An endowment policy is a life coverage arrangement that covers the life and enables the policyholder to spare normally over a predetermined timeframe so that at development, they can get a single amount upon term endurance. So, let’s here know about different types of endowment policy.

What is Endowment Insurance Policy?

Table of Contents

An endowment insurance policy is a kind of Life Insurance, where, upon completion of insurance term, the policy pays the full sum insured to the holder, if the policyholder dies during the term of the insurance policy, then the beneficiaries will get the full sum assured.

Endowment Insurance Plan is the most prevalent and traditional method in India to take insurance. A risk-free investment that provides financial security by adding a small amount fulfills your savings goals and helps in making a good amount of money by meeting the long-term investment objective.

For whatever length of time that you need to be guaranteed for a specific period (for a fixed period), you can protect yourself and you get the aggregate guaranteed alongside a reward for the span of the endowment policy.

Let us know the types of endowment policy, why we should take it, and what things should be taken care of before taking it. To know more read our article below.

How Does The Endowment Insurance Policy Work?

The Endowment insurance plans are parallel to normal insurance plans. However, one of the best types of endowment policy provides life insurance cover and a saving prospect for its financiers to save repeatedly over a precise period.

On the development of such a policy, the lump-sum maturity money is offered to the policyholder that he or she can further use to complete the monetary objectives of life including his or her children’s education, retirement planning, purchasing property, etc.

Now that you have a brief overview of the types of endowment policies and how does it work, let’s take a look at the best endowment plans in India.

What Should We Check Before Taking Endowment Insurance Plan?

There is an abundance of endowment insurance plans available in the market today. Choosing a suitable plan will depend on many factors, including your existing living standards, personal need, and income, etc.

It is very important that you know how your endowment insurance premium is determined. Also, be sure to read terms & conditions to know before taking an endowment insurance policy from any insurance company.

Always consider comparing the policies before buying them. Different insurance companies offer different facilities to its policyholder. So at first check which company meets your requirements and then buy your endowment policy.

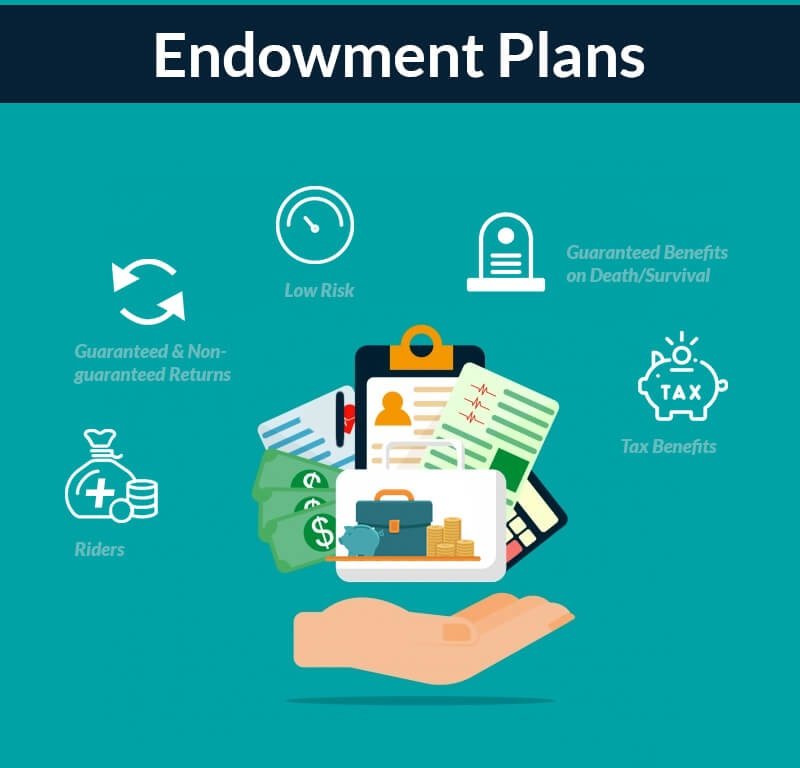

Salient Features of An Endowment Policy:

Low Risk:

Conventional Endowment approaches are viewed as more secure when contrasted with the other speculation alternative, for example, the Unit Linked Insurance Plans (ULIP) or the Mutual Fund’s on the grounds that the sum here isn’t straightforwardly put resources into value reserves or the financial exchange.

Death & Survival Benefits:

In the event of the death of the guaranteed, the nominee/beneficiary one of the policy gets the aggregate guaranteed alongside rewards. Likewise, the safeguarded is permitted to get the whole guaranteed on the off chance that he/she outlasts the policy.

Tax Benefits:

The policyholder is qualified to get charge exclusion on both premium installments, development, and last compensation outs under Section 80C and Section 10(10D) of the Income Tax Act, 1961.

Higher Returns:

The endowment policy is useful in building a corpus for the future and giving money related assurance to your family. The compensation out for endurance advantage and passing advantage of an endowment plan is higher than that of an unadulterated disaster protection policy for example Term Plans.

Flexibility In Cover:

Riders like basic ailment, absolute changeless inability, and coincidental passing can be added to the base arrangement and upgrade the existence spread. Also, there are a couple of plans that offer waiver in the top-notch installment on all-out perpetual handicap or basic sickness.

PremiumX Payment Frequency:

The policyholder can make installment of the premium depends on the policy picked by him/her. Installment should be possible on a month to month, quarterly, half-yearly, and on a yearly premise.

Benefits of Endowment Plan:

- Provides insurance cover during the policy term

- It provides a lump sum payout when the policy matures

- Presents with a double reason as it functions as a protection policy as well as offers you with long haul venture benefits

- Offers Long-term savings

- The policyholder is qualified to get charge exclusion on both premium installments, development, and last compensation outs under Section 80C and Section 10(10D) of the Income Tax Act, 1961.

- Offers Low-Risk Investments

- Provides the option to add riders

- Offers additional bonuses

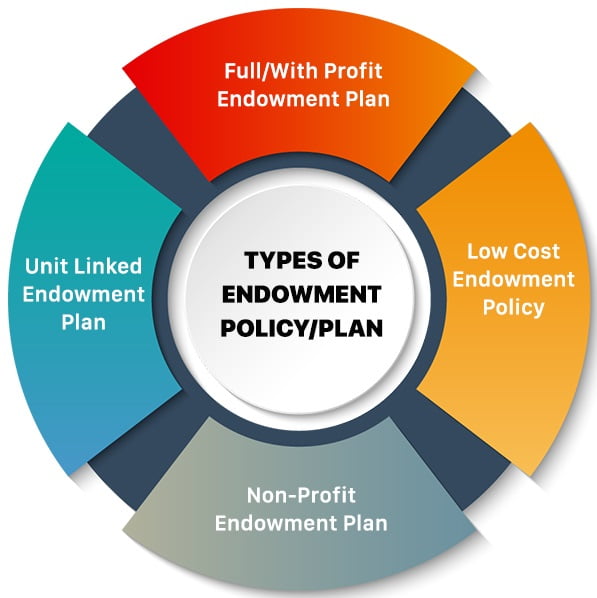

What Are The Types Of Endowment Policy?

There is a total of 4 types of Endowment Policy exists. Today in this article below I am going to give you a brief idea regarding the types of Endowment policy. So keep your eyes on to know in details about the types of endowment Policy:

- Endowment With Profit

- Endowment Policy Without Profit

- Low-Cost Endowment Plan

- Full Endowment Plan

- Unit-Linked Endowment plan

Endowment Policy With Profit

Endowment policy with profit guarantees the policyholder lump-sum to be remunerated during its maturity or death of the Endowment insurance policyholder. The total sum assured money of this policy rises as the policyholder acquires regular/reversionary additional benefit.

These are assured advantages are certainly payable to its insured. In Addition to this, in some cases, the insurance policy also provides a terminal advantage, which is known as the non-assured bonus. This bonus is payable by the company to the policyholder at the completion of an Endowment Insurance plan.

With profit is one of the best types of endowment policy for persons who wish to have a steady flow of revenue or need to achieve a precise objective like reimbursing a mortgage and so many more.

Endowment Policy Without Profit

This is one of the most traditional types of endowment policy, where the total sum assured money is remunerated to its insured as the maturity profit or to its beneficiary as the death benefit.

Low-Cost Endowment Plan

Such policies are structured so the assessed future development rate will meet the objective sum and pay a base demise advantage. These are normally used to help reimburse contract credits.

It is comprised of diminishing term protection and a venture component. It’s alluded to as low cost on the grounds that the entirety and the month to month premiums are lower than that of a without-benefit or customary with-benefits endowment.

Full Profit Endowment Policy

Under the Full Profit Endowment Policy, the elementary amount assured has to be paid to the insured is equivalent to the death profit, right from the initial time of the policy. As per the ventured market-based obligation, the ultimate expenditure provided is comparatively higher in such types of Endowment Policy.

Unit-Linked Endowment Policy

A unit-linked endowment plan is a type of endowment policy in which a share of the premium is remunerated for its insurance coverage and the remaining premium is capitalized in various units of the investment resources. The policyholder can select the fund alternatives for the investment as per their suitability.

FAQ:

Q. What are the different types of endowments?

A. There is a total of 4 types of Endowment Policy exists.

- Endowment With Profit

- Endowment Policy Without Profit

- Low-Cost Endowment Plan

- Full Endowment Plan

- Unit-Linked Endowment plan

Q. Which is the best endowment policy?

A. Each endowment policy has its separate and unique features. So, to find out the best one, you need to compare them all and find out which one fulfills your requirements.

Q. What is the endowment policy example?

A. An Endowment policy is a risk-free investment that provides financial security by adding a small amount fulfills your savings goals and helps in making a good amount of money by meeting the long-term investment objective.

Q. Can you still buy endowment policies?

A. YES, of course, you can still buy endowment policies as it is widely available for its customers.

Q. What is the purpose of an endowment?

A. An Endowment policy provides life insurance cover and a saving prospect for its financiers to save repeatedly over a precise period.

Q. Are endowments a good idea?

A. An endowment insurance policy is a kind of Life Insurance, where, upon completion of insurance term, the policy pays the full sum insured to the holder, if the policyholder dies during the term of the insurance policy, then the beneficiaries will get the full sum assured. So, indeed its a good idea

Q. Is the endowment plan a good investment?

A. It is a risk-free investment that provides financial security by adding a small amount to fulfill your savings goals as well as helps in making a good amount of money by meeting the long-term investment objective.

Q. What are the benefits of endowment policy?

A. An endowment policy is a life coverage arrangement that covers the life and enables the policyholder to spare normally over a predetermined timeframe so that at development, they can get a single amount upon term endurance.

Q. What do you mean by the endowment policy?

A. An endowment insurance policy is a kind of Life Insurance, where, upon completion of insurance term, the policy pays the full sum insured to the holder

Recommended Articles:-