The Oriental Insurance Company offers Oriental health insurance products. The company began operations in September 1947 as a subsidiary of the Oriental Government Security Life Assurance Company and was later handed to the central government in 2003. There are simple processes to be an agent of oriental insurance. So, in this article, see the Oriental Insurance Agent Commission Chart 2026.

Oriental Health Insurance Plans:

Table of Contents

Oriental health insurance products can be acquired to provide financial protection against a wide range of medical issues. The Oriental Insurance Company offers the following health plans:

Oriental Happy Family Floater Plan:

The Oriental Happy Family Floater coverage is intended to cover the medical expenses of the entire family.The plan offers sum insured amounts ranging from Rs 1 lakh to Rs 50 lakh and is offered in three types: Silver, Gold, Diamond, and Platinum.

Oriental Mediclaim Insurance Plan (individual):

The Oriental Mediclaim Insurance plan covers an individual’s medical expenses related to the treatment of an injury or disease. The sum insured amount ranges from Rs 1 lakh to Rs 10 lakh.

Oriental Super Health Top-Up Plan:

The Oriental Super Health Top-Up plan offers medical coverage in addition to the standard policy and includes a necessary deductible. The total insured ranges from Rs 3 lakh to Rs 30 lakh, with a deductible between Rs 3 lakh and Rs 20 lakh.

Oriental Health Of Privileged Elders Plan:

The Oriental Health of Privileged Elders (HOPE) plan has been tailored to meet the health needs of older individuals aged 60 and up. The sum insured options for this plan vary from Rs 1 lakh to Rs 5 lakh.

Oriental Dengue Kavach Plan:

The Oriental Dengue Kavach plan is a tailored plan that covers the cost of treating dengue disease. The plan is available for sums covered between Rs 10,000 and Rs 20,000.

How to Become an Agent of Oriental Insurance:

There is a lot of earning potential in this industry, and if you don’t mind putting in some effort, Oriental welcomes you to join its family. The IRDA’s requirements for licensing insurance agents are as follows:

1. Qualifications: If the applicant resides in a place with a population of five thousand or more as per the last census, the applicant must have passed the 12th Standard or equivalent examination conducted by any recognized Board/Institution, or a pass in the 10th Standard or equivalent examination from a recognized Board/Institution if the applicant resides in any other place.

2. Practical Training: The applicant must complete 100 hours of general insurance training at an approved institution. This will be 150 hours for agents pursuing a license in both life and general insurance.

3. Examination: Following completion of practical training, the applicant must pass a pre-recruitment examination administered by the Insurance Institute of India, Mumbai. (Full data are available on the IRDA website, www.irdaindia.org.

If you meet the required criteria, please visit our company’s local office (Divisional Office, Branch Office, or Regional Office). The addresses of our offices are shown on this website. Please approach the Officer in Charge and provide him with an application on plain paper.

Following a preliminary review and brief contact with you, the concerned officer will proceed with your application based on your eligibility. The office would organize training for a modest fee. IRDA sets the license fees (now Rs. 250/-).

How to Become an Oriental Insurance Agent?

-

Check Eligibility:

- Age: Minimum 18 years old

- Education: At least 10th pass (may vary by region)

-

Contact Oriental Insurance:

- Visit the nearest Oriental Insurance branch or their official website (orientalinsurance.org.in)

- Inquire about their agent recruitment process

-

Submit Application:

Fill out the agent application form with the required details:- ID proof (Aadhaar, PAN, Voter ID)

- Address proof

- Educational certificates

- Passport-sized photos

-

Complete IRDAI Training:

- Attend the IRDAI-mandated 50-hour training (online or in-person)

- Learn about insurance products, policies, and regulations

-

Pass IRDAI Exam:

- Register and appear for the IRDAI licensing exam

- You need at least 35% marks to pass the exam

-

Get Your License:

After passing the exam, receive your IRDAI license and become a certified Oriental Insurance agent -

Start Selling Policies:

Once licensed, you can sell insurance products like:- Motor insurance

- Health insurance

- Home insurance

- Travel insurance

- Commercial insurance

-

Earn Commission:

Get paid based on the commission structure for each policy you sell. For example:- Motor Insurance: 10% to 15% of the premium

- Health Insurance: 15% to 20%

- Renewal Policies: 5% to 10%

-

Grow Your Business:

- Build a client base through networking and referrals

- Cross-sell multiple insurance products

- Maintain good customer service for higher renewals and long-term income

-

Enjoy Incentives and Bonuses:

High-performing agents often get performance-based incentives, bonuses, and rewards like trips and gifts.

Oriental Insurance Agent Commission Chart 2026:

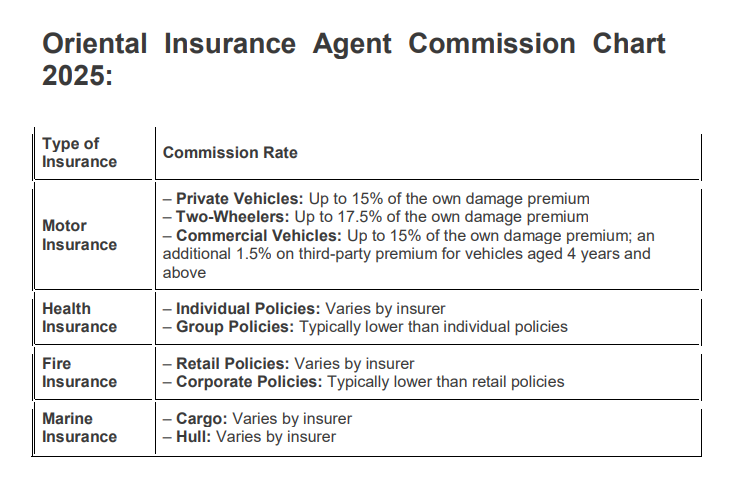

As of now, the specific commission structure for Oriental Insurance agents in 2026 has not been publicly disclosed. However, the Insurance Regulatory and Development Authority of India (IRDAI) sets maximum commission limits for various insurance products, which insurers typically adhere to. Below is a general overview of the Oriental Insurance agent commission chart for different types of insurance policies:

| Type of Insurance | Commission Rate |

|---|---|

| Motor Insurance | – Private Vehicles: Up to 15% of the own damage premium – Two-Wheelers: Up to 17.5% of the own damage premium – Commercial Vehicles: Up to 15% of the own damage premium; an additional 1.5% on third-party premium for vehicles aged 4 years and above |

| Health Insurance | – Individual Policies: Varies by insurer – Group Policies: Typically lower than individual policies |

| Fire Insurance | – Retail Policies: Varies by insurer – Corporate Policies: Typically lower than retail policies |

| Marine Insurance | – Cargo: Varies by insurer – Hull: Varies by insurer |

Please note that these rates are subject to change based on IRDAI regulations and the company’s internal policies. For the most accurate and up-to-date information regarding Oriental Insurance’s commission structure for 2026, it’s advisable to contact the company directly or visit their official website.

How to Calculate Oriental Insurance Agent Commission?

-

Identify the Type of Policy:

Commission rates vary by insurance product:- Motor Insurance: Cars, bikes, commercial vehicles

- Health Insurance: Individual and group health plans

- Home Insurance: Property and household coverage

- Travel Insurance: Domestic and international travel plans

- Commercial Insurance: Fire, marine, and liability insurance

-

Know the Commission Rate:

Commission rates typically follow IRDAI guidelines. Approximate rates:- Motor Insurance:

- Private Cars: Up to 15% of own-damage premium

- Two-Wheelers: Up to 17.5% of own-damage premium

- Commercial Vehicles: 10% to 15% of own-damage premium + ~1.5% on third-party premium (for older vehicles)

- Health Insurance: 15% to 20% on individual plans; lower for group policies

- Fire Insurance: 10% to 15% for retail; lower for corporate policies

- Marine Insurance: Varies based on cargo and hull policies

- Motor Insurance:

-

Get the Premium Amount:

Exclude GST and any additional charges. Use only the base premium amount. -

Apply the Commission Formula:

Commission = Premium Amount × Commission Rate (%) -

Example Calculation:

Suppose you sell a comprehensive car insurance policy with a ₹40,000 own-damage premium:- Premium: ₹40,000

- Commission Rate: 15%

- Commission Earned: ₹40,000 × 15% = ₹6,000

-

For Policy Renewals:

Renewal commissions are typically lower, around 5% to 10% for most insurance products.

Example for a car insurance renewal with a ₹35,000 premium at a 7% rate:- Commission: ₹35,000 × 7% = ₹2,450

-

Earnings from Add-Ons:

Selling additional covers like zero depreciation, engine protection, or roadside assistance often gives 5% to 15% extra commission. -

Incentives and Bonuses:

High-performing agents may qualify for performance-based bonuses, extra commissions, and rewards. -

Annual Earnings Estimation:

If you sell 10 motor insurance policies a month with an average ₹30,000 premium and a 12% commission rate:- Monthly Commission: 10 × ₹30,000 × 12% = ₹36,000

- Annual Commission: ₹36,000 × 12 = ₹4,32,000

FAQ:

Q. What is the commission rate for Oriental Insurance agents?

A. Commission rates vary by product:

-

- Motor Insurance:

- Private Cars: Up to 15% of the own-damage premium

- Two-Wheelers: Up to 17.5% of the own-damage premium

- Commercial Vehicles: 10% to 15% on the own-damage premium + ~1.5% on third-party premium (for older vehicles)

- Health Insurance: 15% to 20% on individual policies; lower for group policies

- Renewal Policies: 5% to 10% commission

- Other Insurance (Fire, Marine, etc.): Varies, usually between 10% and 15%

- Motor Insurance:

Q. How is the commission calculated?

A. Commission is calculated on the base premium (excluding taxes and additional charges):

Commission = Premium Amount × Commission Rate (%)

Example: For a motor insurance policy with a ₹40,000 premium and a 15% rate:

₹40,000 × 15% = ₹6,000 commission

Q. When is the commission paid?

A. Commissions are generally paid monthly after the policy’s premium has been collected and processed.

Q. Do agents earn commission on policy renewals?

Yes! Renewal commissions are usually 5% to 10%, depending on the policy type.

Q. Are there any performance-based incentives?

A. Yes, Oriental Insurance often offers bonuses and incentives for agents who meet or exceed sales targets. These may include higher commission rates, cash bonuses, or rewards.

Q. Is there a cap on the commission an agent can earn?

A. No, there’s no upper limit — the more policies you sell and renew, the more you earn.

Q. Do agents earn commission on add-on covers?

A. Yes! Selling add-ons like zero depreciation, engine protection, or roadside assistance can increase your commission — these usually carry 5% to 15% commission rates.

Q. Can an Oriental Insurance agent sell multiple types of policies?

A. Absolutely! Agents can sell a variety of insurance products, including:

-

- Motor Insurance

- Health Insurance

- Home and Property Insurance

- Travel Insurance

- Commercial and Business Insurance

Q. How can I maximize my earnings as an Oriental Insurance agent?

-

- Sell high-premium policies

- Focus on renewals for consistent income

- Cross-sell multiple products like health, motor, and home insurance

- Build long-term relationships and provide excellent customer service