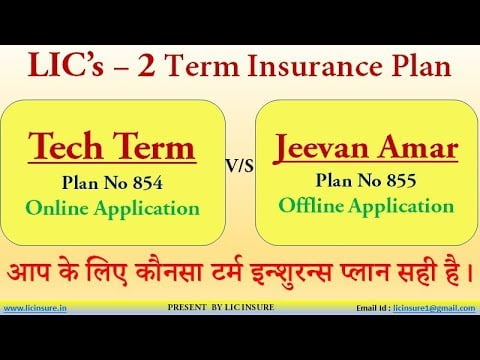

Last year Life Insurance Corporation of India launched Jeevan Amar’s new term plan in August. And after a month, i.e. in September LIC launched another term plan which is known as LIC Tech offline Term Insurance Plan. Both are

term insurance plans but there are some basic differences between LIC Tech Term vs Jeevan Amar.

LIC Tech Term vs Jeevan Amar: What Is It?

Table of Contents

Now you may think why Life Insurance Corporation of India has launched 2 policies within a month time frame.

To understand that, we have to know what a LIC Tech Term Plan is, what LIC Jeevan Amar 855 Term Plan is all about, and how the benefits and features compare between LIC Jeevan Amar and Tech Term.

What is LIC Jeevan Amar Term Plan?

Life Insurance Corporation of India (LIC) in August 2019 launched ‘Jeevan Amar’, a cheap, traditional, and pure protection online term insurance plan. This plan will be available offline for sale. That is, it can be purchased only through an agent.

This plan of LIC 855 is cheaper than the already available term plans. LIC has withdrawn the priceless life-term plan. LIC Jeevan Amar Policy is not only cheaper but many new features have been added to it.

According to the statement issued by LIC, under the Jeevan Amar plan, there will be a facility to choose one of the two death benefit options, such as Level Sum Assured and Increasing Sum Assured.

Knowing about the LIC Jeevan Amar plan we will be able to distinguish between LIC Jeevan Amar vs Tech Term.

What Is LIC Tech Term Plan?

Life Insurance Corporation of India (LIC) has launched a new term insurance plan. This plan will be available online only. The new term plan has been named the LIC Tech Term 855 Plan. It is a non-linked, without profit pure protection online term insurance policy.

Under this, the amount of the cover is received by the policy taker on the death of his / her family before the completion of the policy’s maturity period. At the same time, no amount is received when the policy taker is alive after the maturity period is completed.

The new LIC term insurance plan covers all types of death including accidental death and other accident benefit rider. But it does not cover suicide during the first year.

The sale of the Tech Term Plan started on 1 September 2019. Knowing about the LIC Tech Term plan we will be able to distinguish between LIC Jeevan Amar vs Tech Term.

LIC Jeevan Amar Policy Term

The policy term will be from 10 years to 40 years

To know the difference between LIC Jeevan Amar vs Tech Term we need to know about their policy term first. Jeevan Amar LIC Plan has been made available for people between 18-65 years of age. Under this, the maximum age maturity is 80 years. The policy term under LIC Jeevan Amar plan 855 will be from 10 years to 40 years.

LIC Tech Term’s Policy Term

To know the difference between LIC Tech Term vs Jeevan Amar we need to know about their policy term first. So, LIC Tech Term Insurance Plan can be taken by any citizen residing in India.

It is not for Indian citizens living abroad or citizens of Indian origin. The policy term of this plan is 10 years to a maximum of 40 years. LIC Tech Term vs Jeevan Amar

Individuals between the age of 18 years and 65 years can take this insurance plan. The maximum age limit for policy coverage that has been kept in LIC Tech Term Plan is 80 years. LIC Tech Term plan vs Jeevan Amar

Maximum And Minimum Sum Assured

LIC Jeevan Amar minimum and maximum Sum Assured

| High Sum Assured Rebate: LIC’s Jeevan Amar |

Option I: Level Sum Assured

| Age Group | Less Than Rs. 50 Lakhs | Rs.50 Lakhs to Less Than Rs. 1 Crore | Rs. 1 Crore and Above |

| <=30 years | Nil | 12% | 20% |

| 31-50 years | Nil | 10% | 15% |

| >=51 years | Nil | 5% | 7% |

Option II: Level Sum Assured

| Age Group | Less Than Rs. 50 Lakhs | Rs.50 Lakhs to Less Than Rs. 1 Crore | Rs. 1 Crore and Above |

| <=30 years | Nil | 10% | 18% |

| 31-50 years | Nil | 8% | 13% |

| >=51 years | Nil | 4% | 6% |

LIC Tech Term Plan Sum Assured

The minimum life cover or sum assured for a LIC take-term policy is Rs 50 lakh. It has no maximum limit. The policy taker will have the option to pay the premium. They can pay a half-yearly or yearly or single premium if they wish. These details will help us to know the difference between the LIC Tech Term insurance plan vs Jeevan Amar

If a 30-year-old person takes a LIC tech term plan of Rs 50 lakh for a term of 30 years, then his annual premium will be Rs 9,912 including GST. At the same time, if this time takes the cover of Rs 1 crore, then the annual premium will be Rs 17,445.

Under the plan for the sum assured, two options ‘Level Sum Assured’ and ‘Insuring Sum Assured’ is given. In the level sum assured option, the amount of cover will remain the same till the completion of the policy term.

The amount of cover will remain the same for the first 5 years in the underlying Sum Assured option. After that, it will grow at a rate of 10% for the next 10 years. After this, the policy will remain the same again till the end of the term.

In other words, the basic sum assured increases by 10% every year from the 6th policy year on the incremental sum assured option. This is till the 15th policy year when the amount doubles the basic sum assured. From the 16th policy year, this new cover amount will remain the same till the policy ends.

Premium Payment Option

LIC Jeevan Amar’s plan will offer three options for premium payment.

- Single-Premium payment term option,

- Regular Premium Payment policy, and

- Limited Premium payment option.

Under a Limited minimum Premium or limited premium payment policy, there are two options for premium paying terms (PPT), the LIC term plan Jeevan Amar is less than 5 years and the second policy term is less than 10 years. However, the maximum age to pay the premium will be 70 years only. So, the premium rates differ for several things.

No surrender value will be available under the regular premium option but it will be available in sing premium. At the same time, some terms and conditions will be added to the limited premium mode.

The premium amount will be different for men and women. Similarly, there will be a difference in the premium between smokers and non-smokers. The premium for males will be more than for females Similarly, a smoker will have to pay a higher premium than a non-smoker.

Premium Payment of LIC Tech Term Plan

In LIC Tech Term Plan, different premiums have been fixed for

- Smoker and

- Non-Smoker.

Premium will be higher for smokers, while non-smokers will have to pay less premium. LIC Tech Term vs Jeevan Amar

In this, the premium will be higher for males and a lower premium for females. Apart from this, this plan comes with an Accidental Benefit Rider, which can be added to the plan by paying an additional premium. LIC Tech Term vs Jeevan Amar

Check related Articles:-

- Eye-Opening Facts About Well-Known LIC Jeevan Labh Plan 936

- 4 Ways To Make Retirement Funds Last Longer!

- What Is Employment Practices Liability Insurance (EPLI)?

- SBI Term Insurance Plan: Here Is All You Need To Know

- How To Buy LIC Policy Online Without Agent?

- What Is Business Identity Theft Insurance?

- Get A Brief Idea About The SBI Life Money Back Plan

- Do I Need To Buy Identity Theft Insurance?

- Details Of Children Education Allowance Exemption