If you have also bought a policy from LIC (Life Insurance of India), then there is no need to put in a long line or wait in the LIC office to check the policy, you can buy a LIC policy online without an agent.

Life Insurance Corporation of India (LIC) has launched an online insurance plan. It is a pure protection online term insurance policy, which provides financial security to the family of the policyholder. For this now the policy can only be purchased online.

An Overview:

Table of Contents

Financial security is essential for the well-being of life. And to get this security in India one can blindly trust LIC (Life Insurance Company of India). But there were times when our LIC agents used to misguide us and thus we used to end up purchasing the wrong plan.

However, LIC has facilitated the purchase of an online insurance policy for the convenience of its customers. So, now you can buy a LIC policy online without an agent. An agent’s commission is included in your premium in an insurance policy sold through an agent.

NOTE:

You can LIC policy without agent commission. LIC policy online purchase process is so easy that anyone can buy online LIC policy within a few seconds.

Documents Required To Buy LIC Policy Online Without Agent:

Check out the list of documents required to buy a LIC policy online without an agent.

One Passport Size Photo

Proof of Age:

Any one of the following documents will be adequate for the proof of age:

- Madhyamik Admit Card

- Pan card

- Passport

- Aadhar card

- Driving license

Proof of Address:

Any one of the following documents will be adequate for the proof of address:

- Voter Id

- Passport

- Ration card

- Driving license

- Xerox of Bank passbook

- Utility bills such as telephone bills / Electricity bills/gas bills/credit card bills etc.)

- Rental agreement

- Bank statement, etc.

Photo Id Proof

Any one of the following documents will be adequate for the Photo Id Proof

- Aadhar card

- Passport

- Voter ID card

- Pan card

- Driving license, etc.

Proof of Income:

Any one of the following documents will be adequate for the Proof of Income

- 3 months of bank statements

- Pay slip / Salary slip

- Last 3 years of Income Tax Returns

How To Buy LIC Policy Online Without Agent?

To buy an LIC policy online without an agent, you will have to go through some easy and simple steps provided in this article below. You can buy a LIC policy online without an agent in 5 easy and simple steps. So, check out the steps to buy a LIC policy online without an agent. Here are the steps on how to take a LIC policy online

Step 1

First, go to the official website of LIC Click Here

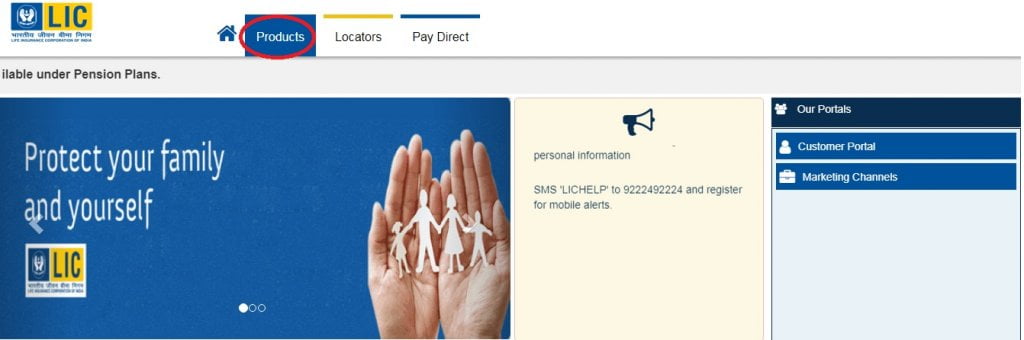

Step 2

Click on the Product button as mentioned in the above picture

Step 3

Go through all the policies mentioned there by clicking on the specific type of insurance you need to buy. And also do not forget to check the features as well as the sample illustrations provided in LIC before you headed for online LIC policy buy/LIC policy online buy

Step 4

Now to buy a LIC policy online without an agent, click on the Buy a New Policy button as mentioned in the picture above

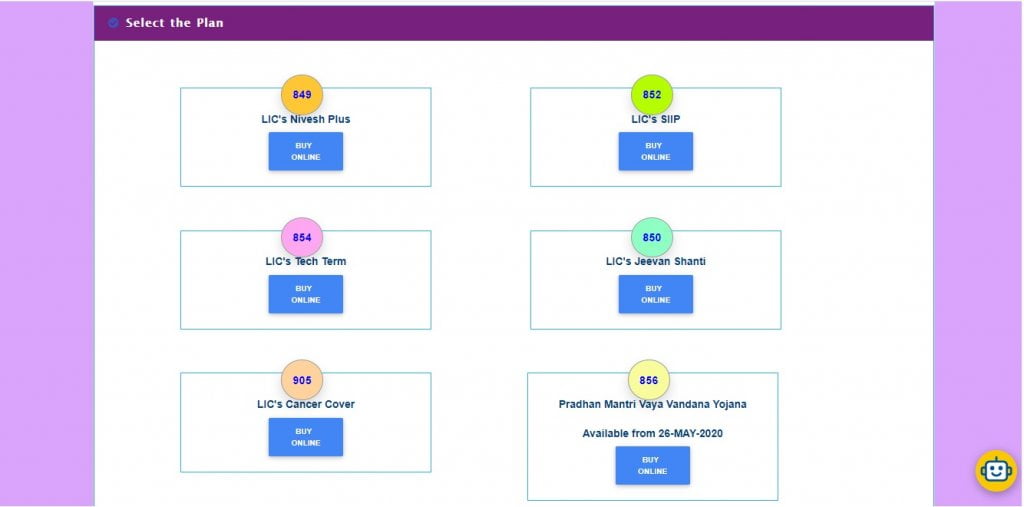

Step 5

When you click on the Buy a New Policy button then this above-mentioned page will open in a new tab

Step 6

- LIC’s Nivesh Plus

- LIC’s SIIP

- LIC’s Tech Term

- LIC’s Jeevan Shanti

- LIC’s Cancer Cover

- LIC’s Pradhan Mantri Vaya Vandana Yojana (Available from 26-MAY-2020)

You will get these 6 options. Click on the BUY ONLINE button to continue the process

Step 7

After clicking on the buy online button, a new page will open in front of you. And there at the bottom, you will get the CLICK TO BUY ONLINE option. Just as shown in the picture

Step 8

Fill in the required fields and provide Documentation for the Policy Completion.

Step 9

You will get a 9-digit Access Id on your email Id / Mobile Number as well as an OTP. Proceed with that access id and OTP and then fill in all the required fields

NOTE:

Buying insurance from the LIC website directly, you can buy LIC policy online without agent as well as without added commission of the agent.

LIC Policies That Are Available Online:

Now let’s check out the plans that you can buy LIC policy online without an agent. Here are the 6 LIC plans that you can buy online without any agent’s help.

The LIC Nivesh Plus Policy

Life Insurance Corporation of India (LIC) launched the Nivesh Plus Insurance Policy. This is a Unit Linked, Non-participating, Single Premium Individual Life Insurance Plan. It has the option of offering a single premium and a regular premium.

Nivesh Plus Insurance plan offers which offers insurance cum investment during the term of the policy. It is designed for a child of 90 days of age to up to the age of 70 years old individual. Under this plan, you can take insurance for a minimum of INR 1 lakh.

LIC’s SIIP

LIC’s SIIP is a Regular Premium, Non-Participating, Unit Linked, Individual Life Insurance plan which offers insurance cum investment during the term of the policy. It is a regular premium policy, Unit Linked, Non-Participating, Individual Life Insurance plan.

A policyholder can partially withdraw the units at any time after the fifth policy anniversary, maybe in the form of a fixed amount or the form of a fixed number of units as per details

LIC’s Tech Term Policy

LIC’s Tech-Term is a Non-Linked, Without Profit, Pure Protection “Online Term Assurance Policy” which provides financial protection to the insured’s family in case of his/her unfortunate demise. This plan will be available through the online application process only and no intermediaries will be involved.

LIC’s Jeevan Shanti

The LIC’s Jeevan Shanti Insurance plan is an annuity policy. Through this policy, you can buy an annuity immediately and later. There is also the option to surrender this policy.

Apart from this, you can take a loan under this insurance policy of LIC. Under this, it is necessary to buy a plan of at least INR 1.5 lakh. The maximum limit is not available.

LIC’s Cancer Cover

LIC’s cancer coverage is a regular health insurance policy with premiums. If the policyholder is a cancer patient then he gets an amount under this insurance. It will get the amount of money according to the different stages of cancer.

Under this, you can get insurance of at least INR 10 lakh and a maximum of INR 50 lakh. The minimum premium under this policy is INR 2400.

LIC’s Pradhan Mantri Vaya Vandana Yojana

The Life Insurance Corporation of India (LIC) has come up with the Pradhan Mantri Vaya Vandana Yojana for people aged 60 years old. Through this, it provides a pension. So, in this insurance plan, you get a pension for 10 years.

Also, there is no need for a medical checkup for this policy. After 3 years, you can take a loan from this insurance plan.

BOTTOM LINE

So, as you can see, you can buy LIC policy online without agent but not all the insurance plans. Only a few insurance plans are available online at present which you can buy LIC policy online without agent.

FAQ:

Q. How can I get the LIC policy online?

A. You can buy a LIC policy online without an agent as well as without added commission from the agent. The process to get the LIC policy online is described in detail below. Check it out here.

Q. What is the difference between online and offline insurance policies?

A. There were times when our LIC agents used to misguide us and thus we used to end up purchasing the wrong plan. But on the online platform when you purchase insurance you get all the details written there, which the agency used to hide from us. To know more visit this site…

Q. How can I get a LIC premium receipt online?

A. At first, go to the official website of LIC or you can just Click Here to reach the official website of LIC. Then put in the policy number to get your receipt online.

Q. Which is the best online plan in LIC?

A. Go through all the policies mentioned there so that you can buy an LIC policy online without an agent. And also do not forget to check the features as well as the sample illustrations provided in LIC.

- LIC’s Nivesh Plus

- LIC’s SIIP

- LIC’s Tech Term

- LIC’s Jeevan Shanti

- LIC’s Cancer Cover

- LIC’s Pradhan Mantri Vaya Vandana Yojana (Available from 26-MAY-2020)

Q. Can I buy LIC without an agent?

A. An agent’s commission is included in your premium in an insurance policy sold through an agent. At the same time, by buying insurance from the LIC website directly, you can buy a LIC policy online without an agent as well as without added commission from the agent.

Q. How can I check my LIC premium online?

A. To check your LIC premium online you will have to go to the official website of LIC. Put your LIC policy number. And you are good to go. You will get all the essential information there.

Q. How can I buy LIC Jeevan Shanti online?

A. The LIC’s Jeevan Shanti Insurance plan is an annuity policy. To know how to buy LIC Jeevan Shanti online click here

Q. How can I get the LIC agent portal?

A. See the steps here:

- Visit the official website of the LIC

- Click on the Agents Portal under the Online Services menu tab

- Select the role of Agent

- Enter your Agent Code/Mobile Number/Email ID

- Enter the date of birth and password

- Click Sign In to proceed

Q. Which plan is best in LIC?

A. Each LIC policy comes with different and unique facilities. Among those plans, which one is the best that entirely depends on your needs

Q. Which is the best online pension plan for LIC?

A. Pradhan Mantri Vaya Vandana Yojana is the best online pension plan for LIC where you can pay your premiums online.

Q. Do LIC agents pay the first premium?

A. NO, not at all. For your life insurance policy, you will have to pay all the premiums. You can buy life insurance via an agent and he will help you handle all the paperwork, And that’s it.

Recommended Articles:-

- What Are The Best LIC Policy For 10 Years?

- How To Find LIC Policy Number By Name & DOB?

- Can I Surrender LIC Policy | How To Surrender LIC

- Know About The LIC Best Policy With Best Return Here

- Which Policy Gives Maximum Return In India?

- Know Why Life Insurance Is Important To Have?

- Retirement Life Insurance Plans In India: Know In Details

- Life Insurance Penetration In India Here Is All You Need To Know

- History Of Life Insurance In India: All You Need To Know