ICICI Lombard General Insurance Company offers a structured commission framework for its agents and intermediaries, aligning with the Insurance Regulatory and Development Authority of India (IRDAI) guidelines. This framework varies based on the type of insurance product and the mode of distribution. See below ICICI Lombard agent commission chart…

About ICICI Lombard:

Table of Contents

ICICI Lombard General Insurance is one of India’s leading private sector general insurance companies. It offers a wide range of insurance products across various categories, including motor, health, travel, home, and business insurance. Below is an overview of its key offerings and features:

Founded: 2001 (a joint venture between ICICI Bank and Fairfax Financial Holdings)

Headquarters: Mumbai, Maharashtra, India

Listed on: NSE and BSE

Website: www.icicilombard.com

Key Insurance Products:

Motor Insurance:

Types: Car Insurance, Bike Insurance, Commercial Vehicle Insurance

Coverage:

- Own Damage (OD)

- Third-Party Liability

- Add-ons like zero depreciation, engine protection, etc.

Health Insurance:

Plans: Individual, Family Floater, Top-up, Critical Illness, Senior Citizen

Popular Products: Health AdvantEdge, Complete Health Insurance, Corona Kavach

Benefits:

- Cashless hospitalization across 7,500+ network hospitals

- No-claim bonus & annual health checkups

- Pre and post-hospitalization cover

Travel Insurance:

- Coverage: Medical expenses, trip cancellation, passport loss, baggage delay/loss

- Available for: Students, frequent travelers, family trips, corporate travel

Home Insurance:

- Covers damage due to fire, theft, natural disasters, and more

Business/SME Insurance:

- Tailored for small and medium businesses

- Includes fire, marine, liability, cyber, and engineering insurance

Types of ICICI Lombard Agents:

Here’s a complete breakdown of how to become an ICICI Lombard Agent, the types of agents you can become, benefits, earnings, and other details:

1. Individual Insurance Agent:

Represents ICICI Lombard exclusively

Can sell a wide range of general insurance products

Works directly with ICICI Lombard or through a regional office

2. PoSP (Point of Sale Person) Agent:

A digitally empowered agent

Can sell motor, health, personal accident, and business insurance

Ideal for part-time agents, homemakers, students, and working professionals

Eligibility Criteria:

Criteria Requirements:

- Age: Minimum 18 years

- Education Minimum 10th pass (as per IRDAI norms)

- Certification IRDAI PoSP Exam (after 15-hour training)

- Documents Required PAN Card, Aadhaar, Education Proof, Photo

Training & Certification:

- 15-Hour Online Training (IRDAI mandated)

- PoSP Certification Exam

- Get your Agent ID and Login for the iPartner Pro App

- ICICI Lombard provides training support and study materials.

Commission & Earnings:

Insurance Type PoSP Commission Rate

- Car Insurance 15% (on Own Damage)

- Bike Insurance 15%

- Health Insurance 15%

- Business Insurance 10%

For example: Selling a car policy with ₹30,000 OD premium = ₹4,500 commission.

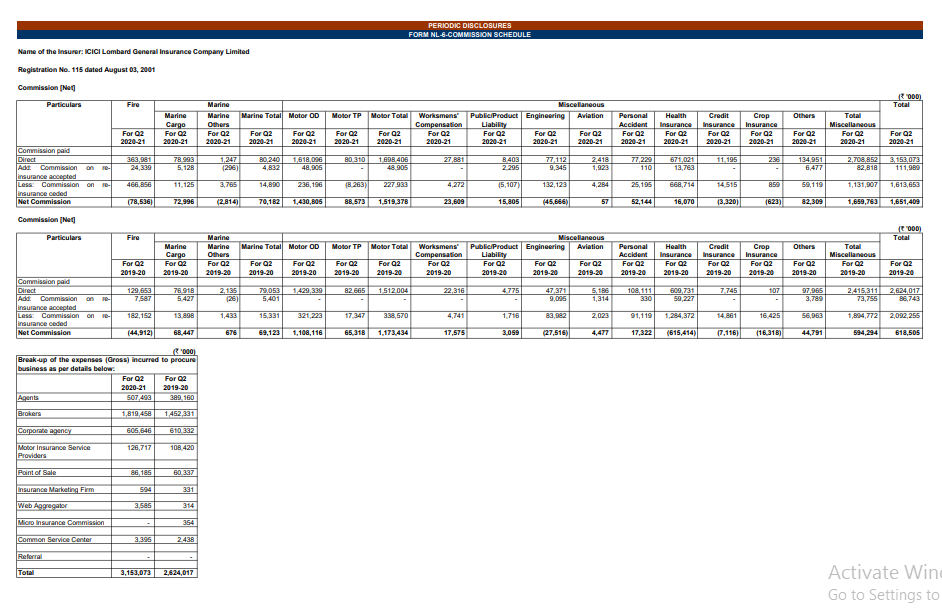

ICICI Lombard Agent Commission Chart:

Here’s a comprehensive ICICI Lombard Agent Commission Chart presented in a clean table format for better understanding:

| Insurance Product | Category | Commission Rate |

|---|---|---|

| Motor Insurance | Car/Bike (Comprehensive) | 15% (Car), 17.5% (Bike) on Own Damage |

| Car/Bike (Standalone TP) | 2.5% | |

| Health Insurance | Retail/Individual | Up to 15% |

| Group/Corporate | Up to 7.5% | |

| Fire Insurance | Retail | Up to 16.5% |

| Commercial (< ₹2,500 Cr SI) | Up to 11.5% | |

| Commercial (> ₹2,500 Cr SI) | Up to 6.25% | |

| Marine Insurance | Cargo | Up to 16.5% |

| Hull | Up to 11.5% | |

| Miscellaneous Insurance | Retail | Up to 16.5% |

| Commercial/Group | Up to 12.5% | |

| Engineering (> ₹2,500 Cr SI) | Up to 6.25% | |

| Business Insurance | SME/Business Protection | Up to 10% |

| Point of Sale (PoSP) Agents | Car/Bike via iPartner Pro | 15% on OD premium |

| Health Insurance | 15% | |

| Business Insurance | 10% |

See below the icici lombard agent commission chart in PDF format.

Steps to Become an ICICI Lombard Agent:

- Visit: https: //www.icicilombard.com/become-posp-insurance-agent

- Fill out the registration form

- Complete the training and pass the PoSP exam

- Start selling via the iPartner Pro App

Why Become an ICICI Lombard Agent?

- Work from anywhere, anytime

- Be your boss

- Sell high-demand insurance products

- Earn commissions instantly

- Join one of India’s largest private general insurers

FAQ:

Q. Are there additional rewards or incentives for agents?

A. Yes, ICICI Lombard provides additional rewards to agents based on performance metrics such as business volume and quality. These rewards are governed by the company’s reward policy and are subject to the discretion of the Distribution Commission and Remuneration Committee.

ICICI Lombard

Q. How can one become a PoSP agent with ICICI Lombard?

A. To become a PoSP agent:

- Age Requirement: Must be at least 18 years old.

- Educational Qualification: Minimum of 10th standard pass or equivalent.

- Training: Complete the required training modules provided by ICICI Lombard.

- Examination: Pass the prescribed examination to obtain certification.

Once certified, agents can use the iPartner Pro platform to sell insurance policies.