Whole Life Assurance (WLA), Convertible Whole Life Assurance (CWA), Endowment Assurance (EA), Anticipated Endowment Assurance (AEA), Children Policy, and Joint Life Assurance or Yugal Suraksha (YS) are among the policies that Postal Life Insurance provides to central government and semi-government employees. All of the aforementioned policies provide bonuses. So, see below the PLI agent commission chart 2026.

Factors Affecting PLI Agent Commission:

Table of Contents

Several factors influence the Postal Life Insurance (PLI) Agent Commission in 2026. These factors determine how much an agent can earn through first-year and renewal commissions.

1. Type of Policy

Different PLI policies have varying commission structures. The main types of PLI policies include:

- Whole Life Assurance (Suraksha)

- Endowment Assurance (Santosh)

- Convertible Whole Life Assurance (Suvidha)

- Anticipated Endowment Assurance (Sumangal)

- Children Policy (Bal Jeevan Bima)

Each of these policies may offer different commission rates.

2. First-Year vs. Renewal Commission

- Higher first-year commissions: Agents typically earn a larger percentage of the first-year premium.

- Lower renewal commissions: Commissions on subsequent premium payments are generally lower than first-year commissions.

3. Policy Premium Amount

Higher premium amounts result in higher absolute commission earnings. For example, selling a ₹50,000 annual premium policy yields more commission than a ₹10,000 premium policy.

4. Policy Term

- Longer policy terms often provide extended renewal commissions, increasing an agent’s total earnings over time.

- Short-term policies may provide higher first-year commissions but fewer renewal benefits.

5. Number of Policies Sold

Agents who sell more policies in a given period can earn higher commissions. Some companies offer incentives for exceeding sales targets.

6. Policy Lapse Rate

- If a policyholder stops paying premiums (policy lapse), the agent loses renewal commission on that policy.

- Some companies may claw back first-year commissions if the policy is canceled within a short period.

7. Government Regulations

Postal agent commissions are subject to government regulations and periodic changes. The rates and eligibility criteria for commissions can be updated by the Department of Posts.

8. Mode of Premium Payment

- Some policies offer higher commissions for regular premium payments than single premium policies.

- Monthly, quarterly, and annual payments might have different commission structures.

9. Agent Performance & Experience

- Senior agents with consistent sales records may receive higher commission rates and bonuses.

- New agents may have to meet certain targets before receiving full commissions.

10. Taxation & Deductions

- GST (18%) may apply to commissions above a certain threshold.

- Agents are required to provide PLI agent commission report earnings for income tax purposes.

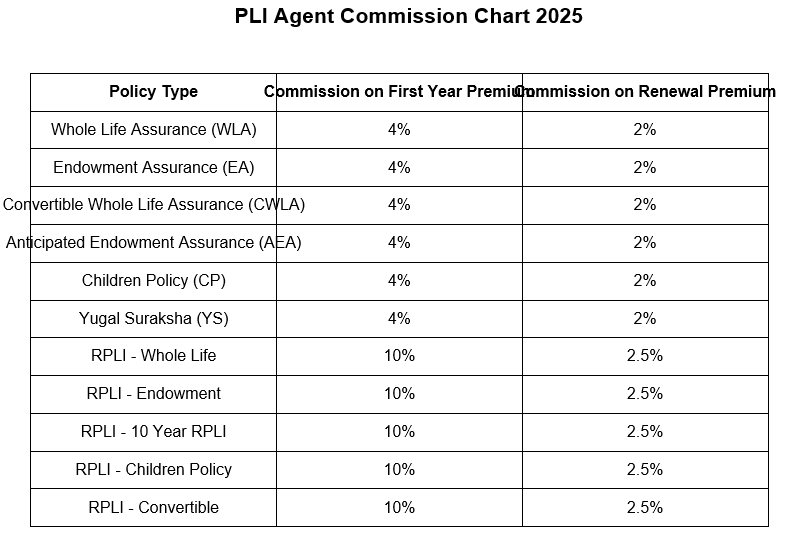

PLI Agent Commission Chart 2026:

As of February 2026, the Postal Life Insurance (PLI) in India has not publicly released a detailed agent commission chart for the year. However, based on general industry standards, PLI agents can anticipate commission structures similar to those in the broader life insurance sector. See below the Post Office agent commission chart 2026.

General Commission Structure:

Life insurance agents typically earn commissions based on the premiums paid by policyholders. The structure is usually divided into:

- First-Year Commission: A significant percentage of the premium paid in the first year.

- Renewal Commission: A smaller percentage on premiums paid in subsequent years.

Illustrative Commission Rates:

While exact percentages can vary, an illustrative example based on industry norms is as follows:

| Commission Type | Percentage of Premium |

|---|---|

| First-Year Commission | 60% – 80% |

| Renewal Commission | 5% – 10% |

| Policy Type | First-Year Commission | Renewal Commission |

|---|---|---|

| Endowment Assurance (Santosh) | 10% | 2% |

| Whole Life Assurance (Suraksha) | 10% | 2% |

| Convertible Whole Life (Suvidha) | 10% | 2% |

| Anticipated Endowment (Sumangal) | 10% | 2% |

| Children Policy (Bal Jeevan Bima) | No commission | No commission |

Example Calculation:

If a policyholder pays an annual premium of ₹10,000:

- First-Year Commission: At a 70% rate, the agent would earn ₹7,000 in the first year.

- Renewal Commission: At a 7% rate, the agent would earn ₹700 annually in subsequent years, provided the policy remains active.

Factors Influencing Commissions:

- Policy Type: Different policies (e.g., endowment plans, whole life insurance) may offer varying PLI commission rates.

- Premium Amount: Higher premium amounts result in higher absolute commission earnings.

- Policy Term: Longer-term policies may provide extended renewal commissions.

Important Considerations:

- Policy Lapses: If a policyholder discontinues premium payments early, agents might lose out on renewal commissions.

- Regulatory Changes: Commission structures are subject to change based on governmental regulations and organizational policies.

For precise and up-to-date information regarding PLI agent commissions in 2026, it’s advisable to contact the official Postal Life Insurance authorities or visit their official website.

See below the PLI agent commission chart pdf form

PLI Commission Calculator:

As of February 2026, the Postal Life Insurance (PLI) in India has not publicly released a specific Agent Commission Calculator. However, understanding the general commission structure can help agents estimate their potential earnings. See below the PLI agent commission calculator.

General Commission Structure:

While exact percentages may vary, PLI agents typically earn commissions based on the premiums collected:

-

First-Year Commission: Agents receive a percentage of the premium paid in the first year of the policy.

-

Renewal Commission: A smaller percentage is earned on premiums paid in subsequent years.

Example Calculation:

If a policyholder pays an annual premium of ₹10,000:

-

First-Year Commission: Assuming a 10% rate, the agent would earn ₹1,000 in the first year.

-

Renewal Commission: Assuming a 2.5% PLI commission rate, the agent would earn ₹250 annually in the following years, provided the policy remains active.

Factors Influencing Commissions:

-

Policy Type: Different policies (e.g., Endowment Assurance, Whole Life Assurance) may offer varying PLI agent commission rate.

-

Premium Amount: Higher premium amounts result in higher absolute commission earnings.

-

Policy Term: Longer-term policies may provide extended renewal commissions.

Important Considerations:

-

Policy Lapses: If a policyholder discontinues premium payments early, agents might lose out on renewal commissions.

-

Regulatory Changes: Commission structures are subject to change based on governmental regulations and organizational policies.

For precise and up-to-date information regarding PLI agent commissions, it’s advisable to contact the official Postal Life Insurance agent commission chart authorities or visit their official website.

FAQ:

Q. Do PLI agents earn commissions on policy renewals?

A. Yes, PLI agents earn a 2% renewal commission for every premium paid after the first year, except for certain policies like Bal Jeevan Bima.

Q. What factors affect the PLI agent commission?

A. Several factors influence the commission:

- Policy type (Different policies have different commission rates).

- Premium amount (Higher premiums result in higher commissions).

- Policy term (Longer policies allow more renewal commissions).

- Policy lapse rate (If a policyholder stops paying, the agent loses renewal commissions).

- Government regulations (Commission rates are subject to policy changes by the government).

Q. How do PLI agents receive their commission?

A. Commissions are credited directly to the agent’s registered bank account.

Payments are made monthly based on the policies sold and renewed.

Q. Is there any tax deduction on commissions?

A. Yes, if the total commission exceeds a certain threshold, TDS (Tax Deducted at Source) and GST (18%) may apply.

Q. Do agents get bonuses or incentives?

A. Currently, PLI does not offer extra incentives beyond commissions, but agents can increase earnings by selling more policies.

Q. Can an agent lose their commission rights?

A. Yes, an agent may lose commission earnings if:

- The policy lapses due to non-payment of premiums.

- The agent violates PLI rules or regulations.

Q. How can someone become a PLI agent?

A. To become a PLI agent, one must:

- Be at least 18 years old.

- Apply through the India Post Office.

- Attend a PLI training session.

- Pass an agent exam conducted by the Department of Posts.

Q. Can PLI agents sell both PLI and RPLI policies?

A. Yes, a PLI agent can also sell Rural Postal Life Insurance (RPLI) policies, earning commissions on both categories.

Q. Where can I find the latest PLI commission updates?

A. For the most up-to-date PLI commission structure and policy changes, visit the India Post official website or contact the nearest post office.