An SBI Life Insurance Agent is an authorized individual who sells SBI Life Insurance policies and earns commissions on the premiums paid by customers. SBI Life agents help customers choose the right life insurance plans while earning attractive commissions and incentives. So, see below the SBI life insurance agent commission chart 2026.

How to Become an SBI Life Insurance Agent?

Table of Contents

Eligibility Criteria:

- Must be an Indian citizen, 18 years or older.

- Minimum educational qualification: 10th pass (for rural areas) or 12th pass (for urban areas).

- Basic knowledge of insurance and financial services.

- Good communication and sales skills.

Registration Process:

- Visit SBI Life’s Official Website – https://www.sbilife.co.in/

- Click on “Become an Advisor” and fill out the online application.

- Submit KYC documents (Aadhaar, PAN, qualification proof, and address proof).

- Complete a mandatory 15-hour IRDAI training.

- Pass the IRDAI exam and get certified as an SBI Life Insurance Advisor.

- Start selling SBI Life Insurance policies and earning SBI agent commission!

SBI Life Insurance Agent Commission Chart 2026:

SBI Life Insurance agents earn commissions based on the policy type and premium payment mode (single vs. regular premium). See below the SBI Life Insurance advisor commission chart.

Commission Structure:

| Policy Type | 1st Year Commission | 2nd & 3rd Year | 4th Year Onwards |

|---|---|---|---|

| Regular Premium (Traditional & ULIP) | 30-35% | 7.5% | 5% |

| Single Premium Policies | 2% | – | – |

| Term Insurance (Protection Plans) | 30-35% | 7.5% | 5% |

| Pension Plans | 7.5% | 2% | 2% |

Example:

- If a customer buys a policy with ₹50,000 annual premium, the agent earns:

- ₹15,000 – ₹17,500 (30-35%) in the 1st year

- ₹3,750 (7.5%) in the 2nd & 3rd years

- ₹2,500 (5%) from the 4th year onwards

Factors Affecting SBI Life Insurance Agent Commission:

The income and success of an SBI Life Insurance Agent depend on several factors. Here are the key factors that influence an agent’s commission, sales performance, and career growth:

Commission Structure & Policy Type:

- Different policies have different commission rates.

- Regular premium plans offer 30-35% in the first year, while single premium policies give only 2% commission.

- Selling long-term policies (15+ years) leads to higher renewal commissions.

Example:

- Selling a ₹1 lakh annual premium regular policy earns ₹30,000 – ₹35,000 in the first year.

- Selling a ₹1 lakh single premium policy earns only ₹2,000.

Number of Policies Sold:

- The more policies sold, the higher the agent commission in SBI life insurance.

- Consistently selling 10+ policies per month increases earnings significantly.

- High-ticket policies (with ₹50,000+ premiums) bring in more commission than smaller policies.

Example:

| Policies Sold per Month | Avg. Premium (₹) | 1st Year Commission (30%) | Monthly Earnings (₹) |

|---|---|---|---|

| 5 policies | ₹50,000 | ₹75,000 | ₹6,250 |

| 10 policies | ₹50,000 | ₹1,50,000 | ₹12,500 |

| 20 policies | ₹50,000 | ₹3,00,000 | ₹25,000 |

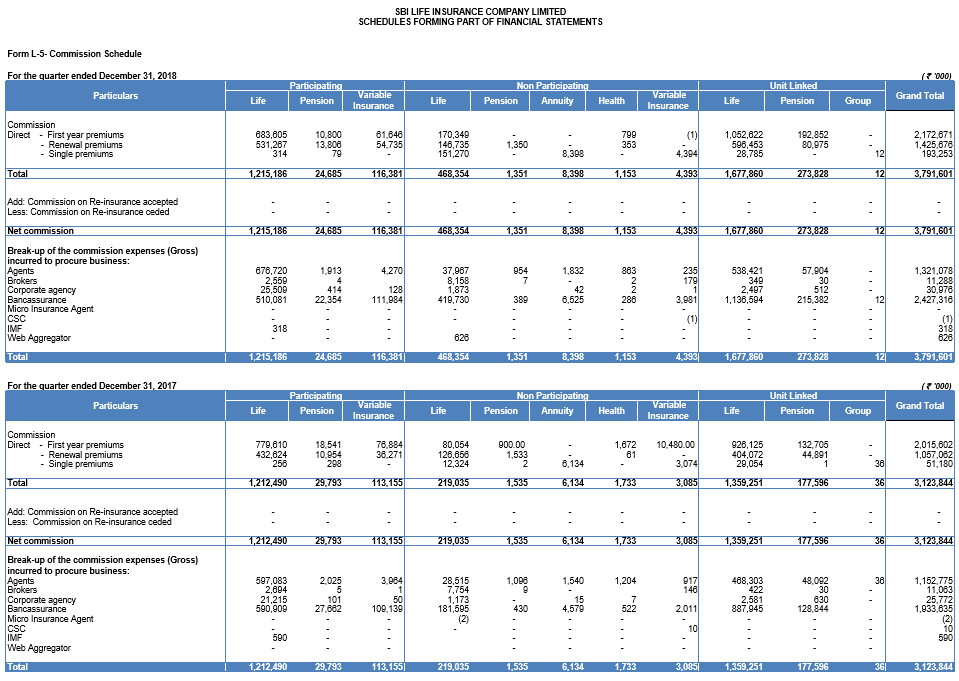

See below the SBI life insurance agent commission chart 2026 in PDF format.

Market Demand & Customer Awareness:

- Selling life insurance is easier in cities where people are financially aware.

- Rural areas may have lower awareness, but government-backed policies sell well.

- Explaining tax benefits and long-term security helps convince customers.

Product Knowledge & Selling Skills:

- Agents who understand SBI Life’s product range can match the right policy to customer needs.

- Better explanations = Higher conversions!

- Strong negotiation and convincing skills help close deals faster.

Renewal Commissions & Persistency Ratio:

- Renewal SBI life agent commission depends on how many customers continue their policies.

- If customers stop paying premiums, agents lose renewal earnings.

- Good customer service & reminders help retain policies and maximize commissions.

Benefits of Becoming an SBI Life Insurance Agent

- Attractive Commissions – Earn up to 35% on the first-year premium.

- Recurring Income – Get renewal commissions every year.

- Flexible Working Hours – Work full-time or part-time at your convenience.

- Additional Incentives & Bonuses – Earn extra rewards, gifts, and foreign trips based on performance.

- Digital Support & Training – SBI Life provides online tools, marketing materials, and training to agents.

SBI Life Agent Earnings Potential:

Your earnings depend on the number of policies sold and premium amounts.

Estimated Monthly Earnings:

| Policies Sold per Month | Average Annual Premium | 1st Year Commission (30%) | Monthly Earnings |

|---|---|---|---|

| 5 policies | ₹50,000 | ₹75,000 | ₹6,250 |

| 10 policies | ₹50,000 | ₹1,50,000 | ₹12,500 |

| 20 policies | ₹50,000 | ₹3,00,000 | ₹25,000 |

FAQ:

Q. How much can an SBI Life Agent earn per month?

A. An SBI Life agent can earn anywhere from ₹10,000 to ₹1 lakh+ per month, depending on policy sales.

Q. Is SBI Life Agent a full-time job?

A. No, it can be a part-time or full-time career, depending on your preference. Many agents work part-time alongside other businesses.

Q. Is training required to become an SBI Life Agent?

A. Yes, you must complete a 15-hour IRDAI training and pass the IRDAI exam. SBI Life provides free training and support.

Q. How do SBI Life Agents get paid?

A. Agents receive their commission directly in their bank account linked to SBI Life. Payments are credited monthly.

Q. How can I apply to become an SBI Life Insurance Agent?

A. You can apply online at https://www.sbilife.co.in/ or visit your nearest SBI Life branch.