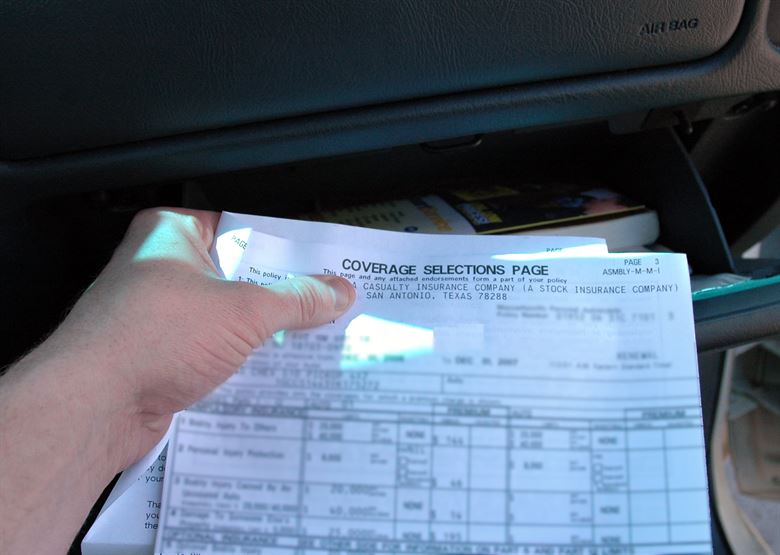

Collision coverage auto insurance is an inclusion that causes pay to fix or supplant your auto if it’s harmed in a mischance with another vehicle or protest, for example, a fence or a tree. In case you’re renting or financing your auto, the bank ordinarily requires collision coverage auto insurance. If your auto is satisfied, collision is a discretionary insurance on your auto insurance policy.

How It Works:

Table of Contents

Quick Facts

Collision coverage can be expensive, however, individuals can save money on premiums by picking a $500 or higher deductible.

Collision covers pothole damage.

Collision insurance will cover damage to your vehicle if you hit ice and slide into a lifeless thing.

Collision insurance fixes harm when two vehicles in drive or turn around crash into one another.

Collision insurance can only be bought in conjunction with and comprehensive and liability coverage.

How To Choose Your Collision Insurance Deductible:

Your collision deductible is the measure of cash you will pay out-of-stash if a crash harms your auto. When settling on the measure of your deductible, assess the age of your vehicle, the amount you figure fixes may cost you, and your readiness to pay for fixes under the measure of the deductible. For example, on the off chance that you hit a solid obstruction and you have a $500 deductible, you would pay $500 and Liberty Mutual would cover whatever is left of the fix costs over that sum. A higher crash deductible implies that you will take care of a greater amount of the expense of fixes when they emerge, which thus brings down your month to month premium.

Limit Of Collision Coverage Auto Insurance:

Collision coverage auto insurance a limit, which the highest sum your arrangement will pay toward a secured case. Your collision coverage auto insurance confine is regularly the genuine money estimation of your vehicle.

For instance, say your auto is totaled in a secured collision. Your guarantor would write you a check for the auto’s deteriorated esteem, less your deductible. Remember that “deteriorated esteem” implies you will be unable to supplant your old vehicle with one of a more up to date make and model. You’d almost certainly need to utilize your very own portion cash to do that.

Cost of Collision Coverage Auto Insurance:

This can shift generally relying upon various components, including what sort of auto you have, how old it is, how much it’s value right now, your own driving history, your age, and gender.

On the off chance that you have a poor driving history or have previously filed claims for harm to your auto, the insurance agency will most likely value your collision coverage higher than another person with a similar auto since they trust you will probably utilize it.

You can take in more about car collision coverage and get cites from organizations like Allstate and Travelers.

Why Buy Collision Coverage Auto Insurance?

On the off chance that you owe cash on your auto, or in case you’re renting it, collision coverage auto insurance is typically not discretionary; most loan specialists and leaseholders require it. If your auto is satisfied, in any case, you can pick whether to purchase collision coverage auto insurance.

One interesting point: How much it would cost to fix or supplant your vehicle on the off chance that it was harmed or pulverized in a mischance. If you couldn’t stand to settle your auto or purchase another one after a disaster area, acquiring collision coverage auto insurance could give you some genuine feelings of serenity.

Collision Coverage Auto Insurance Benefits:

- Conceivably pay nothing at all to fix or supplanting your vehicle when adding Deductible Fund alongside your collision coverage auto insurance.

- Abstain from paying out-of-take for fixes over the expense of your deductible.

- Coverage for your misfortune when your harmed vehicle is esteemed to be totaled

Summary:

Collision coverage auto insurance is something to consider. It may be appropriate for you if paying to take an imprint out would be fiscally troublesome, yet paying for coverage would not be. Also, it can give you genuine feelings of serenity that you’ll be secured paying little mind to whose blame the mishap may be.