A bike insurance third party protects your vehicle from losses brought on by any injury or property damage caused to a third party while operating the insured two-wheeler.

If a third party is killed in an accident that was caused by the policyholder’s vehicle, third-party two-wheeler insurance even offers legal protection.

All two-wheeler owners are required by The Motor Vehicle Act of 1988 to carry at least the third-party bike insurance. Without a third-party two-wheeler insurance policy, riding a bike or scooter in India is punishable by steep fines from the RTO. So, to ride a two-wheeler, you must have a 3rd party insurance policy in India.

Third-party insurance coverage or two-wheeler insurance plans in India may not provide damage cover but third-party bike insurance is mandatory. So, let’s know in detail about the third-party bike insurance policy.

What Is Third-Party Two-Wheeler Insurance?

Table of Contents

According to the Motor Vehicle Act of 1988, all two-wheeler owners must carry third-party insurance. Bike insurance for third parties provides the policyholder with the security needed to pay for any third-party obligations. It pays for the costs associated with injuries or damage you cause to another person’s property.

Consider the following scenario: You are riding when you get into an accident, damaging another bike and injuring the rider. In such situations, third-party insurance will pay for the harm your two-wheeler caused to the other rider’s bike and their property.

How Does Bike Insurance 3rd Party Work?

Three parties are involved in third-party bike insurance. The owner of the two-wheeler is the first party, followed by the insurer as well as the person who is harmed by the insured’s vehicle as the second and third parties.

Losses and damages resulting from third-party obligations are covered by third-party bike insurance. These are the things that are covered by a two-wheeler third-party insurance policy:

- Injuries to or death of the third party

- Death of the rider or owner of the insured bike.

- Third-party property damage

- Insured two-wheeler rider’s permanent disability

Inclusion Coverage Under Third-Party Bike Insurance Online

Following is the inclusion of a third-party bike insurance policy in India. Let’s have a look at the inclusions below:

- Provides coverage for third-party property damage, with a liability cap of Rs. 7.5 lakh.

- Covers damages brought on by a third party’s injuries or death in the event of an accident

- Covers a mandatory personal accident benefit of INR 15 lakh for two-wheeler owner-drivers, which can be added on for a premium.

Exclusion Under Third-Party Two-Wheeler Insurance Policy

Following are the exclusions of a third-party bike insurance policy in India. Let’s have a look at the exclusions below:

- Unlike a comprehensive bike insurance policy, third-party insurance does not cover the damage or loss sustained by the insured vehicle as a result of a collision

- If it involves an instance of drunk driving, no claims are accepted.

- Accident-related loss or damage brought on by driving without a current DL, PUC certificate, RC, or two-wheeler insurance policy

- If incidents occur outside of the specified geographic areas in the policy documentation, there is no compensation provided.

- There are no claims for harm or loss brought on by riots, conflicts, or radioactive contamination.

- No claims deriving from contractual obligations are recognized.

Key Features of 3rd Party Two-Wheeler Insurance Policy

Let’s have a look at the most common features of third-party bike insurance policies in India.

Coverage

There is little coverage provided by third-party insurance. A third-party liability two-wheeler insurance can only protect the insured person from harm or loss incurred by a third party.

Add-Ons

This third-party bike insurance policy only provides Personal Accident Cover. however, no matter what, according to the Motor Vehicles Act, of 1988 you must carry at least a third-party bike insurance policy.

Third-party bike Insurance Premium Price

As the insurance regulator, IRDAI sets the pricing for this policy, third-party bike insurance is less expensive as compared to comprehensive bike insurance.

Claim Settlement

The claims procedure is governed by the Motor Accident Claims Tribunal under the third-party bike insurance policy to cover the third-party damages.

Add-on Cover for Third-Party Two Wheeler Insurance

Here are two add-on covers that you can add to your third-party insurance plan in India. Let’s know in detail about those add-ons below:

Zero Depreciation Cover

In the event of an unfortunate accident involving your bike, purchasing a two-wheeler coverage with a zero-depreciation add-on cover is the ideal approach to cover your repair costs and save some money. New motorcycles qualify for zero depreciation, and the coverage is offered for a maximum age range of 2 to 5 years.

Additionally, there is a yearly claim cap that varies from business to firm. Zero depreciation two-wheeler insurance does not cover losses brought on by technical failures or ordinary wear and tear.

The greatest candidates for zero depreciation two-wheeler insurance are those who own pricey luxury bikes with expensive spare parts, live in an accident-prone location or travel there frequently, own new bikes, or are inexperienced riders.

Roadside Assistance Cover for Bike

Purchasing a bike insurance policy has several advantages. A decent bike insurance policy offers numerous reassuring advantages, from remaining legally safe to guaranteeing that your bike will be fixed as and when needed.

One such advantage is having the choice to purchase the highly useful Add-on coverings, commonly known as the riders. The roadside assistance rider is one of the most practical options available.

Advantages of a Third-Party Bike Insurance

Here are some advantages of a third-party bike insurance plan in India:

Avoid legal intricacies

Two-wheeler insurance for third parties is required by law. To prevent any legal implications, it is imperative to obtain and renew the coverage on time.

If your two-wheeler doesn’t have active third-party insurance, you could face severe traffic fines.

Coverage for third-parties

Third-party bike insurance generally covers third-party liabilities. It provides financial protection for the policyholder to pay for harm done to a third party’s car or property. Protects in the event of a third party’s demise as well.

Saves Money

Protects you against traffic violation fines because the new minimum fee for not having third-party insurance is now INR 2,000, and the subsequent fine is INR 4,000!

Covers for Personal Damages

Safeguards you in the terrible event that you suffer an injury when riding a two-wheeler.

Protects you from Incidental Losses

Protects you from financial damages and legal obligations that can result from using a two-wheeler and injuring someone, something, or something else.

Comply with the law

Enables you to bike legally on all roads in India while abiding by the law.

24×7 Support

When you purchase third-party bike insurance online, you will receive 24×7 help, so no matter what, your bike insurer, will always be there for you!

Peace of Mind

Relieves your mental worry because you know that you’ll be covered in the event of any accidents you may encounter.

Disadvantages of Third-Party Bike Insurance

Just like the benefits, a third-party insurance plan also comes with some disadvantages. These disadvantages are as follows:

Does Not Cover Own Damages:

If you accidentally damage your two-wheeler, it won’t pay for the damages!

Does Not Cover Natural Disasters:

It doesn’t protect you from natural disasters like floods, cyclones, fires, and various other natural calamities that could harm or destroy your two-wheeler.

No Customized Plans:

You are unable to add optional features, such as add-ons and coverage like the zero-depreciation cover, and engine and gearbox protection, to your third-party bike insurance policy.

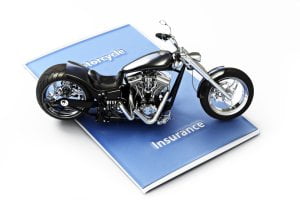

Third Party Two Wheeler Insurance Premium Rates

The most fundamental kind of coverage is offered to the policyholder by third-party two-wheeler insurance. It protects you from any losses or damages to your person, property, or car. All owners of two-wheelers must also carry third-party bike insurance. Driving without a third-party insurance policy could result in a Rs. 2000 fine and/or up to 3 months in jail. The IRDAI determines the cost of two-wheeler third-party insurance.

- Engine Capacity Not exceeding 75 cc- Rs. 538

- Exceeding 75 cc but not exceeding 150 cc – Rs. 714

- Exceeding 150 cc but not exceeding 350 cc- Rs. 1,366

- Exceeding 350 cc- Rs. 2,804

How to Calculate Your 3rd-Party Bike Insurance Premiums?

It’s important to understand how the cost of third-party bike insurance is determined before making an online purchase. Here is a step-by-step tutorial for figuring out the cost of your bicycle insurance.

Step 1 –

Visit the official website of the company

Step 2-

Enter your vehicle registration no. and proceed by simply clicking on the “get a quote” option.

Step 3-

You’ll also have to enter the bike make & model to calculate the premiums.

Step 4 –

Choose a 3rd-party two-wheeler insurance policy.

Step 5 –

Provide details of your last two-wheeler insurance policy- Expiry Date. Enter your email ID and mobile number.

Step 6 –

Now you can see your 3rd-party two-wheeler insurance price.

How to Buy a 3rd-Party Two-Wheeler Insurance Plan?

You can buy third-party bike insurance from your preferred insurance provider offline or online. However, since the internet’s invention, individuals prefer to purchase insurance online. Online shopping for third-party two-wheeler insurance plans is a highly practical and economical option. You may easily get 3rd-party two-wheeler insurance online by following the instructions below.

- Go to the official website of the company you prefer

- From the drop-down menu labeled “Insurance Product,” select “Third-party Bike Insurance.”

- After entering your bike number, select “View Plans.”

- Choose a plan from a variety of rates provided by leading insurers in India.

- To obtain owner-driver coverage, add Personal Accident coverage according to your needs.

- You must include mandatory Personal Accident (PA) coverage to obtain owner-driver coverage.

- Utilize a debit/credit card, UPI, or net banking to pay the indicated premium.

- Finally, a copy of the third-party two-wheeler insurance policy you purchased will be sent to your registered email address.

If the online method is unfamiliar to you, you can visit the insurance company’s nearest branch and speak with an agent there. They will help you choose an insurance plan based on your needs. If all goes according to plan, you can complete your purchase by paying the premiums with cash or a bank check.

How to Renew 3rd-Party Insurance Online?

The majority of motor insurance firms allow their clients to renew their third-party bike insurance policies online. Additionally, you can check IRDAI’s third-party bike insurance premiums. The insurers anticipate that the insurance policy will be renewed on time because renewal is the most important time to make a decision. The steps for reactivating it online are shown below:

- Visit the Insurance Brokers Pvt Ltd website for further information.

- From the drop-down menu labeled “Insurance Product,” select “Third-party Bike Insurance.”

- Enter the registration number for your two-wheeler.

- Pick a plan from a variety of insurers.

- To obtain owner-driver coverage, add Personal Accident coverage according to your needs.

- Utilize a debit/credit card, UPI, or net banking to pay the indicated premium.

- Obtain a copy of the updated policy at the email address you provided.

Relevant Factors To Take Into Account While Making A Claim

Here are a few vital points you must remember when you claim your third-party bike insurance plan.

Valid Proof:

Before claiming the damage the insured vehicle caused to them, their automobile, or their property, the third party must have adequate, reliable evidence.

Notifying the police and the insurance provider:

In case your covered vehicle is involved in an accident, make sure to call your insurance provider and the police right away so that you can quickly take the necessary actions if any third parties are hurt.

The Maximum Damages:

The maximum sum that can be awarded in damages will be specified in an order that the Motor Accident Claims Tribunal will issue. The compensation sum complies with IRDAI regulations. The current maximum amount owed for property damage to a 3rd party is 7.5 lakhs. There is no limit on the sum of compensation, nevertheless, in circumstances of harm to third parties.

Documents Needed For Making A Claim

- For verification, provide a copy of the Bike’s RC and the original tax receipts.

- copy of third-party bicycle insurance estimate for damage repair.

- a duplicate of your driving license.

- When reporting a third party’s death, property damage, and physical injuries, police must file an FIR.

- Payment confirmations and repair invoices.

How to Claim?

The third-party bike insurance claim process varies depending on the circumstance.

- If a third party has harmed your bicycle,

- If you have harmed a third party’s car, house, or person

The process for filing a claim under 3rd-party insurance differs in both situations. Look at this-

Claim Procedure – If You’re the Victim

Here is the procedure to claim if third-party is responsible for the damage and you are the victim

- Call the police helpline and let them know about the incident.

- Take photos of the damage your insured car has sustained as evidence.

- Write down the specifics of the car that ran over your bike, like the license plate number, color, make, and model.

- Take note of the eyewitnesses’ contact information who were there at the scene of the incident.

- At the police station with jurisdiction over the area that is the closest to the accident scene, file a FIR, or First Information Report.

- Bring the necessary documentation and evidence to the hearing to show that your vehicle was harmed by a third party’s car.

- The motor insurer of the at-fault third party will reimburse you for all losses and damages if the court issues its verdict in your favor.

Claim Procedure- If Your Vehicle Caused the Damage

Here is the procedure to claim if you are responsible for the damage

- Call the police helpline and let them know about the incident.

- Take photos of the wrecked car or the injured bystander at the scene of the collision as proof.

- Write down all the contact information and vehicle information for any third parties involved in the collision who suffered injuries.

- Take note of the eyewitnesses’ contact information who were around at the scene of the occurrence.

- File an accident report (FIR) at the closest police station that has authority over the accident site.

- As soon as possible, notify your insurance provider of the collision.

- Deliver the necessary information and documentation to your insurance provider.

- Register a claim with the local Motor Accidents Claims Tribunal.

- To prevent further disputes, save a copy of any correspondence (emails and conversations) related to the issue.

- The Tribunal will determine the compensation amount, and your insurance provider will pay the third party’s claim.

- To avoid further problems, you should pay the remaining balance to the victim of the third-party accident if the reimbursement amount paid by the insurance company is less than the amount of the compensation.

Why Is Third-Party Bike Insurance Important?

In addition to being required by the Motor Vehicles Act, third-party two-wheeler insurance is recommended for the following reasons:

Mandatory by Indian Law:

Every bike owner in India is required to obtain third-party two-wheeler insurance. The traffic police have the authority to punish you for up to INR 2000 if they discover that you do not have third-party bike insurance.

Coverage for Death or Any Injury of Third-Party:

The third-party insurance will cover the monetary damages for such personal harm if the driver of a third-party car sustains injuries as a result of an accident involving the covered bike.

Additionally, third-party insurance covers the insured from the financial and legal repercussions if a third-party person perishes as a result of the accident.

Covers Any Loss To A Third-Party Bike/Car:

Your third-party insurance coverage will cover the cost of harm without you having to worry if an accident involving the covered bike damages a third party’s car or property.

Cost-Effective:

Since the IRDAI has set the rates for all Third Party Insurance, everyone may afford this policy.

As a result, you can anticipate coverage for any unforeseen third-party costs waiting for you at the end of the road within a reasonable price.

Quick & Easy Purchase:

Long and tedious insurance purchase processes are outdated. By visiting the insurance company’s website and making a few quick clicks, you can now obtain your selected third-party motorcycle insurance with the least amount of paperwork.

FINAL WORDS

The most fundamental kind of bike insurance protects the policyholder against any financial obligations lawfully incurred by any third party person or property as a result of an accident for which the insured vehicle is responsible. The Indian Motor Tariff Act mandates that every bike owner maintain a third-party insurance policy at the absolute least.

FAQ

Q. Is Third Party Bike Insurance Mandatory?

A. This insurance plan is a must for all vehicle owners in India to avoid penalties and expensive fines. The purpose of the law is to make sure that people feel safe driving on the roads and that the roads are safer. However, third-party insurance does not cover harm to your vehicle.

Q. Can I Buy two-wheeler insurance online?

A. Yes, of course, you can buy your two-wheeler insurance online.

Q. What is the Difference Between Third Party Bike Insurance and Comprehensive Bike Insurance?

A. Third-party bike insurance is a basic insurance plan owning at least which is compulsory as per the Indian Motor Tariff. It is designed to take care of damages incurred towards the third party with the involvement of the insured person’s vehicle.

Whereas, the comprehensive bike insurance plan gives complete coverage to policyholders against the financial liabilities towards the third party and own damage expenses due to an accident or mishap.

Q. Do we need third-party insurance for bikes?

A. Of course, as per the Motor Vehicles Act of 1988, in India, you must have at least a third-party bike insurance policy

Q. Is personal accident cover available under third-party Two-wheeler insurance?

A. Yes, the cost of bike insurance would go up if you were to purchase a personal accident plan for the first time. Please be aware that a personal accident cover must be purchased separately.

It does not include comprehensive insurance coverage or third-party insurance.

Recommended Articles:-

- What Is The Average Bike Insurance Price In India?

- Zero Depreciation Bike Insurance in India: An Overview

- How To Download Insurance Copy By Vehicle Number

- Public Liability Insurance In India: Know In Details

- Car Insurance: Everything About Types Of Auto Insurance

- All About Liability Car Insurance, You Should Know

- Simple Procedure For Car Insurance Renewal Online In India

- Reliance Two Wheeler Insurance: Know Every Detail About It

- Comprehensive Insurance For Bike: All You Need To Know

- Online New India Assurance Company Limited Two-Wheeler Insurance Plans

- Pick the Best Two Wheeler Insurance Company in India