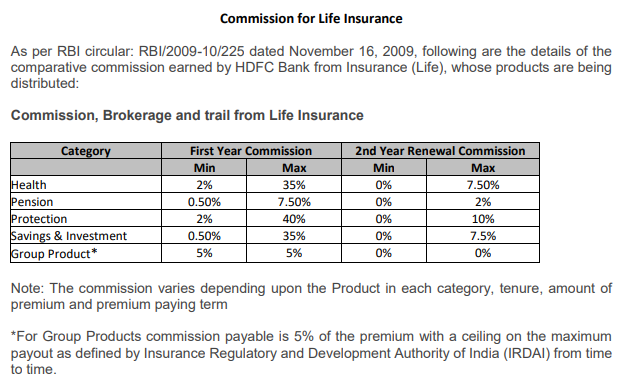

The product, premium amount, premium paying term, and tenure all affect the commission that HDFC Life Insurance agents receive. When first and renewal-year premiums are issued and cleared, the commission is paid. So, see below the HDFC life insurance agent commission 2026.

How to Become an HDFC Life Insurance Agent?

Table of Contents

Becoming an HDFC Life Insurance agent is a great career opportunity with flexibility, financial growth, and professional development. Here’s a step-by-step guide:

Check Eligibility:

- Age: Minimum 18 years.

- Education: At least 10th or 12th pass (varies by region).

- Documentation: PAN card, Aadhaar card, educational certificates, and address proof.

Register with HDFC Life:

- Visit the HDFC Life website or approach your nearest HDFC Life branch.

- Fill out the agent application form and submit the necessary documents.

Complete Mandatory Training:

- IRDAI requires a 50-hour training program (online or classroom) on insurance concepts, regulations, and ethics.

- For experienced agents switching from another insurer, 25 hours of training is sufficient.

Pass the IRDAI Exam:

- Appear for the IRDAI IC-38 examination, which tests your knowledge of insurance products, rules, and market conduct.

- A minimum of 35% marks is required to pass.

Get Your Agent License:

- After passing the exam, you’ll receive your IRDAI agent license, allowing you to officially sell HDFC Life Insurance products.

Start Selling and Earning:

- Attend HDFC Life’s product and sales training sessions.

- Begin advising clients, selling policies, and earning commissions on every policy you sell and renew.

Enjoy Growth Opportunities:

- Earn performance-based incentives, bonuses, and rewards.

- Build a long-term career with the possibility of becoming a Certified Financial Consultant (CFC) or even managing teams.

HDFC Life Insurance Agent Commission 2026:

As an HDFC Life Insurance agent, your HDFC Life insurance agent commission earnings are influenced by several factors, including the type of insurance product, premium payment terms, policy tenure, and the amount of premium. Here’s a detailed HDFC Life agent commission chart:

| Product Category | First-Year Commission | Renewal Commission |

|---|---|---|

| Health Insurance | 2% to 35% | 0% to 7.5% |

| Pension Plans | 0.5% to 7.5% | 0% to 2% |

| Protection Plans | 2% to 35% | 0% to 2% |

| Savings & Investment Plans | 0.5% to 30% | 0% to 3% |

| Group Products | 5% | Not Applicable |

See below the HDFC Life Insurance Agent Commission 2026 in PDF format.

Factors Affecting HDFC Life Insurance Agent Commission:

HDFC Life Insurance agent commissions depend on several variables, and understanding them can help you maximize your earnings. Here’s a breakdown:

Type of Insurance Policy:

Term Insurance Plans: Generally lower commissions due to lower premiums.

Endowment and Savings Plans: Higher commissions, especially in the first year.

ULIPs: Variable commissions depending on the fund structure and policy features.

Health and Critical Illness Plans: Moderate commissions with potential for renewals.

Premium Payment Term:

Single-Premium Policies: A one-time, lower commission (usually around 2-5%).

Regular-Premium Policies: Higher first-year commissions (up to 35-40%) and renewal commissions for the policy term.

Policy Term (Duration):

Longer-term policies often offer higher commissions compared to short-term ones.

Premium Amount:

Higher premiums result in larger HDFC Life agent commission payouts as the commission percentage is applied to the premium amount.

Renewal Persistence:

Consistent policy renewals ensure you keep earning renewal commissions (5-7.5% on average).

Higher persistency rates (keeping clients from lapsing) contribute to long-term passive income.

Product Category:

Traditional Plans: Higher first-year and renewal commissions.

Investment and ULIP Plans: Moderate commissions with additional bonuses based on fund performance.

Group Insurance Products: Lower commission rates, often around 5%.

Performance and Incentives:

HDFC Life rewards top-performing agents with bonuses, incentives, and international trips.

Meeting and exceeding sales targets can boost your overall income significantly.

Regulatory Guidelines:

Commission structures are regulated by the Insurance Regulatory and Development Authority of India (IRDAI), which sets limits on maximum commissions for different policy types.

Mode of Premium Payment:

Annual premium payment modes usually offer higher commissions compared to monthly or quarterly payments.

Experience and Tenure:

Senior agents with consistent performance often get additional incentives and recognition, impacting overall earnings.

Benefits of Becoming an Aditya Birla Sun Life Agent:

The benefits are…

Attractive Commission Structure:

Earn competitive commissions on new policy sales and renewals.

Enjoy long-term passive income from renewal commissions.

Performance-Based Incentives:

Get bonuses, rewards, and recognition for hitting sales targets.

Win cash rewards, international trips, and other incentives.

Flexible Working Hours:

Work at your own pace and choose your own schedule.

Balance personal and professional life with ease.

Training and Development:

Access world-class training on insurance products and sales techniques.

Get mentorship and guidance to grow your business.

Vast Product Portfolio:

Offer a wide range of life insurance, health, investment, and savings products.

Cater to diverse customer needs with tailored solutions.

Professional Growth:

Opportunity to become a Certified Financial Advisor.

Grow into leadership roles by building and managing your own team.

Financial Security:

Steady income through renewals and high-value policy sales.

Build long-term wealth with consistent policy retention.

Strong Brand Association:

Represent a trusted and established company with a solid reputation.

Gain credibility and customer trust through the ABSLI brand.

Marketing and Sales Support:

Get access to marketing materials, digital tools, and sales assistance.

Leverage technology for lead generation and customer management.

Recognition and Prestige:

Join exclusive clubs and recognition programs for top performers.

Get awards and public acknowledgment for your achievements.

How to Calculate Aditya Birla Sun Life Agent Commission?

Agent commission at ABSLI depends on several factors like policy type, premium amount, and payment term. Let’s break down the calculation step by step:

Identify the Policy Type:

Term Insurance: Lower premiums, lower commission percentage.

Endowment or Savings Plans: Higher first-year commissions.

ULIPs (Unit-Linked Insurance Plans): Commission varies based on the fund and policy structure.

Check the Commission Rate:

Commission rates are regulated by IRDAI and differ based on policy type and duration:

First-Year Commission: Typically 15% to 35% of the first-year premium.

Renewal Commission: 5% to 7.5% from the second year onwards.

Single-Premium Policies: 2% to 5% as a one-time commission.

Consider Premium Payment Term:

Regular Premium Policies: Higher first-year and ongoing renewal commissions.

Limited Pay: Commission depends on the number of premium-paying years.

Single Premium: A one-time, lower commission rate.

Apply the Formula:

Let’s say:

- First-year premium: ₹50,000

- First-year commission rate: 30%

- Renewal commission rate: 7.5%

- Policy term: 20 years

First-Year Commission:

₹50,000 × 30% = ₹15,000

Renewal Commission (for each year from the 2nd year):

₹50,000 × 7.5% = ₹3,750

Total Commission Over 20 Years:

₹15,000 + (₹3,750 × 19) = ₹86,250

Additional Incentives:

On top of standard commissions, you can earn:

- Performance bonuses.

- Persistency bonuses for policy retention.

- Incentive programs like foreign trips and cash rewards.

FAQ:

Q. What is the commission structure for ABSLI agents?

A. ABSLI agents earn commissions based on the type of policy sold and the premium payment term.

- First-Year Commission: 15% to 35% of the first-year premium.

- Renewal Commission: 5% to 7.5% from the second year onward.

- Single-Premium Policies: 2% to 5% as a one-time commission.

Q. How is the agent commission calculated?

A. Commission is calculated as a percentage of the premium paid by the policyholder. For example:

- First-year premium: ₹1,00,000

- First-year commission rate: 30%

- Commission = ₹1,00,000 × 30% = ₹30,000

Q. Do agents earn commissions on policy renewals?

A. Yes, agents earn renewal commissions (typically 5% to 7.5%) for every year the policy remains active, depending on the product and term.

Q. Are there additional incentives for ABSLI agents?

A. Absolutely! Beyond commissions, agents can earn:

- Performance bonuses for meeting sales targets.

- Persistency bonuses for policy retention.

- Rewards and recognition, like cash prizes and international trips.

Q. Do commissions vary by product type?

A. Yes, commission rates differ based on the policy:

- Term Plans: Lower commissions due to lower premiums.

- Endowment and Savings Plans: Higher first-year commissions.

- ULIPs: Variable commissions based on the fund and policy features.

Q. Is the commission structure regulated?

A. Yes, ABSLI follows the Insurance Regulatory and Development Authority of India (IRDAI) guidelines, which set maximum commission limits for different policy types.

Q. Can I earn passive income as an ABSLI agent?

A. Definitely! Renewal commissions offer long-term passive income as long as the policy stays active.

Q. How often are commissions paid?

A. HDFC term insurance agent commissions are typically credited monthly after the policy premium is received and processed.

Q. Do agents get any training and support?

A. Yes, ABSLI provides comprehensive training programs, mentorship, and digital tools to help agents grow their businesses and increase earnings.

Q. Is there a minimum sales requirement to continue earning commissions?

A. While there’s no strict quota, maintaining good sales and policy retention ensures a consistent income and eligibility for bonuses and incentives.