Contents

A mutual fund agent is a professional who helps investors select mutual funds that align with their financial goals. They work for asset management companies (AMCs), but may also be independent brokers or advisory firms. Their role is to:

- Assist investors in understanding mutual fund products.

- Advise on the best funds based on an investor’s risk profile, time horizon, and goals.

- Facilitate the purchase and redemption of mutual funds.

How Do Mutual Fund Agents Earn?

Mutual fund agents earn a commission from the fund company for selling their products. These commissions can be of two types:

- Upfront Commission: A one-time fee paid to the agent when an investor first invests in a mutual fund.

- Trail Commission: An ongoing, recurring commission paid based on the value of the investor’s assets under management (AUM) in the mutual fund. This is paid periodically (monthly or quarterly).

Mutual Fund Agent Commission Types in Detail:

1. Upfront Commission:

The upfront commission is a one-time fee that is paid to the agent when the investor makes an initial investment in a mutual fund. This fee is typically calculated as a percentage of the amount invested by the investor.

- Equity Funds: The upfront commission for equity funds ranges from 0.5% to 1% of the invested amount.

- Debt Funds: For debt funds, the commission tends to be lower, typically between 0.25% to 0.5%.

- Hybrid Funds: These funds, which mix both equity and debt, generally have an upfront commission of 0.5% to 1%.

2. Trail Commission:

The trail commission is an annual recurring payment that agents receive based on the value of the assets under management (AUM) in the mutual fund. This payment is made throughout the duration of the investor’s holding period.

- Equity Funds: The trail commission on equity funds can range from 0.2% to 0.5% annually.

- Debt Funds: For debt funds, the trail commission is generally 0.1% to 0.3% annually.

- Hybrid Funds: These funds usually have a trail commission of 0.2% to 0.4% annually.

The key difference between upfront and trail commission is that while the upfront commission is paid only once, the trail commission is paid over time as long as the investor holds the fund. This creates an incentive for agents to ensure that investors stay invested for the long term, which aligns their interests with those of the investor.

3. Commission for Direct Plans:

Direct plans are mutual fund plans where the investor bypasses the agent or intermediary and invests directly with the fund house. Since no agent is involved, there is no commission paid to anyone.

- Lower Expense Ratios: Since direct plans do not involve an intermediary, the expense ratio is typically lower, making them more cost-effective for investors.

- No Commission: Since the agent doesn’t receive a commission, direct plans generally have a lower overall cost. However, investors must be knowledgeable enough to select the right mutual fund.

4. No Entry Load (in Most Countries):

Many countries, including India and the U.S., have eliminated entry loads (also known as upfront sales loads), which means mutual fund houses can no longer charge investors a fee when they make an investment in the fund. Instead, the agent earns through upfront or trail commissions as described above.

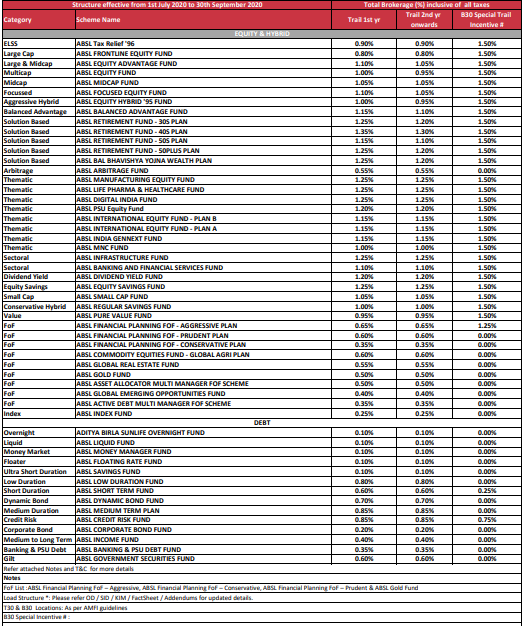

Mutual Fund Agent Commission Chart:

The commission structure varies across different types of mutual funds, depending on the investment vehicle (e.g., equity, debt, hybrid, etc.) and whether it’s a regular plan or a direct plan. Below is a sample commission chart showing approximate percentages for upfront and trail commissions.

| Fund Type | Upfront Commission | Trail Commission |

|---|---|---|

| Equity Funds | 0.5% – 1% | 0.2% – 0.5% |

| Debt Funds | 0.25% – 0.5% | 0.1% – 0.3% |

| Hybrid Funds | 0.5% – 1% | 0.2% – 0.4% |

| Index Funds | 0.25% – 0.75% | 0.1% – 0.25% |

Commission for Different Types of Mutual Fund Plans:

- Regular Plans: These plans involve an intermediary, and agents receive both upfront and trailing commissions.

- Direct Plans: In direct plans, no intermediary is involved, so no commission is paid.

See below the Mutual Fund Agent Commission Chart in PDF format.

Impact of Commissions on Investors:

1. Higher Costs for Regular Plans:

Investors in regular plans (through agents) end up paying higher costs due to commissions. The extra costs might not seem significant initially, but over a long investment horizon, they can add up and eat into returns.

2. Direct Plans Cost-Effective Option:

Investing directly in a fund (through direct plans) is generally cheaper since the investor avoids paying intermediary fees. However, choosing a direct plan requires a certain level of investment knowledge and understanding of financial products.

3. Impact on Returns:

Commissions can affect the overall return on investment (ROI). An investor who opts for a regular plan might see a smaller net return than one who chooses a direct plan due to the higher expense ratio in regular plans. For instance:

- Expense ratio for regular plans: Typically 0.5% to 1% higher than direct plans.

- Expense ratio for direct plans: Typically lower, without the extra fees for intermediaries.

Pros and Cons of Using a Mutual Fund Agent:

Pros:

- Expert Guidance: An agent provides personalized financial advice, helping investors select the right funds.

- Convenience: Agents assist with paperwork, fund selection, and transactions, making the process easier for investors who may not be familiar with the financial markets.

- Ongoing Support: Agents often provide continuous support, answering questions and helping investors manage their portfolio.

Cons:

- Higher Costs: Due to the commission structure, regular plans tend to have higher expense ratios compared to direct plans.

- Conflict of Interest: Agents may sometimes recommend funds that offer higher commissions, even if they are not the best options for the investor.

- Lack of Transparency: Some investors may not fully understand how much they are paying in commissions or how it affects their returns.

Conclusion:

Understanding the commission structure of mutual fund agents is crucial for any investor. While agents provide valuable advice and services, investors must weigh the costs associated with mutual fund commissions. Opting for direct plans can save money, but requires more effort and knowledge in fund selection.

Ultimately, investors need to make an informed decision about whether they want to go through an agent (and pay higher commissions) or opt for direct plans to keep costs low. For those who need guidance or are new to investing, working with an agent can be beneficial, but they should ensure they’re comfortable with the costs involved and the value they are receiving in return.

By evaluating the different types of plans, commissions, and understanding the long-term effects on their investment returns, investors can make smarter, more cost-effective decisions aligned with their financial goals.

FAQ:

Q. What are the primary types of commissions for mutual fund agents?

A. Mutual fund agents, also known as Mutual Fund Distributors (MFDs), typically earn through two main types of commissions:

Upfront Commission: A one-time payment received at the time of the initial investment. This commission usually ranges from 0.5% to 1.5% of the investment amount, depending on the mutual fund type and distributor agreement.

Trail Commission: An ongoing commission paid at regular intervals (e.g., monthly, quarterly, or annually) for as long as the investor remains invested in the mutual fund scheme. The trail commission is calculated as a percentage of the average assets under management (AUM) and serves as a recurring income for distributors.

Q. How much commission do mutual fund agents typically earn?

A. The commission rates for mutual fund agents can vary based on several factors, including the type of mutual fund scheme and the distributor’s agreement with the Asset Management Company (AMC). Generally:

- Equity Mutual Funds: Higher commission rates, often ranging from 0.1% to 2% of the investment amount or AUM.

- Debt Mutual Funds: Lower commission rates compared to equity funds.

It’s important to note that these rates can vary, and agents should refer to the specific commission structures provided by the AMCs they are associated with.

Q. What factors influence the commission rates for mutual fund agents?

A. Several factors can impact the commission rates:

- Type of Mutual Fund Scheme: Equity funds generally offer higher commissions than debt funds.

- AMC Policies: Each AMC may have its own commission structure based on its internal policies and objectives.

- Distribution Channel: Commissions can vary depending on whether the investment is made through direct plans (which have 0% commissions) or regular plans.

- Geographical Location: Investments from cities beyond the top 30 (B-30 cities) may attract higher commissions to encourage penetration in these areas.

Q. How do direct and regular mutual fund plans differ in terms of commissions?

A. Direct Plans: These are purchased directly from the AMC without involving any intermediaries. As a result, they have 0% commissions, leading to a lower expense ratio and potentially higher returns for investors.

Regular Plans: These involve intermediaries like mutual fund agents, and the commissions paid to these agents are included in the expense ratio, which is higher compared to direct plans.

Q. Are there any additional incentives or rewards for mutual fund agents?

A. Yes, beyond standard commissions, AMCs may offer additional incentives to agents based on performance metrics such as business volume, client retention, and the acquisition of new investors. These incentives can include:

- Performance Bonuses: Extra payouts for achieving specific sales targets.

- Contests and Recognition Programs: Opportunities to earn rewards or recognition through AMC-organized contests.

- Training and Development Programs: Access to exclusive training sessions to enhance skills and knowledge.

Q. How can one become a mutual fund agent in India?

A. To become a mutual fund agent:

- Educational Qualification: Minimum of 10th standard pass or equivalent.

- Training: Complete the required training modules provided by the National Institute of Securities Markets (NISM).

- Examination: Pass the NISM Series V-A: Mutual Fund Distributors Certification Examination.

- Registration: Obtain an ARN (AMFI Registration Number) by registering with the Association of Mutual Funds in India (AMFI).

- Empanelment: Empanel with various AMCs to start distributing their mutual fund schemes.