United India Insurance Company is one of India’s leading general insurers. The insurance company provides personalized health plans with a variety of coverage options, including hospitalization charges and Ayush treatment coverage. A policyholder can receive a variety of health insurance advantages with United India insurance policies. In this article, we are going to discuss about United India General Insurance Agent Commission Chart 2026.

About United India General Insurance:

Table of Contents

United India General Insurance is headquartered in Chennai and was formed through a combination of 22 companies. It offers affordable and customizable health insurance products in the Indian market. Furthermore, ICRA has accredited United India Insurance for its outstanding claim-paying capabilities.

The health plans are specifically designed to provide the insured with peace of mind as well as the greatest medical treatment available. As we all know, medical concerns are unpredictable and can cause emotional and financial anguish. However, with United India medical insurance, you may be assured of financial support in the event of an emergency.

United India Health Insurance Plans:

Customers can choose from a wide range of health insurance policies offered by United India General Insurance Company. The list of various health insurance policies offered by United India is as follows:

United India’s Family Medicare Plan:

United India Family Medicare Plan is a health plan that provides full medical coverage to the policyholder and their family members for a single amount assured.

United India’s Family Medicare 2014 Plan:

United India Family Medicare 2014 is a health insurance policy that extends the United India Family Medicare plan with additional coverage and features.

United India Health Insurance’s Gold Plan:

United India Health Insurance Gold Plan is a comprehensive United India medical protection plan that covers hospitalization fees for illnesses, diseases, and injuries experienced or contracted by the insured during the policy period, as well as select daycare surgeries.

United India Insurance Individual Mediclaim Policy:

The United India Insurance Mediclaim Policy is intended to cover hospitalization expenditures for a person or their family members.

United India Health Insurance Platinum Plan:

United India Platinum is a comprehensive medical shield plan that covers hospitalization fees for illnesses, diseases, and injuries experienced or received by the insured during the policy period, as well as a few specific surgeries.

United India Senior Citizens Plan:

United India Senior Citizen is a health insurance plan that has created a customized protection plan for old age disorders.

United India’s Super Top Up Plan:

United India Health Insurance Company provides this customized plan to supplement your basic coverage with this plan. It is handy if you already have insurance and want to increase your coverage at a low rate.

United India Insurance’s Health Top-Up Plan:

United India Top-up is an add-on health plan that covers hospital expenditures that exceed the deductible limit during a hospitalization.

UNI Criticare Insurance Plans:

UNI Criticare Insurance is a comprehensive medical plan that covers all expenses incurred during the treatment of any critical disease.

United India Workmen’s Medicare Plan:

Workers in United India Medicare is a comprehensive health insurance plan for employees that covers all hospitalization expenses incurred as a result of work-related accidents.

How to Become a United India General Insurance Agent?

To become an insurance agent with United India Insurance Company (UIIC), you’ll need to follow a structured process, in line with the guidelines set by the Insurance Regulatory and Development Authority of India (IRDAI). Here’s how:

-

Meet Eligibility Criteria:

- Age: You must be at least 18 years old.

- Education: You should have passed at least the 10th standard (for rural areas) or 12th standard (for urban areas).

-

Contact United India Insurance:

- Reach out to the nearest United India branch office or visit their official website.

- Express your interest in becoming an agent and collect the application form and relevant details.

-

Complete the Application:

- Submit the filled application form along with required documents like your age proof, educational certificates, address proof, PAN card, and passport-size photographs.

-

Attend Pre-Licensing Training:

- You must undergo 25 hours of mandatory training conducted by UIIC or an IRDAI-approved training institute.

- The training covers insurance basics, product knowledge, legal and regulatory aspects, and ethical selling practices.

-

Pass the IRDAI Examination:

- After completing training, you need to pass the IRDAI licensing exam for general insurance agents.

- The exam tests your understanding of insurance products, regulations, and the role of an agent.

-

Get Licensed:

- Once you pass the exam, you’ll receive your IRDAI license, which allows you to work as a United India Insurance agent.

-

Start Selling and Earning:

- With your license in hand, you can start selling United India’s general insurance products like motor, health, fire, and travel insurance and earn commissions on policies sold.

United India General Insurance Agent Commission Chart 2026:

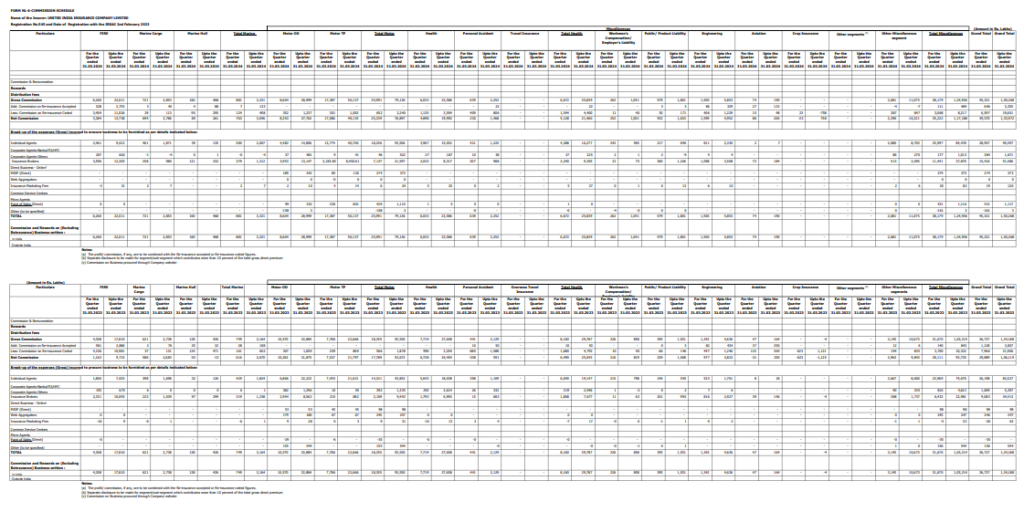

See below the United India Insurance Commission chart PDF format.

How to Calculate the United India General Insurance Agent Commission?

Calculating the United India Insurance Agent Commission Percentage depends on the specific insurance product being sold, as different products have varying insurance agent commission rates India. While UIIC’s internal documents provide detailed breakdowns of commissions paid across various categories, these documents are primarily for internal accounting and may not directly reflect the commission rates applicable to agents.

For a more precise understanding of the current health insurance agent commission structures, it’s advisable to consult the latest circulars and official communications from UIIC. These documents are regularly updated to reflect any changes in commission policies and can be accessed through UIIC’s official channels.

The Insurance Regulatory and Development Authority of India (IRDAI) also sets maximum United India Insurance commission limits for various insurance products. For example, as per industry standards, the maximum commission payable to insurance agents for certain lines of business is:

- Fire Insurance (Retail): 15%

- Marine Cargo Insurance: 15%

- Miscellaneous Retail Insurance: 15%

Please note that these rates are subject to change based on regulatory updates and company policies. For the most accurate and up-to-date information, it’s recommended to refer to the latest guidelines issued by IRDAI and official communications from UIIC.

For detailed and personalized information regarding your commission structure, consider contacting UIIC agent support directly or accessing their agent portal, where official circulars and updates are regularly posted.

FAQ:

Q. What factors influence the commission rates for UIIC agents?

A. Commission rates are determined by the specific insurance product sold, adherence to IRDAI’s prescribed maximum commission limits, and UIIC’s internal policies. Different products, such as motor, health, fire, or marine insurance, have distinct commission structures.

Q. Are there standard commission percentages for different insurance products?

A. Yes, IRDAI sets maximum commission limits for various insurance products. For instance, the maximum commission payable to insurance agents for certain lines of business is:

- Fire Insurance (Retail): 15%

- Marine Cargo Insurance: 15%

- Miscellaneous Retail Insurance: 15%

Please note that these rates are subject to change based on regulatory updates and company policies. For the most accurate and up-to-date information, it’s recommended to refer to the latest guidelines issued by IRDAI and official communications from UIIC.

Q. How can I access the latest commission structures and updates?

A. UIIC regularly publishes circulars and updates regarding commission structures on its official agent portal. Agents are encouraged to log in to the portal to access the most recent information. Additionally, staying in touch with your regional or branch office can provide personalized insights and updates.