An ICICI two wheeler insurance policy for the two-wheeler that keeps the vehicle protected against any damage produced by man-made and natural disasters. The ICICI two wheeler insurance policy covers for personal damage, liability, and personal accident under just one policy.

We all want our bike or scooter to be protected and for this, the best technique is to buying ICICI insurance two wheelers. In case you are pondering how to buy and renew motor insurance, we’re here to help you out.

Main Benefits Of The ICICI Two Wheeler Insurance Policy

Table of Contents

- The No Claim Bonus or NCB* will be valid for one or maybe for more privileges as per your policy period

- No vehicular check-up conducted under this policy, not even in the event of the expired policy

- Renewing the policy via the online portal is very easy and effortless as the ICICI vehicle insurance renewal online is very easy.

- Acquire a personal mishap cover to keep the loved ones protected with add-on cover for co-passenger

- Protected your co-passengers and yourself

- Select added safety for the two-wheeler

- Acquire a long-term hassle-free policy

- Pick add-on cover to anchor non-electrical and electrical embellishments of your bike or scooter

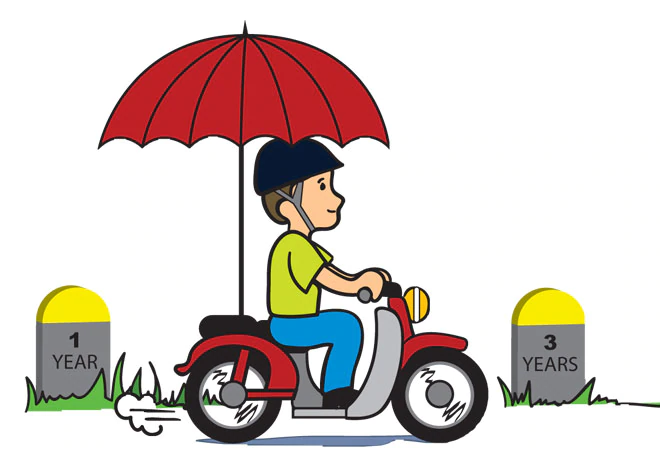

- Acquire a sole policy certificate with 3 years validity

- Depend on two wheeler insurance ICICI’s 2,150 plus system carports crosswise over India for help with the instance of any malfunctions amid your adventure.

- Drive with a protecting shield

- The plan accompanies residency alternatives of 1, 2 and 3 years. Select long haul residency and ride effortlessly

- Pick comfort over issues of renewal

* No Claims Bonus (NCB) might be permitted given the plan is reestablished in 90 days of the expiration date of the past arrangement. The NCB will be accessible if you indicate proof that you are qualified for NCB from your past engine insurance agency. Proof can be as a composed presentation or a recharging notice or a letter affirming the NCB privilege from the past back up plan. To get the NCB you will have to ICICI insurance renewal for bike before it expires.

ICICI TWO WHEELER INSURANCE COVERAGE

Source:- businesstoday . in

Man-made Disasters

Theft, burglary, riot, malicious act, strike, accident by outside means, extremist activity, any loss in transportation by road

Natural Disasters

Explosion, fire, lightning or self-ignition, earthquake, typhoon, flood, hurricane, tempest, storm, inundation, hailstorm, cyclone, frost, rockslide, landslide like natural disasters get coverage under the bike insurance online ICICI

Coverage for Personal Accident

Up to INR 1 Lakh coverage for the driver of the bike or scooter while traveling or driving, dismounting or mounting with the two-wheeler. Noncompulsory personal accident coverage for co-passengers is also obtainable.

Third-Party Liability Coverage

Shield against the third party liability because of accidental compensations consequential in the everlasting damage or death of any third party person, and any damage produced to the third party property. This ICICI bank two wheeler insurance offers third-party liability coverage under the package.

ICICI TWO WHEELER INSURANCE POLICY OMISSIONS

Source:- moneybapu . com

What isn’t covered under the ICICI motorcycle insurance/bike insurance ICICI/ICICI bike insurance online:

- Reduction or any significant loss

- Regular tear and wear and the overall aging of your vehicle

- Electrical or mechanical breakdown

- The loss to tubes and tires if the two-wheeler is not damaged at that time, in that case, the obligation of the corporation shall be partial to 50% of the charge of replacement

- Damage to an individual driving any motor vehicles without a lawful license

- Damage or loss because of mutiny, war or any nuclear risk

- Damage to an individual driving the motor vehicle under the effect of any liquor or drugs

Renewing the bike or scooter is as significant as purchasing another plan. Inability to do as such nullifies the sole point of purchasing protection. By not renewing your strategy, you open yourself to startling dangers as well as miss collected advantages for not making a case. So, here are the procedures to renew ICICI bike insurance described below:

Documents Needed For Renewal Of ICICI Two Wheeler Insurance

Source:- paydaymall . com

To start your bike or scooter insurance renewal, you have to retain all your needed documents prepared. For the renewal, you need documents like

- The insurance policy number

- Bike’s Cubic Capacity or cc

- The registration date of the bike

- Model of the bike

- The Engine number of bike

- The Chassis number of the bike etc.

You can get this required information in the policy certificate and the registration book of your bike. Do not forget to keep these documents while you go through the process of ICICI 2 wheeler insurance renewal online. There are 3 ways to renew your ICICI two wheeler insurance. Let’s know one by one below:

BRANCH RENEWAL

- Visit the nearest ICICI branch

- Take a policy renewal form and carefully fill it

- Do not forget to carefully check all details given

- Submit your policy form in ICICI branch

- Make payment through DD or Cheque

- You’ll get your renewed insurance policy or you can also opt for ICICI bike insurance renewal online/Online bike insurance renewal ICICI

MOBILE APPLICATION

- At first login to ‘iMobile’ app

- Then go to the Mutual Fund option, find Insurance & Tax Payment – General Insurance.

- Now, click on the Buy/Renew and select Two-Wheeler Insurance

- Thus fill your renewal form online to initiate ICICI two wheeler policy renewal procedure

- Before submitting check all filled details carefully

- Confirming the details of the form, make your payment

- You’ll get the renewed insurance policy in a PDF format

- Finally, save the two wheeler insurance PDF format to take a print out of it for future reference

ONLINE RENEWAL

- for ICICI two wheeler insurance renewal online, at first log on to the www.icicibank.com i.e. official site

- Go to Products -> Insurance –> Two-Wheeler Insurance

- Now fill in the renewal form online for ICICI motor insurance renewal online/ICICI two wheeler insurance online renewal

- Confirm you fill all the required fields properly

- Once your form filled, do not forget to check its details

- Confirming the details, proceed to payment for two wheeler insurance renewal online ICICI

- You’ll get the renewed policy in PDF format

- Finally, save the PDF to take an ICICI two wheeler insurance print out/ICICI bike insurance duplicate copy for future reference