The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a retirement cum pension scheme that has been undertaken by the Govt. of India on 4th May 2017 for the senior citizens of the country. This is a pension scheme for senior citizens.

Under this scheme, the option of a monthly pension is mandatory for senior citizens of 60 years or more, an interest rate of 10 percent is required for them.

Since this is a scheme through the Life Insurance Corporation (LIC) of India, LIC agents get a commission on PMVVY. But how much is a LIC agent commission on PMVVY? Let’s know about the commission ratio on the senior citizens saving scheme.

What is Pradhan Mantri Vaya Vandana Yojana (PMVVY)?

Table of Contents

PMVVY or Pradhan Mantri Vaya Vandana Yojana scheme by the Indian Government is a pension cum retirement plan. This scheme is subsidized by the Indian government as well as was launched on 4th May 2017.

The purchase price of the program is the sum of money that the buyers invested. The system gives a secured rate of return for financial investments since the sovereign guarantees it.

The frequency of payments under the plan can be every month, every quarter, every half-year, or yearly. The PMVVY is a great substitute for conventional bank deposits.

Eligibility Criteria Of Pradhan Mantri Vaya Vandana Yojana

The requirements that people must fulfill to be qualified for the PMVVY program are listed down:

- Minimum entry age: The person must be of 60 years old or more.

- Maximum entry age: No limitation.

- Policy duration: The policy term is 10 years.

- The applicant must be an Indian citizen.

When determining the maximum pension ceiling, the entire family is taken into account. The retiree, his or her dependents, along with their spouse make up the family underneath this program.

- The minimum pension given under this PMVVY scheme is as follows:

- Monthly- INR 1,000

- Quarterly- INR 3,000

- Half-Yearly- INR 6,000

- Yearly- INR 12,000

- The maximum pension given under this PMVVY is as follows:

- Monthly- INR 9,250

- Quarterly- INR 27,750

- Half-Yearly- INR 55,500

- Yearly- INR 1,11,000

- Under the PMVVY, the entire purchase price cannot be more than INR 15 lakh.

Benefits Of Pradhan Mantri Vaya Vandana Yojana

PMVVY has the following benefits available in this Scheme are as follows:

Pension Payment Modes–

PMVVY promises a secure return of 8% annually as soon as it’s payable monthly (It’s equal to 8.30% yearly) for 10 years. It’s higher than FB (4% to 6% max) as well as bank return (3% to 4%).

Maturity Benefit –

The purchase amount as well as the final pension installment will be given to the scheme’s subscriber if he or she is still alive at the end of the policy’s 10-year term.

Death Benefit –

One of the key advantages of PMVVY is that the beneficiary will receive a full refund of the purchase price if the pensioner passes away during the first ten years of the policy.

Tax Exemption –

The Goods and Services Tax or GST is not applied to the returns made under this program. The deposits made in the program are exempt from income tax under Section 80C of the Income Tax Act of 1961.

No Effect Of Market Volatility –

This plan is supported by the government. The government decides the interest rate each year; it is not determined by the market. As a result, the investment is unaffected by market volatility.

Multiple Payout Options –

This program offers subscribers a variety of payout options for quarterly, half-yearly, monthly, or annual pension payments. This crucial aspect of PMVVY is what makes it a well-liked scheme.

Loan Facility –

The program also offers the option of borrowing around 75% of the total purchase price. The financing facility is available three years after policy enrollment. For the fiscal year 2016–17, the applicable interest rate is 10% per annum.

Premature Exit –

Additionally, it permits early termination of the plan in exchange for paying medical bills for any serious disease suffered by the self or spouse.

Surrender Value-

Under rare circumstances, such as whenever the pensioner needs money to pay for the care of any serious or terminal sickness of themselves or their spouse, the scheme permits early termination throughout the policy. In these circumstances, the pensioner will receive the surrender value, which is equal to 98% of the purchase price.

Promotion of Silver Economy –

Elderly retirees will receive monthly pensions from PMVVY. They will use this pension to pay for daily expenses and medical needs. This will boost consumer spending, which will result in the creation of jobs.

Government Subsidy –

If the interest promised when registration differs from the interest earned at the termination of the term. Then, the GOI will provide funding for the administrative costs, which will then be repaid to the Corporation.

Free Look Period-

In case an insured is dissatisfied with the plan, he or she may return it to the LIC within 15 days (or 30 days if the insurance was bought online) of the policy receipt date, along with a statement of the reasons why. The purchase price paid by the policyholder, less any applicable pension and stamp duty fees, is the amount that will be reimbursed during the free look period.

Drawbacks of This Scheme

The Pradhan Mantri Vaya Vandana Yojana has a few drawbacks also, for the scheme. Let’s look at the drawbacks here:

- Pension benefits are taxed. Since PMVVY will raise your income if you already receive a pension or are paying taxes at a 20% or 30% rate, your earnings from the plan will be lower as a result.

- The minimum is INR1000, and the highest is INR 10,000. As this amount is fixed for a family, you cannot go over RS 10,000. In other words, no household of two or more elderly citizens may enroll in this plan. You shouldn’t solely rely on this pension plan if you don’t have any other income. This boosts recordkeeping and monitoring because it forces you to consider different investing options. (With the cap rising to $15 lakh currently, the pension will double in 2018)

- Suppose the investor lived longer than the tenure. Given that the tenure is only 10 years, most investors will face reinvestment risk beyond that time.

- The strategy is not movable. Only extraordinary circumstances, such as a serious disease in oneself or one’s spouse, will permit surrender. Therefore, after investing, liquidity is severely restricted.

- Considering the relatively conservative portfolios most financial planners manage, 8% taxed is a fairly poor return. In a portfolio with a moderate risk tolerance, one should strive for increased post-tax income as well as beat inflation by 4% to 5%. To increase returns, alternative investments like mutual funds and tax-free shares can be bought.

Documents Needed for PMVVY Scheme

The following documents must be submitted to subscribe to the PMVVY scheme:

- PAN card

- Aadhaar card

- Address Proof

- Age Proof

- Bank passbook

- Income Proof

- Documents showing that the person has retired from the profession

- Applicant’s Passport size photo

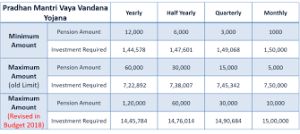

Purchase Price Payment for Various Periodic Payouts

By depositing the purchase money in a lump sum, interested parties can purchase the PMVVY scheme in monthly, quarterly, half-yearly, or yearly payout modes. When choosing this plan, a buyer has the option of choosing the purchase price or the pension amount. For a better understanding of this system, look at the highest and lowest purchasing costs.

Maximum Purchase Price For Different Pension Modes

Monthly- 15,00,000 Maximum purchase price and 9,250 per month Corresponding pension amount

Quarterly- 14,89,933 Maximum purchase price and 27,750 per Quarter Corresponding pension amount

Half-yearly- 14,76,064 Maximum purchase price and 55,500 per half-year Corresponding pension amount

Yearly- 14,49,086 Maximum purchase price and 1,11,000 per annum Corresponding pension amount

Minimum Purchase Price For Different Pension Modes

Monthly- 1,62,162 Minimum purchase price and 1,000 per annum Corresponding pension amount

Quarterly- 1,61,074 Minimum purchase price and 3,000 per Quarter Corresponding pension amount

Half-yearly- 1,59,574 Minimum purchase price and 6,000 Half-year Corresponding pension amount

Yearly- 1,56,658 Pension Minimum purchase price and 12,000 per annum Corresponding pension amount

Application Procedure for The Scheme

There are several methods to join the PMVVY program:

i) PMVVY Scheme Offline Procedure

- Go to the nearest LIC office

- Collect an application form

- Duly fill out the form

- Submit it by attaching all required documents to your nearest LIC branch office.

- After the verification procedure of your documents, the policy will be activated

- The pension payments would be paid through Aadhaar Enabled Payment System or the NEFT.

ii) PMVVY Scheme Online process:

- Open the official website of LIC and login

- By scrolling down the website, select “Buy Online Policies” and then click the “Click here” button.

- Select the ‘Pradhan Manti Vaya Vandana Yojana’ option from the ‘Buy Policy Online’ menu.

- There will be a new page. Select “Click to Buy Online” from the menu.

- Click the “Proceed” button after entering the contact information.

- Complete the application.

- To finish the registration, submit the application online, upload the necessary papers, and click the “Submit” button.

- The Aadhaar Enabled Payment System or NEFT would be used to send the pension payment.

Do You Want To Invest In The PMVVY Scheme?

There are now very few guaranteed return options available to senior persons. For the following ten years, 7–8% is not at all bad. It is significantly better than Fixed Deposit, which is currently between 5% and 7% for seniors. Additionally, the buying price is unaffected by age. For all age groups, it is set.

Ways to Buy – Online Or Through LIC Agent

The Pradhan Mantri Vaya Vandana Yojana (PMVVY), a recently created pension program for senior citizens, would pay insurance companies such as agents and brokers a commission of 0.1% on invested funds.

As previously stated, LIC India disperses this program on behalf of the state.

The government has also exempted this plan from GST. This implies that the distributors who sell this program won’t also have to contribute GST on their commissions. Seniors can also purchase this plan directly from the business website.

How to Check PMVVY Policy Details

The following are the steps to verify the details of the policy:

- Visit Umang PMVVY’s webpage.

- ‘Policy Basic information’ is the heading you want to scroll down to, and you want to click the ‘Open’ button there.

- Choose the ‘Login with MPIN’ or ‘Login with OTP’ option on the following page.

- Once you’ve entered your mobile number and MPIN or OTP, click the “Login” button.

- To access the ‘Policy Basic Details’ page, click the ‘General Services’ option.

- Click the “View Details” button after entering the “Policy Number” and “Mobile Number.”

- The screen will show the specifics of the policy.

How Much Does LIC Agent Commission On PMVVY Scheme

This program is supported by the Indian government and is carried out by the Life Insurance Corporation (LIC). The agent fee is 0.1% of the invested amount under PMVVY.

According to VK Sharma, Chairman, of LIC India, insurance intermediaries, such as agents and brokers, will receive a commission of 0.1% on funds invested in the recently introduced PMVVY pension plan for older citizens. The government distributes this program through LIC India.

SUMMARY

For ten years, PMVVY offers a fixed return of 8% per year, payable monthly (with effect returns of 8.30%). Each period’s end will see the payment of the pension.

At the time of purchase, investors have the option of selecting a payment frequency, such as monthly, quarterly, half-yearly, or yearly. After three years, investors may additionally borrow around 75% of the original purchase price. Additionally, the plan permits early leave for medical care of any serious sickness.

The government has also exempted this plan from GST. This implies that the distributors who sell this program won’t also have to shell out GST on their commissions.

Seniors can also purchase this plan directly from the business website. However, before you buy any policy, you need to read the terms and conditions carefully.

Recommended Articles:

- Pradhan Mantri Awas Yojana Eligibility, Subsidy & All Details

- Senior Citizen Tax Savings Scheme in India

- Five-Year Plan In India | Economic Planning

- Contributory Pension Scheme (NPS)

- AB Arogyadaan Group Health Policy

- Universal Health Insurance Scheme

- All About Collision Coverage Auto Insurance

- Deen Dayal Swasthya Seva Yojana

- Meghalaya Health Insurance Scheme (MHIS)

- 5 Government Insurance Schemes in India