Individuals who desire to protect their bike or scooter from some unforeseen dangers can buy the Reliance two wheeler insurance policies for security. This bike insurance reliance/reliance insurance bike policy has more than 3800 authorized garages under the company’s network to provide a total cashless facility to its policyholder.

Key Features Of The Reliance Two Wheeler Insurance Policy:

Table of Contents

Here are the key features of the Reliance two wheeler insurance policies listed below:

Hassle-free Claims:

Avail the Reliance two wheeler insurance plan’s claim settled quickly with the least possible paperwork

Lower Premium:

Reliance two wheeler insurance starts at just INR 4 per day based on the vehicle category, driving and parking experience, and loyalty

Cashless Repairs:

Avail great suitability by repairing your scooter or bike at the listed garage in the Reliance two wheeler insurance policy’s network. They have over 430 garages listed under their network, from where you can avail cashless repair facility!

Coverage of The Reliance Two Wheeler Insurance Policy:

The Reliance two wheeler insurance tried their best to provide its policyholder the comprehensive coverage, which not only ensures the vehicle but also the owner as well as the third-party for the legal responsibility occurred due to the insured bike or scooter. So, you get Reliance two wheeler insurance 3rd party/Reliance third party bike insurance along with this policy.

The Reliance two wheeler insurance policies provide coverage to lose or damage to your vehicle because of:

- Earthquake

- Cyclone

- Accident

- Flood

- Terrorism

- Explosion

- Fire

- Theft

- Self-Ignition

- Lightening

- Riot

- Malicious Acts

- Strikes etc.

In addition to these, this insurance company recommends that one might opt for the Third-Party Legal Liability Coverage for their scooter, bike, or motorcycle since it is compulsory to buy in accordance with the Motor Vehicles Act in India. You can avail of bike insurance online Reliance.

So, this insurance policy covers the damage to a third-party or its property. It also provides legal responsibility of third-party in the event of death or injury. You can also get Reliance two wheeler insurance policy download/Reliance bike insurance download link from the official website,

Add-On Covers Of The Reliance Two Wheeler Insurance Policy:

Source :- policybazaar . com

Zero Depreciation:

With zero depreciation add-on, you can protect your bike or scooter against the drop in the worth of different parts of the vehicle with age. Since you can replace the parts without cutting your own pocket.

Personal Accident Coverage:

This coverage provides security against a road misfortune not just in India but anywhere on the globe, despite the fact who was driving the vehicle at the time of the accident. With the help of this, is covers against the Permanent Complete Disablement and Accidental Death. This add-on is also available in case of Reliance 4 wheeler insurance

Exclusions Of The Reliance Two Wheeler Insurance Policy:

This Reliance two wheeler insurance copy though tried their best to cover every possible area but still, there are a few exclusions in this policy. These are as follows:

- Electrical and mechanical breakdown

- Usual wear and tear of your vehicle

- Damage occurred to the vehicle by an individual driving the vehicle without driving license

- If you use the vehicle other than as per the limitations, for instance, though you bought the bike for your personal use, now you are using it for racing.

- Damage or loss because of the reduction of your vehicle’s worth

- Damage or loss produced during riding the vehicle under the effect of drug, alcohol, liquor or any intoxicating thing

- Unavoidable deductibles such as a stable sum that gets abstracted during the claim

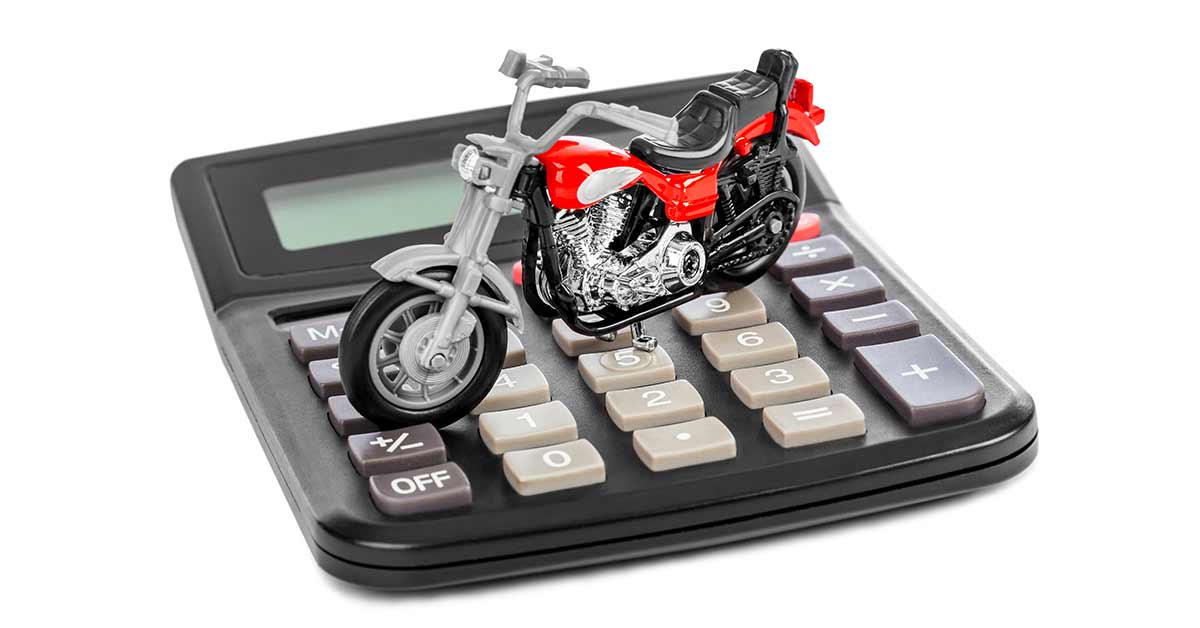

Discounts Availed On The Premium Payments

You can avail discounts on the upcoming premium sum as “No claim Bonus” (NCB) and on the Voluntary Deductible. In addition to this, the policyholder also can avail the advantage of shifting the “No Claim Bonus” (NCB) to the new vehicle of yours.

Discount On “No Claim Bonus”:

We have provided the information about the “No Claim Bonus” (NCB) discounts on your premium sum in this table below.

This discount will be valid on your premium sum during the renewal of your insurance policy.

Years |

Next Premium Discount |

| 1 year | 20% (percent) |

| 2 year | 25% (percent) |

| 3 year | 35% (percent) |

| 4 year | 45% (percent) |

| 5 year | 50% (percent) |

The Voluntary Deductible

Higher the contribution to the Voluntary Deductible, the inferior the premium will be.

Voluntary Deductible |

Premium Discount |

| INR 500/- | 5% (not more than INR 50/-) |

| INR 750/- | 10% (not more than INR 75/-) |

| INR 1000/- | 15% (not more than INR 125/-) |

|

INR 1500/- |

20%(not more than INR 200/-) |

Documents needed for The Reliance Two Wheeler Insurance Policy:

Source :- policybazaar . com

These following documents are needed to avail the Reliance Two Wheeler Insurance Plan:

- Registration Certificate (RC) Number

- The Engine Number

- Last Policy Number (only if needed)

- Place and Date of purchasing the vehicle

- Manufacturing Date of the Vehicle

- Chassis Number

- 1 Copy of your bike or scooter’s RC Book

- Personal Contact details

How To Apply for The Reliance Two-Wheeler Insurance Policy?

There is more than 1 method to apply for the Reliance two wheeler insurance policies. Let’s check out the methods below:

Persons who wish to avail the policy can just call on the company’s Sales helpline to speak with the representative of the consumer service.

Or

You can merely provide your name and your mobile number on the official website i.e. @reliancegeneral.co.in of the Reliance Company to demand to call back

Or

You can apply online by simply visiting Reliance’s official website i.e. @reliancegeneral.co.in and buy the plan.

Or

Visit your nearest Reliance branch or go to an agent to buy the policy.

Process To Reliance Two Wheeler Insurance Policy’s Claim Settlement

Source :- policybazaar . com

While making any claim, the policyholder should keep an eye on the subsequent steps to apply and settle the claim for the two-wheeler:

- The policyholder needs to register the claim by simply calling the insurance company’s helpline number (toll-free) instantly after the claim ascends

- Then take the insured motor vehicle to an authorized garage of the insurance company for repairs

- You need to submit the compulsory documents to the inspector

- Then let the insurance the company confirm the legal responsibility

- The insurance company straightly settles down the bill with authorized garage in the event of Cashless advantage for repairs at the authorized garage

- On the off chance that fixes are not done at the approved garage, then the policyholder has to pay the bills from his or her own pocket. At that point, the policyholder has to present a copy of the bills to let the insurance company settle the matter

- Then the policyholder’s vehicle will be transported to its owner

NOTE:

You can get Reliancegeneral co in policy copy as well as Reliancegeneral co in for instant renewal from their official site reliancegeneral.co.in policy download

Reliance insurance renewal for bike/Reliance vehicle insurance renewal

Ensure your two wheeler with Reliance bike Insurance plan that offers instant Reliance two wheeler insurance policy renewal online with zero paperwork.

NOTE:

For Reliance 2 wheeler insurance renewal/Reliance 2 wheeler insurance online go to the official website of Reliance general insurance company. Reliance two wheeler insurance online renewal/Reliance two wheeler insurance policy renewals don’t require any paperwork at all.