ICICI Prudential is one of the most prominent companies in India’s insurance sector, having started its operations in 2001. Becoming an ICICI Prudential Life Insurance Agent is a great way to earn high commissions, renewal income, and bonuses while helping customers secure their financial future. So, here is the ICICI Prudential Life Insurance Agent Commission Chart 2026.

How to Become an ICICI Prudential Life Insurance Agent?

Table of Contents

Eligibility Criteria:

- Minimum Age: 18 years or older

- Qualification: 10th pass (rural) / 12th pass (urban)

- IRDAI Certification (Mandatory for all agents)

Steps to Register:

- Apply Online at ICICI Prudential Official Website or visit a branch.

- Submit Documents (Aadhaar, PAN, educational certificates).

- Complete IRDAI Training (15 hours online/offline).

- Pass the IRDAI Exam to receive your Agent License.

- Start Selling and earning commissions!

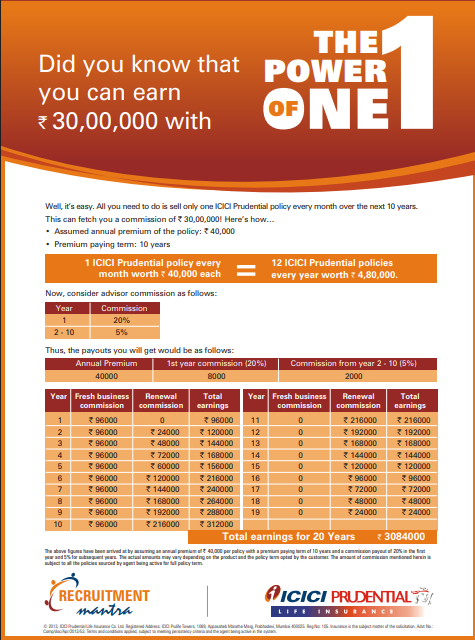

ICICI Prudential Life Insurance Agent Commission Chart 2026:

Your ICICI Prudential agent commission earnings depend on policy type & premium amount.

| Policy Type | 1st Year Commission | 2nd & 3rd Year | 4th Year Onwards |

|---|---|---|---|

| Regular Premium Plans | 30-35% | 7.5% | 5% |

| Single Premium Plans | 2% | – | – |

| Term Insurance Plans | 30-35% | 7.5% | 5% |

| Pension Plans | 7.5% | 2% | 2% |

| ULIP Plans | 2.5% | 2% | 1.5% |

Example:

Selling a ₹50,000 annual premium policy earns:

- ₹15,000 – ₹17,500 in the first year (30-35%)

- ₹3,750 per year in the 2nd & 3rd years (7.5%)

- ₹2,500 per year from the 4th year onwards (5%)

See below the ICICI Prudential Advisor Commission Chart 2026 in PF format.

Factors Affecting ICICI Prudential Agent Commission:

Type of Policy Sold:

- Regular premium plans pay higher commissions (30-35%) than single premium plans (2%).

- Selling term insurance & ULIPs results in higher earnings.

Number of Policies Sold:

- Agents selling 10+ policies per month earn significantly more.

- Selling high-ticket policies (₹50,000+ premiums) results in better commissions.

Customer Base & Referrals:

- A strong personal & professional network generates more policy sales.

- Referrals from satisfied clients boost income without extra marketing costs.

Digital & Social Media Marketing:

- Using WhatsApp, Facebook, and LinkedIn helps attract customers.

- Digital promotions bring in younger buyers who prefer online services.

Renewal Commissions & Policy Persistency:

- If customers stop paying premiums, agents lose renewal commissions.

- Regular follow-ups & good customer service increase policy renewals.

Competition & Market Demand:

- More agents in an area = higher competition.

- Providing excellent service & policy guidance helps agents stand out.

How to Succeed as an ICICI Prudential Life Insurance Agent?

- Sell high-premium & long-term policies for better commissions.

- Use digital marketing & WhatsApp promotions to attract more clients.

- Follow up regularly to ensure policy renewals.

- Attend training sessions to improve sales skills.

- Offer excellent customer service to gain more referrals.

Benefits of Becoming an ICICI Prudential Life Insurance Agent:

- High Commission: Earn up to 35% in the first year.

- Renewal Commissions: Get passive income every year.

- Flexible Work: Work part-time or full-time.

- Incentives & Rewards: Get cash bonuses, gadgets, and international trips.

- Digital Tools & Training: ICICI Prudential provides online sales tools & training support.

ICICI Prudential Life Agent Earning Potential:

| Policies Sold per Month | Avg. Annual Premium (₹) | 1st Year Commission (30%) | Monthly Earnings (₹) |

|---|---|---|---|

| 5 policies | ₹50,000 | ₹75,000 | ₹6,250 |

| 10 policies | ₹50,000 | ₹1,50,000 | ₹12,500 |

| 20 policies | ₹50,000 | ₹3,00,000 | ₹25,000 |

How to Calculate ICICI Prudential Life Insurance Agent Commission?

ICICI Prudential Life Insurance agents earn commissions based on policy type, annual premium, and policy duration. The ICICI Prudential commission chart structure is regulated by IRDAI (Insurance Regulatory and Development Authority of India).

Use the following formula:

🔹 First-Year Commission:

Commission=Annual Premium×Commission Rate\text{Commission} = \text{Annual Premium} \times \text{Commission Rate}

🔹 Renewal Commission (from 2nd Year onwards):

Commission=Annual Premium×Renewal Commission Rate\text{Commission} = \text{Annual Premium} \times \text{Renewal Commission Rate}

Example

Regular Premium Policy

- Annual Premium: ₹50,000

- First-Year Commission (30%): 50,000×30%=₹15,00050,000 \times 30\% = ₹15,000

- 2nd & 3rd Year Commission (7.5%): 50,000×7.5%=₹3,750 per year50,000 \times 7.5\% = ₹3,750 \text{ per year}

- 4th Year Onwards (5%): 50,000×5%=₹2,500 per year50,000 \times 5\% = ₹2,500 \text{ per year}

Conclusion:

ICICI Prudential Life Insurance agents earn high first-year commissions (30-35%) and renewal income (5-7.5%), making it a lucrative career option. Understanding the policy type, premium amount, and commission structure will help maximize earnings.

FAQ:

Q. How much can an ICICI Prudential Life Agent earn per month?

A. Earnings range from ₹10,000 to ₹1 lakh+ per month, depending on sales & renewals.

Q. Is this a full-time job?

A. No, it can be part-time or full-time, depending on your choice.

Q. Is training required?

A. Yes, 15-hour IRDAI training is mandatory before becoming an ICICI Prudential Life Agent.

Q. How do agents receive commission payments?

A. ICICI insurance agent commission is credited directly to the agent’s bank account every month.