Selling auto insurance plans and receiving commissions from the premiums you collect are two benefits of working as a car insurance advisor. So, see below the vehicle insurance agent commission chart 2026.

Vehicle Insurance Agent Commission Chart 2026:

Table of Contents

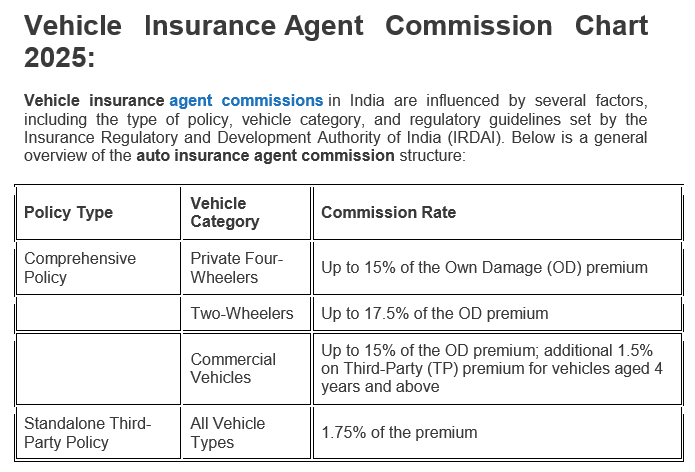

Vehicle insurance agent commissions in India are influenced by several factors, including the type of policy, vehicle category, and regulatory guidelines set by the Insurance Regulatory and Development Authority of India (IRDAI). Below is a general overview of the auto insurance agent commission structure:

| Policy Type | Vehicle Category | Commission Rate |

|---|---|---|

| Comprehensive Policy | Private Four-Wheelers | Up to 15% of the Own Damage (OD) premium |

| Two-Wheelers | Up to 17.5% of the OD premium | |

| Commercial Vehicles | Up to 15% of the OD premium; additional 1.5% on Third-Party (TP) premium for vehicles aged 4 years and above | |

| Standalone Third-Party Policy | All Vehicle Types | 1.75% of the premium |

Factors Affecting Vehicle Insurance Agent Commission:

The factors that affect vehicle insurance agent commission are…

Type of Insurance Policy:

- Comprehensive Insurance: Higher premiums lead to higher commissions (10%–15% of Own Damage premium).

- Third-Party Insurance: Lower commission rates (usually 1.75% of the premium).

- Add-On Covers: Additional products like zero depreciation, engine protection, etc., may increase commission earnings.

Vehicle Type:

- Private Four-Wheelers: Standard commission rates around 10%–15%.

- Two-Wheelers: Slightly higher commissions, often up to 17.5%.

- Commercial Vehicles: Auto insurance commission vary, and older vehicles may offer an additional percentage on third-party premiums.

Premium Amount:

Higher policy premiums lead to higher absolute commission earnings, even if the percentage remains constant.

Vehicle Age:

Older vehicles, particularly commercial ones, may attract an additional 1.5% commission on third-party premiums.

Policy Duration:

Long-term motor insurance policies often lead to higher upfront commissions compared to annual policies.

Renewals:

Renewed policies usually offer the same commission rates as new policies, providing a consistent income stream.

Regulatory Guidelines:

The Insurance Regulatory and Development Authority of India (IRDAI) caps maximum commission rates for different policy types and vehicle categories.

Insurer’s Commission Structure:

Different insurance companies offer varying commission rates based on their business strategy and product lineup.

Agent Performance:

High-performing agents often get bonuses, performance incentives, and higher payout tiers based on sales volume.

Geographical Location:

In some regions, insurance penetration and risk levels can impact premium costs and agent commissions.

How to Calculate Vehicle Insurance Agent Commission:

Calculating a vehicle insurance agent’s commission is pretty straightforward — it’s based on the type of policy, premium amount, and commission rate. Let’s break it down step by step:

Identify the Policy Type and Commission Rate:

Commission rates vary depending on the type of vehicle insurance:

- Comprehensive Insurance: 10%–15% of the Own Damage (OD) premium.

- Third-Party Insurance: 1.75% of the third-party (TP) premium.

- Two-wheeler insurance: Up to 17.5% of the OD premium.

- Commercial Vehicle Insurance: 10%–15% on OD premium and 1.5% extra on TP for older vehicles (4+ years).

Get the Premium Amount:

Let’s assume:

- Own Damage (OD) Premium: ₹25,000

- Third-Party (TP) Premium: ₹5,000

Apply the Commission Rate:

If the commission rate is:

- Comprehensive Policy (OD premium): 15%

- Third-Party Policy: 1.75%

Commission Calculation:

-

- OD Commission = ₹25,000 × 15% = ₹3,750

- TP Commission = ₹5,000 × 1.75% = ₹87.50

Total Commission:

₹3,750 + ₹87.50 = ₹3,837.50

Additional Add-Ons (Optional):

If add-on covers like zero depreciation or engine protection are sold, agents might earn additional motor insurance agent commission chart based on the add-on premium amount.

Long-Term or Renewal Policies:

For long-term policies (3–5 years), agents often receive a higher upfront commission on car insurance. For renewals, the same commission rates generally apply as for new policies.

FAQ:

Q. What is the commission rate for vehicle insurance agents?

- Comprehensive Insurance: 10%–15% of the Own Damage (OD) premium.

- Third-Party Insurance: 1.75% of the third-party (TP) premium.

- Two-wheeler insurance: Up to 17.5% of the OD premium.

- Commercial Vehicle Insurance: 10%–15% on OD premium + 1.5% extra on TP for vehicles older than 4 years.

Q. How is the vehicle insurance agent commission calculated?

A. Let’s say:

- OD Premium: ₹20,000

- TP Premium: ₹5,000

- Commission Rate: 15% on OD, 1.75% on TP

Commission:

- OD Commission: ₹20,000 × 15% = ₹3,000

- TP Commission: ₹5,000 × 1.75% = ₹87.50

- Total Commission: ₹3,000 + ₹87.50 = ₹3,087.50

Q. Do agents earn commission on policy renewals?

A. Yes! Agents earn the same commission rates for policy renewals as for new policy sales, providing long-term income.

Q. Is there a difference in commission for different vehicle types?

A. Yes, commission rates differ:

- Private Cars: Standard 10%–15% on OD premium.

- Two-Wheelers: Higher commission (up to 17.5%).

- Commercial Vehicles: 10%–15% on OD premium, plus 1.5% on TP for older vehicles.

Q. Do agents get commission on add-ons?

A. Yes! Add-ons like zero depreciation, engine protection, and roadside assistance often carry separate premiums — and agents earn commissions on them, too.

Q. Are there performance-based incentives?

A. Definitely! Many insurance companies offer bonuses, cash rewards, and international trips for high-performing agents who meet or exceed sales targets.

Q. How often are commissions paid?

A. Most insurers pay commissions monthly after the policy premium is collected and processed.

Q. Are the commission rates regulated?

A. Yes, commission structures follow IRDAI (Insurance Regulatory and Development Authority of India) guidelines, which set maximum commission rates for different types of policies.

Q. Can vehicle insurance agents earn passive income?

A. Yes! Policy renewals offer a steady stream of passive income as long as the customer keeps the policy active.