Disability health insurance plays a crucial role in protecting individuals from the financial strain caused by unexpected illnesses or injuries that prevent them from working. As awareness about income protection grows, so does the demand for qualified insurance agents who can guide customers in choosing the right disability coverage. To incentivize and reward these professionals, insurance companies offer structured commission systems that determine how much agents earn per policy sold. See below the disability health insurance agent commission chart 2026.

What is Disability Health Insurance Agent Commission Chart 2026?

Table of Contents

The term “Disability Health Insurance Agent Commission Chart 2026” refers to the structured commission rates and earnings breakdown for insurance agents who sell disability health insurance policies in the year 2026. This chart outlines the percentage of premium amounts that agents earn as commission for successfully selling short-term or long-term disability coverage. These commission structures are vital to agents, as they provide the financial incentive for promoting and servicing disability insurance plans.

Disability Health Insurance Agent Commission Chart 2026:

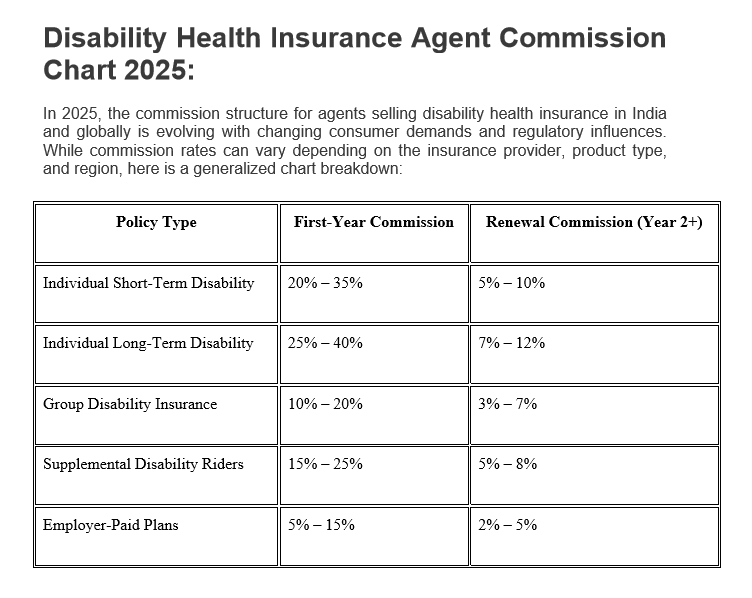

In 2026, the commission structure for agents selling disability health insurance in India and globally is evolving with changing consumer demands and regulatory influences. While commission rates can vary depending on the insurance provider, product type, and region, here is a generalized chart breakdown:

| Policy Type | First-Year Commission | Renewal Commission (Year 2+) |

|---|---|---|

| Individual Short-Term Disability | 20% – 35% | 5% – 10% |

| Individual Long-Term Disability | 25% – 40% | 7% – 12% |

| Group Disability Insurance | 10% – 20% | 3% – 7% |

| Supplemental Disability Riders | 15% – 25% | 5% – 8% |

| Employer-Paid Plans | 5% – 15% | 2% – 5% |

See below the Disability Health Insurance Agent Commission Chart in PDF format.

Types of Disability Health Insurance:

The Disability Health Insurance Agent Commission Chart 2026 outlines the latest commission rates, renewal structures, and influencing factors that shape agent earnings in the disability insurance sector. Understanding this chart is essential not only for insurance agents seeking to maximize their income but also for industry stakeholders analyzing market dynamics. This article offers a comprehensive breakdown of commission trends, policy types, market influences, and practical strategies to boost earnings in 2026.

Short-Term Disability Insurance:

Offers coverage for temporary disabilities, usually ranging from 3 to 12 months.

Long-Term Disability Insurance:

Provides income replacement for extended periods, sometimes up to retirement age, in case of a long-lasting disability.

Group Disability Insurance:

Offered by employers, this covers all employees under a single policy with shared benefits and usually lower premiums.

Supplemental Disability Insurance:

Enhances the coverage provided by base disability plans, especially for high-income individuals.

Voluntary or Employee-Paid Plans:

Purchased by employees at group rates but paid through payroll deductions.

Factors Influencing Disability Health Insurance Agent Commission Chart 2026:

- Policy Duration: Longer-term policies usually offer higher initial commissions.

- Insurer’s Sales Strategy: Companies with aggressive sales targets may offer bonus commissions or incentives.

- Agent’s Licensing & Experience: Senior agents with specialized certifications may access higher commission brackets.

- Sales Volume: Higher sales often result in tiered commissions or performance-based bonuses.

- Client Risk Profile: Policies sold to higher-risk individuals may yield different commission rates due to underwriting complexities.

Market Trends Impacting Agent Earnings:

Increased Awareness of Disability Coverage:

Post-pandemic sensitivity to income protection is driving more customers toward disability plans, increasing agent opportunities.

Digital Sales Tools & Platforms:

Tech integration is speeding up sales processes and allowing agents to service more clients, boosting overall earnings.

Regulatory Oversight:

New insurance norms may cap commissions to control premium inflation, especially in group policies.

Customization Demand:

A growing demand for tailored coverage has created niche markets where agents can charge advisory fees in addition to commissions.

Insurtech Partnerships:

Collaborating with online insurance marketplaces can increase lead generation and diversify commission structures.

How to Maximize Disability Health Insurance Agent Commission Chart 2026:

- Specialize in Long-Term Disability Plans: They offer higher commissions and better renewals.

- Partner with Employers: Selling group disability plans in bulk can ensure consistent income from large accounts.

- Upsell with Supplemental Riders: These add-ons improve the client’s coverage and your commission.

- Utilize CRM and Digital Tools: Efficient client tracking and follow-up boost sales closure rates.

- Stay Licensed & Educated: Continuous learning through IRDAI certifications or international programs increases trust and access to better policies.

Conclusion:

The Disability Health Insurance Agent Commission Chart 2026 is a vital guide for insurance agents to understand their earning potential in a fast-evolving market. With diverse policy types, multiple influencing factors, and digital sales integration, agents must strategically navigate their sales approach to maximize income while ensuring client satisfaction. As consumer awareness around disability insurance grows, so does the opportunity for agents to thrive financially, provided they stay informed and adaptive.

FAQ:

Q. What is the average commission for disability insurance agents in 2026?

A. The rate ranges from 10% to 40% for the first year, depending on the policy type and provider.

Q. Are renewal commissions standard across all insurers?

A. No, they vary but typically range between 3% and 12%.

Q. Do agents earn more from individual or group disability policies?

A. Individual policies usually offer higher commissions than group policies.

Q. Is IRDAI involved in regulating these commissions in India?

A. Yes, IRDAI provides regulatory guidance and may impose limits on agent commissions to maintain fairness in pricing.

Q. Can agents earn incentives apart from commissions?

A. Yes, many insurers offer performance bonuses, travel rewards, and recognition programs for top-performing agents.