Driven by over 23,500 workers, Aditya Birla Sun Life’s companies operate across the country with over 900 locations, over 2,000,000 agents and channel partners, and multiple bank partners. So, see below the Aditya Birla Sun Life Agent Commission Chart 2026.

How to Become an Aditya Birla Sun Life Agent Commission?

Table of Contents

If you’re looking to become an Aditya Birla Sun Life Insurance (ABSLI) agent, here’s a simple step-by-step guide:

Check Eligibility:

Age: Minimum 18 years old.

Education:

- 12th pass for urban areas.

- 10th pass for rural areas.

Contact ABSLI:

- Visit the official website: https://lifeinsurance.adityabirlacapital.com

- Go to the “Become an Advisor” or “Join Us” section.

- Fill in your details and submit the application form.

Training:

- Complete the mandatory 50-hour training program approved by the Insurance Regulatory and Development Authority of India (IRDAI).

- This training covers insurance basics, product knowledge, sales techniques, and regulatory guidelines.

IRDAI Exam:

After training, appear for the IRDAI licensing exam. You must pass this exam to get certified as a life insurance advisor.

Get Your License:

Once you pass the exam, you’ll receive an IRDAI license to start selling ABSLI insurance products.

Start Selling:

With your license, you can start advising clients and selling Aditya Birla Sun Life Insurance policies. Earn commissions on every policy you sell and renew.

Aditya Birla Sun Life Agent Commission Chart 2026:

The commission structure for Aditya Birla Sun Life Insurance (ABSLI) agents varies based on the type of insurance product and premium payment terms. Below is a detailed breakdown:

| Policy Type | Premium Payment Mode | First-Year Commission | Renewal Commission |

|---|---|---|---|

| Single Premium Policies | Single Payment | 2% | Not Applicable |

| Regular Premium Pure Risk Plans | Annual Payments | 40% | 10% per annum |

| Investment-Based Regular Premium | Annual Payments | 15% for the first 5 years | 7.5% per annum thereafter |

Example Calculation:

- Scenario: An agent sells a regular premium pure risk plan with an annual premium of ₹10,000.

- First-Year Commission: 40% of ₹10,000 = ₹4,000

- Renewal Commission (from 2nd year onwards): 10% of ₹10,000 = ₹1,000 annually

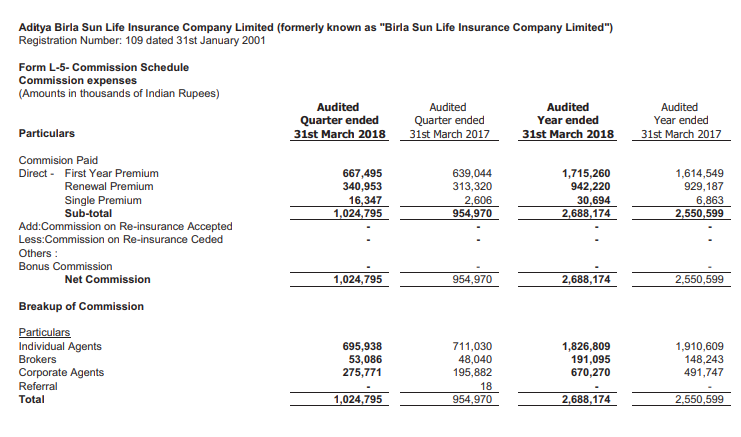

See below the Birla Sun Life Agent Commission Chart 2026 in pdf format.

Factors Affecting Aditya Birla Sun Life Agent Commission:

Several factors influence the commission an Aditya Birla Sun Life Insurance (ABSLI) agent earns. Let’s take a closer look:

Policy Type:

- Traditional Plans (Endowment, Whole Life): Higher first-year commissions and ongoing renewal commissions.

- Term Insurance Plans: Lower premiums, so commission rates tend to be lower.

- Unit-Linked Insurance Plans (ULIPs): Commissions depend on fund management fees and policy duration.

- Single-Premium Policies: One-time lower commission on a lump-sum payment.

Premium Payment Mode:

Single Premium: Lower commission, typically around 2%.

Regular Premium: Higher first-year commission and recurring renewal commissions in subsequent years.

Policy Term:

Longer policy terms often lead to higher first-year commissions and more years of renewal commissions, boosting long-term income.

Premium Amount:

Higher annual premiums result in larger commission payouts, as commissions are a percentage of the premium amount.

Renewal Persistence:

The more policies you keep active over time (i.e., policyholders continuing their premium payments), the more you earn in renewal commissions.

Product-Specific Rates:

Different ABSLI products have distinct commission structures, often aligned with IRDAI guidelines. Some savings or investment-linked plans offer higher commissions compared to pure protection plans.

Agent Performance:

High-performing agents may receive performance-based incentives, bonuses, and higher commission slabs. Consistent sales and policy retention improve your earning potential.

Regulatory Guidelines:

The Insurance Regulatory and Development Authority of India (IRDAI) sets maximum commission limits, ensuring fair practices across the industry.

Market Campaigns and Incentives:

During special sales drives or promotional campaigns, ABSLI may offer additional bonuses or incentives for selling specific products.

Experience and Tenure:

Senior agents with a strong track record may get additional rewards and enhanced commission rates based on their performance history.

Benefits of Becoming an Aditya Birla Sun Life Agent:

Becoming an Aditya Birla Sun Life Insurance (ABSLI) agent comes with a wide range of benefits both financial and professional. Here’s what makes it a great opportunity:

Attractive Commission Structure:

- Earn competitive Aditya Birla Sun Life insurance agent commission on every policy you sell.

- First-year and renewal commissions mean you keep earning as long as the policy remains active.

- Higher commissions for longer premium-paying terms and larger premiums.

Performance-Based Incentives:

- Get bonuses, rewards, and cash incentives for meeting sales targets.

- Participate in contests and qualify for national and international recognition.

Unlimited Earning Potential:

- Your income depends on the number and type of policies you sell — there’s no cap on earnings.

- The more policies you sell and retain, the more you earn in both first-year and renewal commissions.

Flexible Working Hours:

- Work at your own pace and convenience — no fixed 9-to-5 schedule.

- Balance your personal and professional life with ease.

Comprehensive Training:

- Get world-class training on insurance products, sales techniques, and customer service.

- Stay updated on market trends and regulatory guidelines with ongoing development programs.

Professional Growth:

- Build a long-term, stable career in the insurance industry.

- Opportunities to rise through the ranks with excellent performance and dedication.

Strong Brand Association:

- Represent Aditya Birla Sun Life Insurance — a trusted and reputable name in the financial services sector.

- Gain customer trust through association with a well-established and respected company.

Supportive Infrastructure:

- Access to digital tools, marketing support, and an extensive network of branches.

- Get help with customer management, claims processing, and after-sales service.

Recognition and Rewards:

- Enjoy prestigious titles, awards, and exclusive trips based on your performance.

- Join a network of top-performing agents and industry leaders.

Long-Term Passive Income:

- Renewal commissions ensure you keep earning from policies you’ve sold for years to come.

- Build a steady stream of passive income through consistent policy retention.

How to Calculate Aditya Birla Sun Life Agent Commission?

Calculating an Aditya Birla Sun Life Insurance (ABSLI) agent’s commission is pretty straightforward. Let’s break it down step by step:

Understand the Commission Structure:

The Aditya Birla Sun Life Insurance agent commission chart rate depends on the type of policy and premium payment term:

- Single-Premium Policies: Lower, one-time commission (usually around 2%).

- Regular-Premium Policies: Higher first-year commission and renewal commissions in subsequent years.

- Traditional Plans: Higher first-year commission (up to 35-40%) and 5-7.5% renewal commission.

- ULIPs and Investment Plans: Varying rates based on fund structure and term.

Formula for Commission Calculation:

Commission=Premium Amount×Commission Rate

Example Calculations:

-

Single-Premium Policy:

- Premium Amount: ₹100,000

- Commission Rate: 2%

- Commission: ₹100,000 × 2% = ₹2,000

-

Regular-Premium Policy (First Year):

- Annual Premium: ₹50,000

- First-Year Commission Rate: 35%

- Commission: ₹50,000 × 35% = ₹17,500

-

Regular-Premium Policy (Renewal Years):

- Annual Premium: ₹50,000

- Renewal Commission Rate: 7.5%

- Commission: ₹50,000 × 7.5% = ₹3,750

Factors Affecting Commission:

- Policy Term: Longer terms often lead to higher commissions.

- Premium Payment Mode: Regular premiums provide ongoing income through renewals.

- Persistency: Higher policy retention means consistent renewal commissions.

Additional Incentives:

ABSLI often provides performance-based bonuses and contests, which can significantly boost your overall earnings.

FAQ:

Q. How much commission does an ABSLI agent earn?

A. The Aditya Birla agent commission varies by policy type and premium payment term.

- Single Premium Plans: Around 2% of the premium amount.

- Regular Premium Plans: Up to 35-40% in the first year and 5-7.5% in renewal years.

Q. How long do agents earn renewal commissions?

A. Renewal commissions are paid for the duration of the premium-paying term of the policy, typically between 5 to 30 years, depending on the policy.

Q. Are there different commission rates for different products?

A. Yes, commission rates differ based on the type of policy:

- Term Plans: Lower commissions due to lower premiums.

- Traditional Plans: Higher first-year and ongoing commissions.

- ULIPs: Varying commissions based on fund and term structure.

Q. Do ABSLI agents earn bonuses or incentives?

A. Yes! ABSLI offers performance-based bonuses, contests, and rewards like cash incentives, international trips, and recognitions.

Q. How is the commission paid?

A. Commissions are usually paid monthly, directly into the agent’s registered bank account.

Q. Can an agent earn passive income?

A. Absolutely! Renewal commissions create a steady stream of income from policies sold in previous years.

Q. Are there any regulatory limits on commissions?

A. Yes, all commissions are regulated by the Insurance Regulatory and Development Authority of India (IRDAI) to ensure fair practices.

Q. What happens if a policy lapses?

A. If the policyholder stops paying premiums, renewal commissions stop as well. Agents benefit from maintaining high policy retention rates.

Q. Are commissions taxable?

A. Yes, commissions are considered income and are subject to income tax. TDS (Tax Deducted at Source) may also apply.