A Max Life Insurance Agent (also called a Life Advisor) helps customers choose suitable life insurance policies while earning commissions on the premiums paid. It’s a great career option with high earnings, renewal commissions, and additional incentives. In the section that follows, we’ll explain how to become a Max life insurance agent and Max life insurance agent commission chart 2026.

What Is Max Life Insurance Agent?

Table of Contents

A life insurance advisor is a person who will be in charge of selling insurance products on behalf of Max Life Insurance. They act as a go-between for the business and the policyholder, selling insurance products to clients worldwide. Additionally, life insurance consultants have the opportunity to generate extra revenue by offering the appropriate guidance.

Who Can Work as an Advisor for Max Life Insurance?

Some of the groups of people who can work as life insurance consultants for Max Life are listed below:

- Housewives

- Professionals in retirement

- Students who are older than eighteen

- Self-employed

How to Become a Max Life Insurance Agent?

Eligibility Criteria:

- Minimum Age: 18 years or older

- Qualification: 10th pass (rural) / 12th pass (urban)

- IRDAI Certification (Mandatory for all agents)

Steps to Register:

To become an agent for Max Life Insurance, you must do the following steps:

- Register with Max Life Insurance first.

- Next, participate in the offline training course.

- Next, show up for your city’s offline exam.

- After passing the test, you will receive a Max Life insurance agent license.

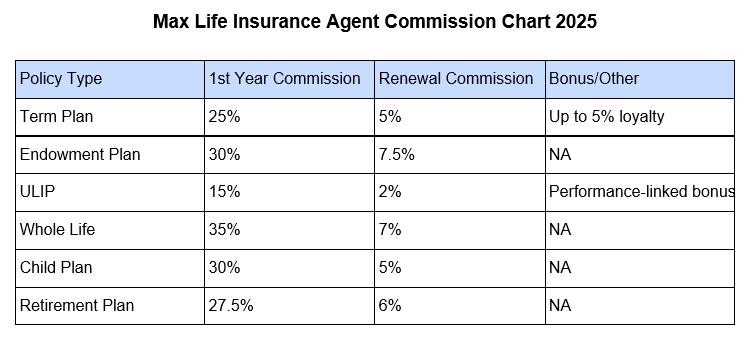

Max Life Insurance Agent Commission Chart 2026

Your earnings depend on policy type & premium amount. The Max life insurance commission chart is…

| Policy Type | 1st Year Commission | 2nd & 3rd Year | 4th Year Onwards |

|---|---|---|---|

| Regular Premium Plans | 30-35% | 7.5% | 5% |

| Single Premium Plans | 2% | – | – |

| Term Insurance Plans | 30-35% | 7.5% | 5% |

| Pension Plans | 7.5% | 2% | 2% |

Example:

Selling a ₹50,000 annual premium policy earns:

- ₹15,000 – ₹17,500 in the first year (30-35%)

- ₹3,750 per year in the 2nd & 3rd years (7.5%)

- ₹2,500 per year from the 4th year onwards (5%)

See below the Max life insurance commission chart in PDF format.

Max Life Insurance Agent Commission Calculator:

Formula to Calculate Max Life Insurance Agent Commission

- 1st Year Commission = (Annual Premium) × (1st Year Commission %)

- 2nd & 3rd Year Commission = (Annual Premium) × (2nd & 3rd Year Commission %)

- 4th Year Onwards Commission = (Annual Premium) × (4th Year Onwards Commission %)

Example: Regular Premium Plan (₹50,000 Annual Premium, 30% Commission)

- 1st Year Commission: ₹50,000 × 30% = ₹15,000

- 2nd & 3rd Year Commission: ₹50,000 × 7.5% = ₹3,750 per year

- 4th Year Onwards: ₹50,000 × 5% = ₹2,500 per year

Factors Affecting Max Life Agent Commission:

Type of Policy Sold:

- Regular premium plans pay higher commissions (30-35%) than single premium plans (2%).

- Selling term insurance & ULIPs results in higher earnings.

Number of Policies Sold:

- Agents selling 10+ policies per month earn significantly more.

- Selling high-ticket policies (₹50,000+ premiums) results in better commissions.

Customer Base & Referrals:

- A strong personal & professional network generates more policy sales.

- Referrals from satisfied clients boost income without extra marketing costs.

Digital & Social Media Marketing:

- Using WhatsApp, Facebook, and LinkedIn helps attract customers.

- Digital promotions bring in younger buyers who prefer online services.

Renewal Commissions & Policy Persistency:

- If customers stop paying premiums, agents lose renewal commissions.

- Regular follow-ups & good customer service increase policy renewals.

Competition & Market Demand:

- More agents in an area = higher competition.

- Providing excellent service & policy guidance helps agents stand out.

How to Succeed as a Max Life Insurance Agent?

- Top Tips for Maximum Earnings:

- Sell high-premium & long-term policies for better commissions.

- Use digital marketing & WhatsApp promotions to attract more clients.

- Follow up regularly to ensure policy renewals.

- Attend training sessions to improve sales skills.

- Offer excellent customer service to gain more referrals.

Benefits of Becoming a Max Life Insurance Agent

- High Commission – Earn up to 35% in the first year.

- Renewal Commissions – Get passive income every year.

- Flexible Work – Work part-time or full-time.

- Incentives & Rewards – Get cash bonuses, gadgets, and international trips.

- Digital Tools & Training – Max Life provides online sales tools & training support.

Max Life Agent Earning Potential:

Your earnings depend on policy sales & renewal commissions. Estimated Monthly Earnings:

| Policies Sold per Month | Avg. Annual Premium (₹) | 1st Year Commission (30%) | Monthly Earnings (₹) |

|---|---|---|---|

| 5 policies | ₹50,000 | ₹75,000 | ₹6,250 |

| 10 policies | ₹50,000 | ₹1,50,000 | ₹12,500 |

| 20 policies | ₹50,000 | ₹3,00,000 | ₹25,000 |

FAQ:

Q. How much can a Max Life Agent earn per month?

A. Earnings range from ₹10,000 to ₹1 lakh+ per month, depending on sales & renewals.

Q. Is this a full-time job?

A. No, it can be part-time or full-time, depending on your choice.

Q. Is training required?

A. Yes, 15-hour IRDAI training is mandatory before becoming a Max Life Agent.

Q. How do agents receive commission payments?

A. Max Life Agent Commissions are credited directly to the agent’s bank account every month.