Becoming a Post Office Agent in India involves a structured process of meeting eligibility criteria, submitting an application, undergoing selection and training, and starting your role with comprehensive knowledge of postal products. While challenges like meeting sales targets and handling customer rejections are common, success can be achieved through strong customer relationships, effective communication, and continuous learning. So, see the post office agent commission chart 2026.

Types of Post Office Agents:

Table of Contents

Becoming a Post Office Agent commission chart in India involves choosing several roles. Each type of agent has distinct responsibilities and targets different customer groups. Below is an explanation of the different types of Post Office Agents:

Standard Post Office Agent (POA):

- Role: Standard Post Office Agents promote and sell various savings schemes offered by the Indian Postal Department. These include popular schemes like the National Savings Certificate (NSC), Kisan Vikas Patra (KVP), and recurring deposit accounts.

- Responsibilities:

- Educate customers about the benefits of different savings schemes.

- Assist customers in filling out application forms and submitting them.

- Maintain records of transactions and provide regular reports to the post office.

Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI) Agent:

- Role: PLI and RPLI Agents focus on selling insurance products. PLI is targeted at government employees, while RPLI is aimed at rural populations, offering them insurance coverage.

- Responsibilities:

- Explain the features and benefits of postal life insurance policies to potential customers.

- Help customers choose the right insurance plan based on their needs.

- Handle policy issuance, premium collection, and claim processing.

Mahila Pradhan Kshetriya Bachat Yojana (MPKBY) AgentL

- Role: MPKBY Agents, often women, promote small savings schemes, especially targeting women and children. This initiative encourages saving habits among rural and urban women.

- Responsibilities:

- Promote schemes like the Sukanya Samriddhi Account (SSA) and recurring deposits.

- Educate women on the importance of savings and financial planning.

- Facilitate account openings, deposits, and withdrawals.

Senior Citizen Savings Scheme (SAS) Agent:

- Role: SAS Agents focus on promoting the Senior Citizen Savings Scheme, which is a government-backed savings instrument specifically for senior citizens.

- Responsibilities:

- Inform senior citizens about the benefits and features of the Senior Citizen Savings Scheme.

- Assist in opening accounts and managing deposits.

- Provide guidance on the scheme’s rules, interest rates, and maturity benefits.

Eligibility Criteria for Becoming a Post Office Agent in India:

To become a Post Office Agent in India, applicants must meet specific eligibility criteria. These criteria ensure that the candidates are suitable for the responsibilities associated with the role. Here’s a detailed explanation of the key eligibility requirements:

Educational Qualifications:

- Minimum Education: Generally, a candidate must have completed at least the 10th standard (secondary school education) from a recognized board. This requirement ensures that agents have a basic level of education to understand and explain financial products to customers.

Age Limit:

- Minimum Age: The minimum age requirement is typically 18 years. This ensures that candidates are legally adults and capable of entering into contracts.

- Maximum Age: The maximum age limit can vary, usually around 50 years. This range ensures that agents are active and capable of performing their duties effectively.

Nationality:

- Indian Citizenship: Candidates must be Indian citizens. This requirement ensures that agents are familiar with the local culture and can effectively communicate with the community they serve.

Additional Requirements:

- Background Check: A background check is often conducted to ensure that the candidate does not have a criminal record and is trustworthy.

- Experience (if applicable): While not always mandatory, having prior experience in sales, marketing, or customer service can be advantageous. This experience helps agents effectively promote and sell postal products.

- Financial Soundness: Some roles might require candidates to be financially stable, ensuring they can manage their finances well and avoid conflicts of interest.

- Local Residency: Being a resident of the local area where they wish to work can be a plus, as local agents are more familiar with the community and can build better relationships with customers.

Application Process to Become a Post Office Agent in India:

The application process to become a Post Office Agent in India involves several steps. Here’s a detailed, step-by-step guide:

Step 1: Obtain the Application Form

- Where to Get the Form:

- Visit your nearest post office and request the application form for becoming a Post Office Agent.

- Alternatively, you can download the application form from the official Indian Postal Department website.

Step 2: Fill Out the Application Form

- Personal Details:

- Fill in your full name, date of birth, address, and contact information.

- Educational Background:

- Provide details of your educational qualifications, including the name of the institution, year of passing, and percentage/grades obtained.

- Previous Experience:

- If applicable, mention any relevant experience in sales, marketing, or customer service.

- Other Information:

- Fill out any additional information required, such as local residency proof, language proficiency, and references.

Step 3: Gather Required Documents

- ID Proof:

- Aadhaar card, Voter ID, Passport, or any other government-issued ID.

- Address Proof:

- Utility bills, rent agreement, or any official document showing your current address.

- Educational Certificates:

- Photocopies of your 10th standard certificate and any higher education certificates.

- Passport-Size Photographs:

- Recent passport-size photographs as specified in the application form instructions.

- Experience Certificates (if applicable):

- Certificates from previous employers or any relevant documents showcasing your experience.

Step 4: Submit the Application Form

- Submission Location:

- Submit the completed application form along with the required documents to the designated post office or the postal division office as mentioned in the application instructions.

- Submission Method:

- Some regions may allow online submission of forms and documents. Check the specific instructions provided by your local postal authority.

Step 5: Pay the Application Fee

- Fee Details:

- Some postal regions may require an application fee. Check the form or official guidelines for details.

- Payment Method:

- Pay the fee at the post office or through an online payment gateway if available. Keep the receipt for future reference.

Step 6: Await Screening and Selection

- Initial Screening:

- The postal authorities will review your application and documents to ensure all criteria are met.

- Written Examination (if applicable):

- If a written exam is part of the selection process, you will be notified of the exam date, venue, and syllabus. Prepare accordingly.

- Interview Process:

- Shortlisted candidates will be called for an interview. Prepare to answer questions about your background, experience, and knowledge of postal schemes.

Step 7: Attend Training

- Training Program:

- Successful candidates will undergo a training program conducted by the postal department. This training will cover:

- Detailed information about postal savings and insurance schemes.

- Customer service skills.

- Sales and marketing techniques.

- Duration:

- The training period can vary, typically lasting a few weeks.

Step 8: Receive Certification and Start Working

- Certification:

- Upon successful completion of the training program, you will receive a certification from the postal department.

- Start Your Role:

- Begin your duties as a Post Office Agent, promoting and managing postal products and services in your assigned area.

Selection Process to Become a Post Office Agent in India

The selection process for becoming a Post Office Agent in India involves multiple steps to ensure candidates are qualified and suitable for the role. Here’s a detailed, step-by-step guide:

Step 1: Screening of Applications

- Initial Review:

- Once you submit your application form and required documents, the postal authorities will conduct an initial review.

- They will check if you meet the basic eligibility criteria, such as educational qualifications, age limit, and citizenship.

Step 2: Written Examination (if applicable)

- Notification:

- If your application passes the initial screening, you may be notified about a written examination.

- Exam Pattern:

- The exam typically includes questions on basic mathematics, general knowledge, and information about postal services.

- Preparation Tips:

- Study basic math concepts, stay updated with current affairs, and understand the various postal schemes and services.

- Exam Day:

- Attend the examination on the scheduled date and ensure you have all necessary documents (admit card, ID proof).

Step 3: Interview Process

- Shortlisting:

- Candidates who pass the written examination will be shortlisted for an interview.

- Interview Notification:

- You will receive details about the interview date, time, and venue.

- Interview Preparation:

- Prepare to discuss your background, experience, and reasons for wanting to become a Post Office Agent.

- Review common interview questions related to sales, customer service, and postal schemes.

- Interview Day:

- Dress professionally and arrive on time.

- Be honest, confident, and articulate your answers clearly.

- Interview Questions:

- You might be asked about your knowledge of postal products, your sales experience, and how you handle customer queries.

Step 4: Background Check

- Verification:

- A background check may be conducted to verify the information provided in your application.

- This includes checking your educational qualifications, previous employment, and any criminal records.

- Additional Documents:

- You may be asked to provide additional documents or references during this process.

Step 5: Final Selection

- Selection Notification:

- If you successfully pass the interview and background check, you will be notified of your selection.

- You will receive an official offer letter or appointment letter from the postal department.

- Acceptance:

- Review the terms of the offer and formally accept the position.

Step 6: Training

- Training Program:

- Selected candidates will undergo a training program organized by the postal department.

- Training Content:

- The training will cover detailed information about postal savings schemes, insurance products, customer service skills, and sales techniques.

- Training Duration:

- The training period typically lasts a few weeks.

- Completion and Certification:

- Completed the training program to receive certification.

Duties and Responsibilities of a Post Office Agent in India:

As a Post Office Agent in India, you will have a range of duties and responsibilities to ensure the efficient promotion and management of postal savings and insurance products. Here’s a detailed explanation of what you will be expected to do:

1. Sales and Marketing:

- Promote Postal Products:

- Educate customers about various postal savings schemes such as National Savings Certificates (NSC), Kisan Vikas Patra (KVP), Public Provident Fund (PPF), and Recurring Deposit (RD) accounts.

- Promote insurance products like Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI).

- Achieve Sales Targets:

- Meet or exceed sales targets set by the postal department for different products. This involves regular outreach to potential customers and converting leads into sales.

- Marketing Strategies:

- Develop and implement marketing strategies to increase awareness and participation in postal schemes. This may include organizing community events, distributing pamphlets, and using social media platforms.

2. Customer Service:

- Assist Customers:

- Help customers understand the features and benefits of various postal products. Provide detailed explanations and answer any questions they may have.

- Application Assistance:

- Assist customers in filling out application forms for different schemes and policies. Ensure that all required documents are submitted correctly.

- Resolve Queries:

- Address and resolve customer queries and complaints promptly and efficiently. This includes providing information on account balances, policy details, and claim procedures.

3. Transaction Management:

- Process Transactions:

- Handle transactions related to opening accounts, deposits, withdrawals, and premium payments for insurance policies. Ensure all transactions are recorded accurately.

- Maintain Records:

- Keep detailed records of all transactions and customer interactions. This includes maintaining ledgers, updating customer profiles, and ensuring data accuracy.

4. Reporting and Compliance:

- Regular Reporting:

- Submit regular reports to the post office on sales performance, customer feedback, and any issues encountered. These reports help the postal department track the effectiveness of its agents.

- Compliance with Regulations:

- Ensure all activities comply with postal regulations and guidelines. This includes adhering to financial transaction limits, maintaining confidentiality of customer information, and following ethical sales practices.

5. Financial Management:

- Handle Funds:

- Manage funds received from customers for deposits, premium payments, and other transactions. Ensure accurate accounting and timely remittance to the post office.

- Budget Management:

- Manage your own budget for marketing activities and other expenses related to promoting postal products.

6. Continuous Learning:

- Stay Updated:

- Keep yourself updated with the latest information on postal schemes, regulatory changes, and market trends. Continuous learning helps you provide accurate and up-to-date information to customers.

- Training Participation:

- Participate in regular training programs conducted by the postal department to enhance your knowledge and skills.

Benefits and Compensation for Post Office Agents in India

Becoming a Post Office Agent in India comes with various benefits and a structured compensation system. Here’s a detailed explanation of what you can expect in terms of earnings and other perks:

Additional Benefits:

- Bonuses and Incentives:

- Agents may receive bonuses or incentives for meeting or exceeding sales targets. These incentives can be periodic (monthly, quarterly, or annually) and are designed to encourage high performance.

- Recognition and Awards:

- High-performing agents are often recognized with awards and certificates by the postal department. This recognition can enhance your professional reputation and provide motivation.

- Flexibility:

- As a Post Office Agent, you often have the flexibility to manage your schedule and work hours. This allows you to balance your professional and personal life effectively.

Other Perks:

- Networking Opportunities:

- Working as a Post Office Agent provides opportunities to build a network of contacts within the postal department and among the customer base. This can be beneficial for personal and professional growth.

- Community Impact:

- You play a crucial role in promoting financial literacy and inclusion, especially in rural and underserved areas. This work can be highly fulfilling as you contribute to the economic well-being of your community.

Financial Management Benefits:

- Access to Financial Products:

- As a Post Office Agent, you gain in-depth knowledge of various financial products. This knowledge can help you make informed decisions about your own financial planning and investments.

- Training and Development:

- Continuous training provided by the postal department helps you stay updated on the latest schemes and products, enhancing your skills and knowledge over time.

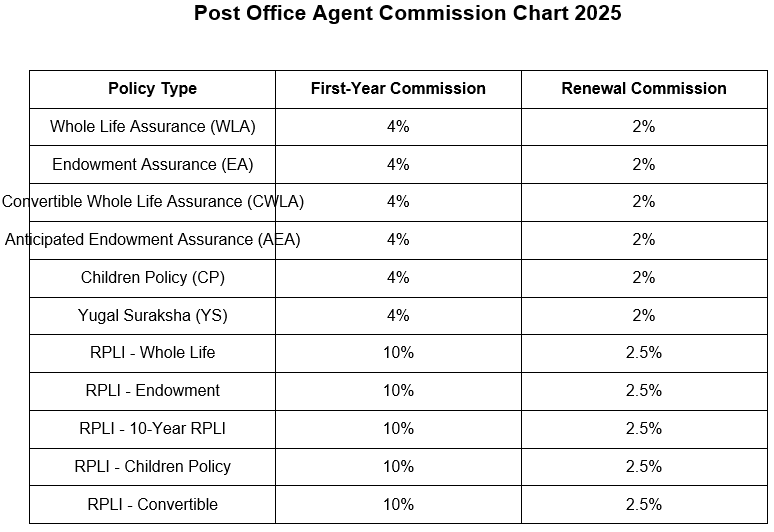

Post Office Agent Commission Chart 2026:

As of February 2026, the Post Office Agent Commission Structure in India remains consistent with previous years. Agents earn commissions for promoting and mobilizing investments in various postal savings schemes. Below is a detailed post office agent commission chart:

Post Office Agent Commission Chart 2026

| Savings Scheme | Commission Rate |

|---|---|

| Recurring Deposit (RD) | 4.0% |

| National Savings Time Deposit (1, 2, 3, 5 Years) | 0.5% |

| Monthly Income Account Scheme (MIS) | 0.5% |

| National Savings Certificate (NSC) | 0.5% |

| Kisan Vikas Patra (KVP) | 0.5% |

| Public Provident Fund (PPF) | Nil |

| Senior Citizens Savings Scheme (SCSS) | Nil |

| Sukanya Samriddhi Account (SSA) | Nil |

Key Points:

-

Recurring Deposit (RD): Agents receive a 4% commission on the total deposits mobilized.

-

Time Deposits (TD): For 1-year, 2-year, 3-year, and 5-year time deposits, the postal agent commission is 0.5% of the deposited amount.

-

Monthly Income Scheme (MIS): A 0.5% postal life insurance agent commission is provided on investments made under this scheme.

-

National Savings Certificate (NSC) & Kisan Vikas Patra (KVP): Agents earn a 0.5% commission on the total amount invested.

-

Public Provident Fund (PPF), Senior Citizens Savings Scheme (SCSS), and Sukanya Samriddhi Account (SSA): No commissions are offered to agents for these schemes.

These PLI agent commission rates are in line with the guidelines provided by the Ministry of Finance and are subject to change based on governmental policies. Agents are advised to stay updated with official communications for any revisions.

See below the Post Office Agent Commission Chart 2026 in PDF form.

Post Office Agent Commission Calculator:

- Earnings Based on Sales:

- Post Office Agents primarily earn through commissions, which are a percentage of the sales they generate. Different postal schemes and products offer varying commission rates.

- Savings Schemes Commissions:

- Recurring Deposits (RD): Agents typically earn a commission of 4% on the total amount of recurring deposits they collect.

- National Savings Certificate (NSC) and Kisan Vikas Patra (KVP): The commission rate is usually around 0.5% of the total amount invested.

- Monthly Income Scheme (MIS): Agents can earn a commission of 0.5% on the amount invested by customers.

- Insurance Products Commissions:

- Postal Life Insurance (PLI): Commissions can range from 2% to 10% of the premium collected, depending on the type and term of the policy.

- Rural Postal Life Insurance (RPLI): Similar to PLI, with commissions typically around 5% to 10% of the premium.

Example:

To illustrate how benefits and compensation work, here’s an example:

Monthly Income for an Agent:

- Recurring Deposit (RD) Sales:

- Total RD amount collected: ₹1,00,000

- Commission at 4%: ₹4,000

- NSC/KVP Sales:

- Total investment amount: ₹2,00,000

- Commission at 0.5%: ₹1,000

- PLI Premiums Collected:

- Total premium amount: ₹50,000

- Average commission at 7%: ₹3,500

Total Monthly Earnings: ₹4,000 (RD) + ₹1,000 (NSC/KVP) + ₹3,500 (PLI) = ₹8,500

In addition to the monthly earnings, the agent might receive a quarterly bonus for achieving sales targets and additional incentives for excellent performance.

FAQ:

Q. How do Post Office agents earn commissions?

A. Post Office agents earn commissions based on the amount deposited or invested by customers in eligible savings schemes. The commission is a fixed percentage of the total deposit and is credited directly to the agent’s account.

Q. Do all Post Office schemes provide agent commissions?

A. No, PPF, SCSS, and SSA do not offer any commission to agents. The commission is available only for schemes like RD, TD, MIS, NSC, and KVP.

Q. How do agents receive their commission payments?

A.

- Commissions are directly credited to the agent’s linked bank account or paid via cheque.

- Agents need to submit investment documents to claim their commission.

Q. Is there a tax deduction on Post Office agent commissions?

A. Yes, TDS (Tax Deducted at Source) and GST (18%) apply to commissions beyond a certain threshold. Agents should declare their income for income tax purposes.

Q. Are there any extra incentives for Post Office agents?

A. Currently, there are no additional incentives beyond the standard commission rates. However, the government may introduce special promotions for high-performing agents.

Q. Can an agent lose their commission eligibility?

A. Yes, an agent can lose their commission rights if:

- They violate Post Office rules or commit fraud.

- They fail to meet the minimum required transactions over time.

- The customer deposits directly in the Post Office instead of through the agent.

Q. How can one become a Post Office agent?

A. To become a Post Office agent, you must:

- Be at least 18 years old.

- Submit an application at the nearest India Post Office.

- Provide ID proof, address proof, and a surety bond.

- Complete the necessary training and pass an agent exam.

Q. Can Post Office agents work part-time?

A. Yes, many agents work part-time alongside other jobs. There are no restrictions on having another occupation while working as a Post Office agent.

Q. Where can I find the latest updates on commission rates?

A. For the latest Post Office agent commission structure, visit the official India Post website (www.indiapost.gov.in) or contact your nearest Post Office branch.