HDFC ERGO General Insurance is one of India’s leading insurance companies, providing a variety of insurance products like health, motor, travel, and home insurance. Agents play a crucial role in the company’s distribution strategy, and they are compensated based on a commission structure that varies across different products and business types. In this article, we will explore the various aspects of the HDFC ERGO agent commission chart, including its key features, rates, and factors that influence commissions.

Understanding the Agent Commission System:

Table of Contents

The commission structure for HDFC ERGO agents is designed to reward agents for the sales and renewals of insurance policies, with incentives based on both new business acquisition and retention (renewals). It typically operates on a percentage of the premium collected for the policy. The exact commission rates can vary depending on the type of policy sold, the volume of sales, and whether the sale is for a new or renewing policy.

Key Factors Influencing Agent Commissions:

Type of Insurance Product:

Commissions vary depending on whether the agent sells a health, motor, travel, or home insurance policy. For example, commissions on health insurance might differ from those on motor policies due to their varying pricing structures.

New Business vs. Renewals:

Typically, agents earn a higher commission on new policies compared to renewals. However, recurring commissions (on policy renewals) ensure that agents maintain an ongoing income from their existing customers.

Premium Amount:

The commission is often calculated as a percentage of the premium paid by the customer. Therefore, higher premium policies (e.g., comprehensive health insurance) may result in higher commissions.

Policy Tenure:

The length of the policy can also affect the commission. For instance, long-term policies such as multi-year policies may provide agents with a lump sum commission upfront, or a spread-out commission over multiple years.

Types of Commissions:

Upfront Commission:

This is the commission an agent earns when they sell a new policy. It is usually a percentage of the first-year premium amount. The commission percentage for new policies can range between 15% to 30%, depending on the product type.

Renewal Commission:

After the first year, agents typically earn a reduced commission for policy renewals. The renewal commission is often lower than the upfront commission, but it offers agents long-term income if they can maintain relationships with clients. Renewal commissions can range between 5% to 10%.

Bonuses & Incentives:

In addition to base commissions, agents can earn bonuses and incentives based on sales performance. These might include meeting sales targets, selling high-value policies, or selling specific products within a quarter or year.

Commission Rates by Insurance Type:

While exact numbers may change from time to time or based on specific agreements with agents, here’s an overview of the commission ranges for different types of policies offered by HDFC ERGO:

Motor Insurance:

New Policies: Typically, agents earn between 15% to 20% on the premium for new motor policies.

Renewals: Renewal commissions are generally in the range of 5% to 7%.

Health Insurance:

New Policies: Commissions for new health insurance policies are often between 15% and 25%.

Renewals: Renewal commissions can vary from 7% to 10%.

Home Insurance:

New Policies: Similar to motor and health policies, agents might earn commissions between 10% and 20% for new home insurance policies.

Renewals: Agents typically receive 5% to 8% on renewals.

Travel Insurance:

New Policies: Travel insurance products usually offer lower commission rates, often ranging from 10% to 15% for new policies.

Renewals: Renewal rates for travel insurance are usually around 5% to 8%.

Commercial Insurance (e.g., Business, Property):

New Policies: Commercial insurance policies often offer higher commissions, ranging from 10% to 20%.

Renewals: Renewal commissions might be around 5% to 10%.

Commission Based on Premium Amount:

The commission percentage might also be linked to the premium size. For example:

Low Premium Policies: Policies with lower premiums (e.g., basic health or car insurance) usually have lower commission rates.

High Premium Policies: For policies with higher premiums (e.g., comprehensive health or high-value property insurance), agents could earn higher commissions, both upfront and on renewals.

Performance-Based Incentives and Bonuses:

HDFC ERGO, like many other insurers, offers performance-based bonuses and incentives. These can include:

Sales Milestones: Agents who meet or exceed certain sales targets may earn additional bonuses. These can be based on monthly, quarterly, or annual targets.

Product-Specific Incentives: Agents may receive special bonuses for selling specific types of policies, such as new product launches or high-margin policies.

Awards and Recognition: Top-performing agents are often recognized at company events or may be eligible for further incentives like trips, cars, or additional commissions for exceptional performance.

Training and Support for Agents:

HDFC ERGO provides training programs for its agents to help them understand the insurance industry’s products, selling techniques, and regulations. Successful completion of the training can also sometimes be linked to higher commission eligibility or bonuses.

How Agents Can Maximize Their Earnings:

To maximize their earnings, agents should focus on:

- Building Strong Customer Relationships: Long-term clients ensure a steady stream of renewals, which contributes to consistent income.

- Understanding the Products Well: Being knowledgeable about different insurance products allows agents to sell more effectively and offer clients the best products for their needs.

- Meeting Sales Targets: Consistently meeting or exceeding sales targets opens up opportunities for additional commissions and performance bonuses.

- Cross-Selling and Upselling: Agents can increase their income by cross-selling or upselling related products, such as offering additional coverage or suggesting other insurance plans.

HDFC ERGO Agent Commission Chart:

Here’s a simplified HDFC ERGO Agent Commission Chart in a table format for easy reference:

| Insurance Type | New Business Commission | Renewal Commission | Bonus/Incentives |

|---|---|---|---|

| Motor Insurance | 15% – 20% | 5% – 7% | Based on sales milestones and high-value policies |

| Health Insurance | 15% – 25% | 7% – 10% | Special incentives for specific products or performance |

| Home Insurance | 10% – 20% | 5% – 8% | Potential bonuses for achieving targets |

| Travel Insurance | 10% – 15% | 5% – 8% | Bonuses for selling travel insurance packages |

| Commercial Insurance | 10% – 20% | 5% – 10% | Performance-based bonuses for high-value sales |

| Group Health Insurance | 10% – 20% | 5% – 8% | Volume-based incentives for large groups |

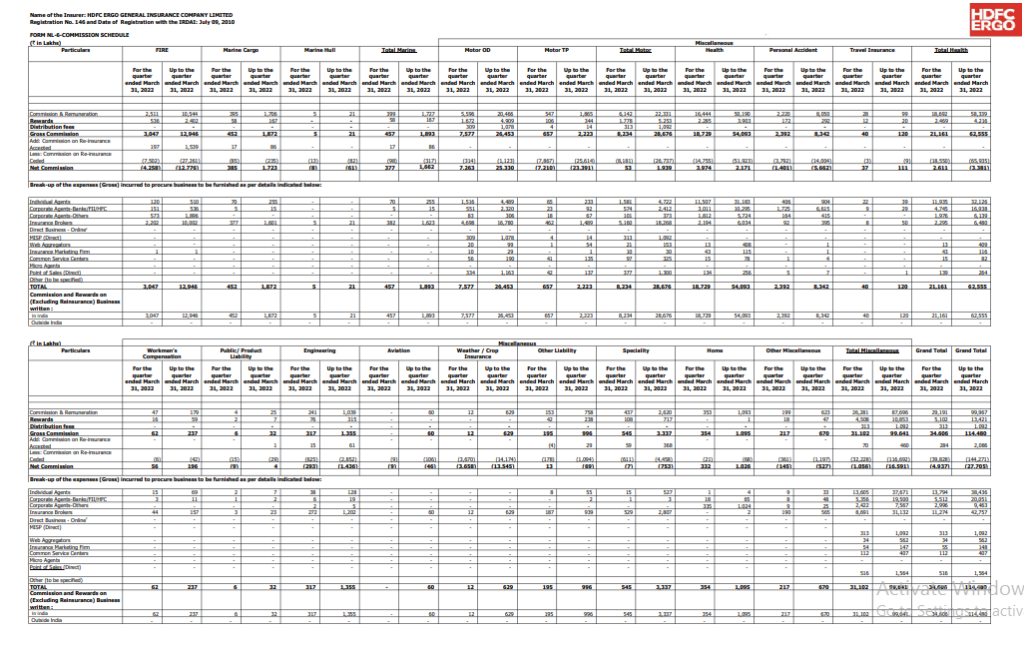

See below the HDFC ERGO Agent Commission Chart in PDF format.

Additional Notes:

- Bonus/Incentives: Additional incentives may be awarded based on the total volume of business sold in a given period (monthly, quarterly, or annually).

- Premium Size: Higher premiums generally lead to higher commissions.

- Cross-Selling & Upselling: Commissions may be higher if agents successfully cross-sell related products (e.g., life insurance with motor insurance).

This table provides a basic overview, and the actual commission rates can vary depending on specific agreements or promotional periods. For the most accurate and up-to-date information, agents should refer to HDFC ERGO’s official documentation or contact their agent support team.

Conclusion:

The commission structure for HDFC ERGO agents is designed to reward performance and incentivize both new business acquisition and client retention. By selling various types of insurance policies, agents have the opportunity to earn both upfront and renewal commissions, with additional performance-based bonuses available for top performers.

For anyone considering becoming an HDFC ERGO agent, understanding the commission structure, the types of policies, and the associated premiums is crucial to maximize earning potential.

If you’re an agent or aspiring to be one, it’s always best to consult with HDFC ERGO’s official agent resources to get the most accurate and updated commission details.

FAQ:

Q. What governs agent commissions in general insurance in India?

A. Agent commissions are regulated by the Insurance Regulatory and Development Authority of India (IRDAI) through the IRDAI (Payment of Commission or Remuneration or Reward to Insurance Agents and Insurance Intermediaries) Regulations, 2016. These regulations mandate that each insurer must have a Board-approved commission policy, specifying maximum permissible commissions for various insurance products.

Q. What are the typical commission rates for HDFC ERGO agents?

A. While specific commission rates can vary based on the product and prevailing regulations, general insurance agents typically earn commissions as a percentage of the premium collected. For instance, commissions might be around 15% for certain general insurance products. However, specific rates can differ based on the product type and company policies.

Q. Do agents receive commissions on policy renewals?

A. Yes, agents are entitled to commissions on policy renewals. However, the renewal commission rates are usually lower than those for new policies. The exact percentage can vary depending on the product and company policies.

Q. Are there additional incentives or bonuses for agents?

A. Yes, HDFC ERGO offers various incentive programs and bonuses to agents based on their performance. These can include:

- Performance Bonuses: Additional bonuses may be awarded for exceeding sales targets or achieving exceptional performance metrics.

- Rewards: Agents may receive rewards based on factors like business volume, quality of business, and persistency.

Q. How can one become an agent with HDFC ERGO?

A. To become an agent:

- Age Requirement: Must be at least 18 years old.

- Educational Qualification: Minimum of 10th standard pass or equivalent.

- Training: Complete the required training modules provided by HDFC ERGO.

- Examination: Pass the prescribed examination to obtain certification.

Once certified, agents can use the company’s platforms to sell insurance policies.

Q. Where can agents find official commission charts and updates?

Agents can access official commission charts, updates, and other relevant information through:

- HDFC ERGO’s official website: www.hdfcergo.com

- Contacting their respective branch offices or relationship managers

Regular communication from the company will also provide updates on any changes to commission structures or policies.