Source:- https://sarkariyojanalist . com/pradhan-mantri-mudra-yojana/

Our Prime Minister Shri Narendra Modi has launched the Pradhan Mantri Mudra Yojana (PMMY) for the development of the country. This Yojana is specially designed for small and new businessmen so that the small businessman can take loans easily and that the new industrialist can move his industry forward. People can easily apply for PMMY online. Mudra bank loan apply online

Scheme Name: Pradhan Mantri Mudra Yojana (PMMY)

Full Name Of MUDRA: Micro Units Development and Refinance Agency

Launch Date: 8th April 2015

Type: Refinance for Micro Enterprises

Loan Limit: Rs.50,000 to Rs.10,00,000

Types of loan: Sishu, Kishore, Tarun

Announced by: Finance Minister Arun Jaitley

Launched by: Prime Minister Shri Narendra Modi

Source:- https://www . e-startupindia . com/blog/pradhan-mantri-mudra-yojana-loans-eligibility-procedure-application-form-apply-online/10010 . html

What Is The Purpose Of The PMMY?

Table of Contents

Central Government Mudra Yojana (PMMY) has two objectives.

- First, give loan easily for self-employment

- Second, creating jobs through small enterprises

If you are facing the problem of capital to start your business then you can fulfill your dream with the PMMY of the Central Government. According to the Govt. on getting loans easily, a large scale of people will be motivated to self-employment. This will create a large number of employment opportunities. Mudra Bank Loan Apply Online

Prior to the Pradhan Mantri Mudra Yojana (PMMY), small enterprises had to complete a lot of formalities in taking loans from the bank. The guarantee was required to take a loan. Because of this, many people wanted to start a business but were unable to borrow from the bank.

NOTE:

According to the website created for PMMY, loans up to INR 228144 crores have been sanctioned under the money scheme till March 23, 2018.

Source:- https://blog . ipleaders . in/get-mudra-loan-pradhan-mantri-mudra-yojana%E2%80%8E/

What is Pradhan Mantri Mudra Yojana (PMMY)?

The full form of MUDRA is “Micro Units Development and Refinance Agency Limited”. This scheme is designed for financial assistance to small traders and industries in the country. It is also known as Pradhan Mantri Mudra Yojana or PMMY. mudra bank loan apply online

Everyone knows how tough it is to start a new business or to get a loan to grow a small business in present days. The Pradhan Mantri Mudra Yojana (PMMY) was initiated by our Prime Minister Shri Narendra Modi to support the small business in growing or to initiate their business.

Under this scheme, you can take a loan to start a new business or to increase your business. Under the Pradhan Mantri Mudra Yojana (PMMY) the mudra loan interest rate is very low as compared to other bank loans. In addition to this, you can take up to INR 10 lakh loan.

NOTE:

You can get term loan, overdraft or cash credit facility under the Pradhan Mantri Mudra Yojana (PMMY).

Women and SC / ST applicants are given major priority for Pradhan Mantri Mudra Yojana (PMMY). Mudra Bank Loan Apply Online

Source:- https://www . splan . in/shishu-kishor-tarun-schemes-mudraloan/mudra-loan/# . XHjyg4gzaM8

Types of Loan Under MUDRA Scheme

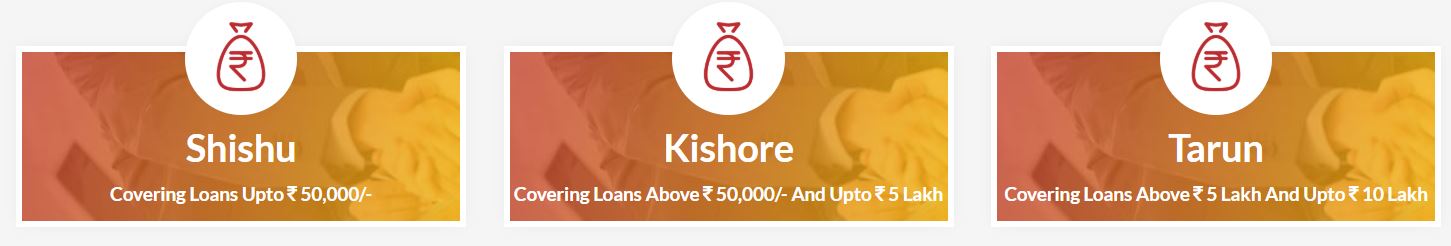

Under the MUDRA Scheme, there are basically 3 different types of loan provided. Mudra Loan is divided into three parts, keeping in mind the needs of different businesses. These different kinds of MUDRA loan are as follow:

Shishu Loan:

Under child loan, loans up to INR 50,000 / – are given

Kishor Loan:

Under the Adolescent up to INR 50,000 / – to INR 5 lakh is given

Tarun Loan:

Under Young loan up to INR 5 lakh to INR 10 lakh are given

NOTE:

Under the money scheme, at least 60% of the loan will be given in the form of Shishu loans.

Source:- https://www . madaboutbookkeeping . co . uk/finding-the-best-funding-for-your-business/

Benefits of the PMMY mudra bank loan apply online

Under the Pradhan Mantri Mudra Yojana (PMMY), loans are usually granted without guarantees

No processing fees are charged for providing loan

The repayment period of this loan can be extended up to 5 years

Working Capital Loan will be provided by Mudra Card

NOTE:

The recipient of a loan gets a credit card, with the help of which he or she can spend on business needs

Pradhan Mantri Mudra Yojana Loan Subsidy

There is no subsidy for loans given under PMMY. However, if the loan proposal is linked to some government scheme, in which the government provides the capital subsidy, then it will also be eligible under PMMY. Mudra Bank Loan Apply Online

Source:- https://www . indiabullshomeloans . com/blog/in-your-best-interests-how-to-get-the-best-out-of-your-interest-rates/

Mudra Loan Interest Rate and Loan Tenure:

There is no fixed interest rate for the Pradhan Matri Murda Yojana loan. Looking at your information, the bank decides the Mudra loan interest rate. There is also no subsidy on the Mudra Loan interest rate from the government.

Bank or Financial Institution decide the term of the loan and loan tenure of the Mudra loan. The duration will depend on the cash flow of your credit score, business or project.

The loan payment period can’t be more than 5 years for the baby loan (up to INR 50,000)

You can also request for a moratorium period while taking a loan.

NOTE:

During the moratorium period, you only have to pay the interest. This facility can prove to be very beneficial.

Source:- https://www . examrace . com/Current-Affairs/NEWS-MUDRA-Bank-Yojana . htm

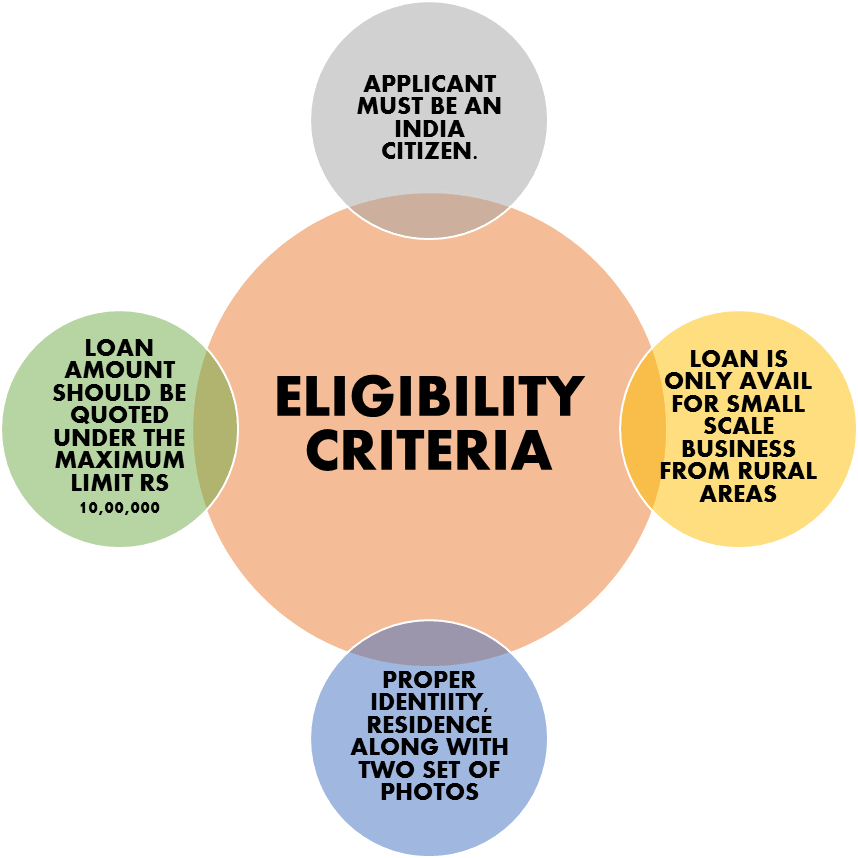

Pradhan Mantri Mudra Loan Eligibility:

Any Indian citizen or firm who wants to start any business other than agriculture or wants to move ahead with his current business and financial needs has the Mudra loan Eligibility

- Any Indian citizen can apply for Mudra loan

- You can get a loan for manufacturing, processing, trading and services, any of these types of business

- You want to set up a small industry, run trucks, shopkeepers, sell fruit / vegetables, run a beauty parlor, operate machines, want to plant a factory, or buy a machine or anything else, you fulfill the Mudra loan eligibility

- You can’t take any personal work, such as buying a car or taking a money loan for studying. But if you want to take a loan for buying a taxi, rickshaw or truck, you will fulfill the Mudra loan eligibility

- Any person sole proprietorship, partnership, private limited company or public company can take mudra loan

- You can get up to INR 10 lakh loan. If a loan of more than INR 10 lakh is required, then you can’t get it under the Mudra loan

NOTE:

If you have taken a loan from a bank before and did not pay it properly, you will not get a money loan.

Source:- http://bheuro2017 . com/yac/2017/02/26/documents-for-download/

Documents Required For Pradhan Mantri Mudra Yojana:

Check out the list of documents required for the Pradhan Mantri Mudra Yojana loan

- Proof of identity including Voter’s ID card, Driving License, PAN Card, Aadhar Card, Passport

- Residence proof including Recent Telephone Bill, Electricity Bill, Property Tax Receipt (not older than 2 months)

- Caste Certificate, only if you come under any reserved category (SC / ST / OBC / Minority)

- Identification of business / proof of address- related license / registration certificate

- The applicant should not be indebted to any bank / financial institution

- Details of bank accounts (Statement of accounts) for the last six months

- Balance sheets of last 2 years, income tax / sales tax return etc. (Required for a loan of 2 lakh or more).

NOTE:

If you are taking up to 50 thousand rupees as mudra loan, then you may not need Balance Sheet and Income Tax Return.

Recommended Articles :-

- Modi Scheme For Loan To Aid Financial Stability & Economic Development

- Central Government Health Scheme (CGHS) Thiruvananthapuram

- ICICI Term Insurance Plan: Here Is All You Need To Know

- Central Government Health Scheme (CGHS) Ranchi Hospitals

- Meghalaya Health Insurance Scheme (MHIS) In India

- Central Government Health Scheme (CGHS) Chandigarh Hospitals

Source:- https://economictimes . indiatimes . com/small-biz/money/different-types-of-business-loans-that-you-can-go-for/articleshow/63875573 . cms?from=mdr

How To Apply Online? Mudra bank loan apply online

For mudra bank loan apply online, you will have to go to this website (https://mudramitra.in/) first

Here you can apply for Shishu, Kishor or Tarun loan.

If you are logging for the first time, you must first register

You can click on “New User” or go directly to this link (https://mudramitra.in/Login/Register)

When registering you will have to give information about yourself

- Your name and address

- Gender

- Caste

A little bit about your business needs to be given

- Mobile number

- E-mail id

Once you register, you will receive an e-mail containing your password

You can log in again by visiting this link (https://mudramitra.in/Login/Register)

Application of Mudra loan is a 6 step process

-

- Information about your business

- Information about you and the partner / director of Business

- If you use the facility of a Current Account, etc., then you should know about its loan, how much loan, etc.

- Now Your Business Sales, Profit, Capital Information

- Upload information about the registration of business, all documents.

- Submit Your Details

After that, you will have to choose the bank or financial institution and you can submit your application.

Your application will automatically reach the bank. After that, the bank will decide whether to lend you or not. Mudra Bank Loan Apply Online

Source:- https://www . howtoanything . in/2018/08/mobile-companies-toll-free-customer-care-number . html

Pradhan Mantri Mudra Yojana Helpline Number

Check out the Pradhan mantra Mudra Yojana helpline number down below:

State-Wise Toll-Free Helpline Number For PMMY |

||

|

Sl. No. |

State or UT name |

Toll-Free Helpline Number |

| 1. | Andaman and Nicobar Islands | 1800-3454545 |

| 2. | Arunachal Pradesh | 1800-3453988 |

| 3. | Andhra Pradesh | 1800-4251525 |

| 4. | Assam | 1800-3453988 |

| 5. | Bihar | 1800-3456195 |

| 6. | Chandigarh | 1800-1804383 |

| 7. | Chhattisgarh | 1800-2334358 |

| 8. | Dadra Nagar Haveli | 1800-2338944 |

| 9. | Daman-Diu | 1800-2338944 |

| 10. | Goa | 1800-2333202 |

| 11. | Gujarat | 1800-2338944 |

| 12. | Haryana | 1800-1802222 |

| 13. | Himachal Pradesh | 1800-1802222 |

| 14. | Jammu and Kashmir | 1800-1807087 |

| 15. | Jharkhand | 1800-3456576 |

| 16. | Karnataka | 1800-42597777 |

| 17. | Kerala | 1800-42511222 |

| 18. | Lakshadweep | 0484-2369090 |

| 19. | Madhya Pradesh | 1800-2334035 |

| 20. | Maharashtra | 1800-1022636 |

| 21. | Manipur | 1800-3453988 |

| 22. | Meghalaya | 1800-3453988 |

| 23. | Mizoram | 1800-3453988 |

| 24. | Nagaland | 1800-3453988 |

| 25. | NCT of Delhi | 1800-1800124 |

| 26. | Orissa | 1800-3456551 |

| 27. | Puducherry | 1800-4250016 |

| 28. | Punjab | 1800-1802222 |

| 29. | Rajasthan | 1800-1806546 |

| 30. | Sikkim | 1800-3453988 |

| 31. | Tamil Nadu | 1800-4251646 |

| 32. | Telangana | 1800-4258933 |

| 33. | Tripura | 1800-3453344 |

| 34. | Uttar Pradesh | 1800-1027788 |

| 35. | Uttarakhand | 1800-1804167 |

| 36. | West Bengal | 1800-3453344 |

NOTE:

Apart from this, you can also use a Nationalized Toll Free helpline number 1800 180 1111 / 1800 180 0001