Commission Earned by LIC Agents:

LIC agents receive a commission from policyholder premiums. The LIC agent commission 2026 percentage is influenced by the type of insurance, the year premiums are paid, and the plan sold.

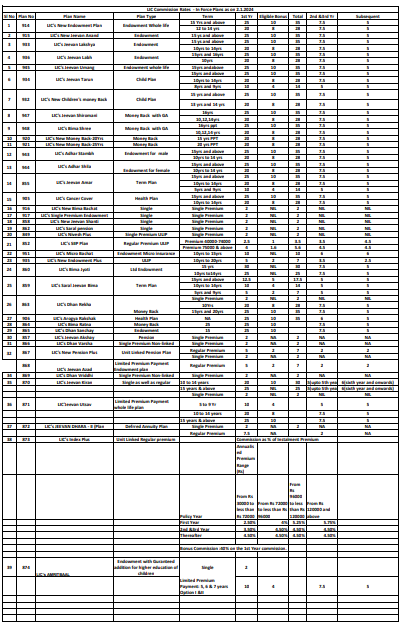

The following is a breakdown of the life insurance agent commission structure:

1. The Plan for Endowments:

An endowment plan is a type of life insurance policy that provides funds in addition to insurance coverage, according to LIC terminology. It offers protection as well as investment. See below the LIC commission chart 2026 India.

| Premium Paying Term | Commission for the First Year | Commission for the Second & Third Year | Commission from the Fourth Year Onwards |

| 15 years and above | 25% | 7.50% | 5% |

| 10 years to 14 years | 20% | 7.50% | 5% |

| 5 years to 9 years | 10% | 5% | 5% |

| 2 years to 4 years | 5% | 2.25% | 2.25% |

2. Money-Banking Plans:

| Premium Paying Term | Commission for the First Year | Commission for the Second & Third Year | Commission from the Fourth Year Onwards |

| As per plan | 15% | 10% | 6% |

| 12 years | 15% | 8% | 6% |

3. Children’s Plans:

Child plans are specialized insurance policies designed to provide children with the future financial security they will require.

| Premium Paying Term | Commission for the First Year | Commission from the Second Year Onwards |

| 9 years and above | 10% | 5% |

| 5 years to 9 years | 7.50% | 5% |

| 2 years to 4 years | 5% | 2% |

4. Pension Plans:

The purpose of pension plans, which are insurance products, is to provide people with financial security in retirement.

| Premium Paying Term | Commission for the First Year | Commission from the Second Year Onwards |

| More than 4 years | 7.50% | 2% |

| 2 years to 4 years | 5% | 2% |

Additional Changes:

- Minimum Sum Assured: The minimum sum assured for policies has been raised from ₹1 lakh to ₹2 lakh, applicable to policies effective from October 1, 2024.

- Premium Increase: LIC has increased premiums by 8-9% across various life insurance products.

- Surrender Value Norms: Policyholders are now eligible to surrender their policies only after completing one full premium year, aiming to promote long-term policy retention.

Gratuity Benefits:

In December 2023, LIC increased the gratuity limit for agents from ₹3 lakh to ₹5 lakh, enhancing financial security for its agents. These changes reflect LIC’s commitment to aligning agent compensation with policyholder benefits, ensuring sustainable growth and retention in the insurance sector.

See the LIC agent commission chart 2026

Commission Calculator:

The LIC agent commission is calculated using a percentage of the policyholder’s premium. The formula varies according to the policy year because commission rates for the first year of the insurance are different from those for subsequent years.

The formula for the First-Year Commission:

First-Year Commission = Annual Premium (First Commission Rate / 100)

For example:

- In the event that an LIC agent offers a policy with an annual premium of ₹50,000 and the commission schedule looks like this:

- The first-year commission is 25%.

The Calculations that Follow Will be Performed:

- 50,000 (25/100) ₹12,500

- Formula for Second and Third-Year Commissions

- The second or third year commission is calculated by dividing the Annual Premium (second or third commission rate) by 100.

For example:

- In the event that a LIC agent offers a policy with an annual premium of ₹50,000 and the commission schedule looks like this:

- Second or third year: 7.5%

The Calculations that Follow Will be Performed:

50,000 (7.5 / 100) = ₹3,750 (P.A.)

The equation for years four and up

Fourth Year Onward Commission = Annual Premium (Fourth Commission Rate/100).

For example:

In the event that a LIC agent offers a policy with an annual premium of ₹50,000, and the LIC agent commission schedule looks like this:

Starting in the fourth year: 5%

The Calculations that Follow Will be Performed:

50,000 (5/100) = ₹ 2,500 (P.A.)

This formula can be used to calculate your earnings as a LIC agent based on commission percentages and premium amounts.

Conclusion:

Working as an LIC agent offers a rewarding career with flexibility, substantial earning potential, and the satisfaction of helping others secure their futures. LIC is a great choice for people who want to start a career in insurance because of its reputation, comprehensive training, and enticing LIC commission 2026 plans. If you’re interested in becoming an agent, follow the above steps to take advantage of the benefits and incentives that LIC offers.

Prospective agents can make wise decisions about this field of business by having a solid understanding of the commission system. Regardless of your career or side gig ambitions, working as an LIC agent can result in both financial gain and personal joy.

FAQ:

Q. Has the commission changed from previous years?

A. Yes, the first-year commission has been reduced from 35% to 28%, while the renewal commission has increased from 5% to 7.5%.

Q. How is the commission calculated for an LIC agent?

A. Commission is calculated as a percentage of the first-year premium and renewal premiums of the policies sold.

Q. Do LIC agents earn commissions for the entire policy term?

A. No, renewal commissions are usually paid for 6 years after the first year. However, this may vary depending on the policy.

Q. Is there any extra commission for long-term policies?

A. Yes, for policies with a term of 15 years or more, agents may get additional benefits.

Q. Are LIC agents eligible for bonuses?

A. Yes, successful agents may receive a LIC agent bonus commission chart, incentives, and other rewards based on their performance.

Q. Do LIC agents earn commissions on single-premium policies?

A. Yes, but the commission on single-premium policies is usually 2% of the premium.

Q. Is GST applicable on the LIC agent commission?

A. Yes, agents earning above the GST threshold are required to pay GST at 18% on their commission earnings.

Q. What is the maximum gratuity limit for LIC agents?

A. The gratuity limit for LIC agents has been increased from ₹3 lakh to ₹5 lakh.

Q. Can an LIC agent earn a pension or salary?

A. No, LIC agents work on a commission-only basis. However, successful agents can earn a steady income from renewal commissions.

Would you like more details on any specific aspect?