The money-back plan is for those who want to protect themselves and their families from insurance, as well as returns like investment from that money. The scheme was well-received among Indian customers. In this policy, if the customer dies in an accident, then his family will get a fixed amount. If everything is going well and you are paying installments continuously, then you will keep getting returns at regular intervals till 5th, 10th, 15th, and 20th year. It is an insurance policy that guarantees returns. Today in this article below I am going to provide you LIC money back policy for 9 years to 25 years.

What Does It Mean By LIC Money Back Policy for 9 Years-25 Years?

Table of Contents

Unlike regular endowment insurance policies where you get survival benefits only at the completion of your endowment term, the LIC money back policy for 9 years to 25 years provides periodic payments (after each 5 years, 10 years, 15 years, and 20 years) of the incomplete survival benefits in this manner during the tenure of your policy. However, of course, as long as the policyholder is alive.

An essential feature of the LIC money back policy for 9 years to 25 years is that in case of death of the policyholder at any period within the plan term, the death claim includes total sum assured without reducing any of the survival benefit sums that have already got paid. In the same way, the additional benefit is also considered on the total sum assured.

All The Plans Under LIC Money Back Policy For 9 Years-25 Years:

Each person’s insurance requirements and needs are dissimilar and vary from person to person. LIC’s Moneyback Insurance policies are plans that understand your requirements and thus provide you the most appropriate alternatives that can suit your requirements. So, let’s now check out all the LIC Money Back Policy for 9 years to 25 years to find out the most suited one. LIC Money Back Policy For 9 Years

LIC Money Back Policy for 9 Years to 25 Years:

- New Bima Bachat Money Back Plan

- Bima Shree Money Back Plan

- New Money Back Plan – 20 Years

- New Money Back Plan – 25 Years

- Jeevan Shiromani Money Back Plan

- New Children’s Money Back Plan

- Jeevan Tarun Money Back Plan

New Bima Bachat (9,12 and 15 Years) Money Back Plan:

LIC’s New Bima Bachat money back plan is a contributing non-linked protection cum savings plan, where the policy premium is funded in a lump sum. It’s a money-back policy that offers monetary security against death all through the policy tenure with the facility of payment for survival benefits at stated durations for the period of the policy tenure. LIC Money Back Policy For 9 Years

Furthermore, on maturity, the particular premium (if any) will be repaid along with the Loyalty Addition. This LIC money back plan for 9 years also pays attention to the liquidity requirements through the loan facility. This plan has 3 term periods such as:

- 9 year

- 12 years

- 15 years

LIC Money Back Plan for 9 Years

Single-Premium = INR 66816

Sum Assured= 1 Lac

Survival Benefit: Policyholder will get INR 15000/- at the end of Third & sixth year

Maturity Benefit: On the maturity of the policy, the policyholder will get INR 86000 {Total: (survival benefit=15000+15000)+(maturity benefit=86000)=116000}

Death Benefit:

If death takes place throughout 7th Year then the Nominee will get INR 1 Lac

LIC Money Back Plan for 12 Years

Single-Premium = INR 71922

Sum Assured= 1 Lac

Survival Benefit: Policyholder will get INR 15000/- at the end of Third, sixth and ninth year

Maturity Benefit: On the maturity of the policy, the policyholder will get INR 96000 {Total: (survival benefit=15000+15000+15000)+(maturity benefit=96000)=141000}

Death Benefit: If death takes place throughout 9th Year then the Nominee will get INR 1 Lac

LIC Money Back Plan for 15 Years

Single-Premium = INR 74967

Sum Assured= 1 Lac

Survival Benefit: Policyholder will get INR 15000/- at the end of Third, sixth, ninth and twelfth year

Maturity Benefit: On the maturity of the policy, the policyholder will get INR 105000 {Total: (survival benefit=15000+15000+15000+15000)+(maturity benefit= 105000)=165000}

Death Benefit: If death takes place throughout 12th Year then the Nominee will get INR 1 Lac

NOTE:

This plan is suitable for people who need Money Back with a single premium

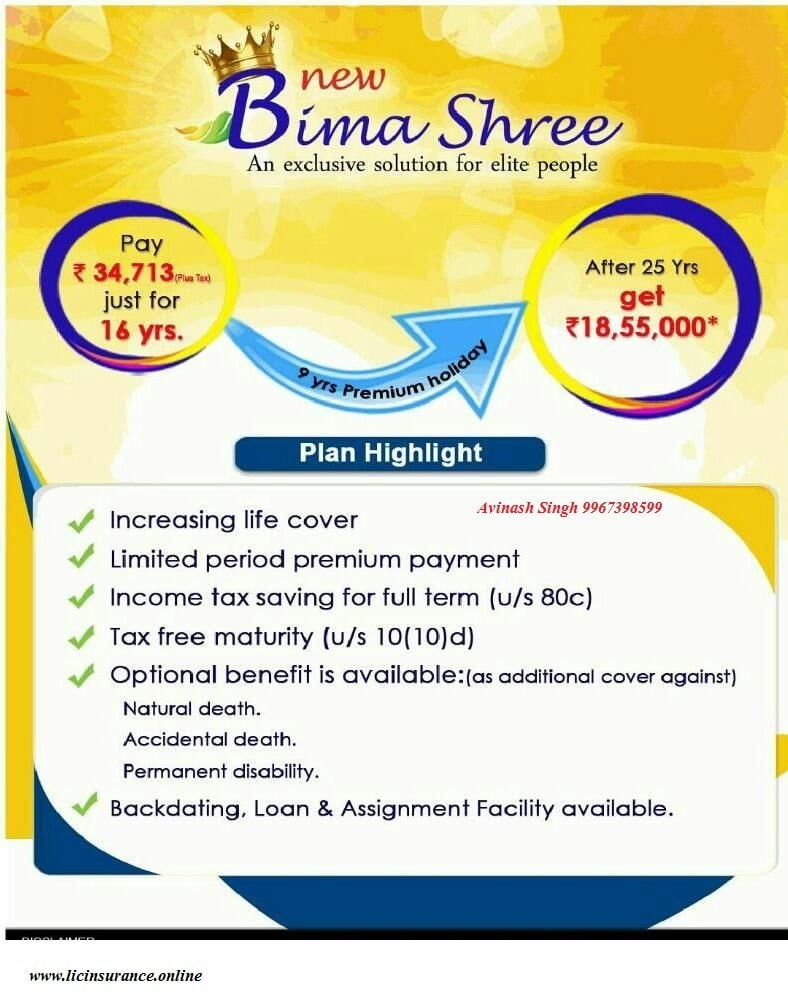

Bima Shree Money Back Plan

LIC’s Bima Shree money back plan provides a combination of security as well as savings. It is specially planned for Great Net-worth Persons. This policy offers monetary support for your family in the case of the disastrous death of the policyholder/s through the policy tenure.

Periodic payments will also be completed on the survival of the policyholder at stated durations throughout the policy tenure as well as a lump-sum reimbursement to the alive policyholder at the period of maturity. This policy also pays attention to liquidity requirements through the loan.

| Conditions & Restriction | 14 years | 16 years | 18 years | 20 years |

|---|---|---|---|---|

| Minimum Basic Sum Assured | INR 10,00,000 | INR 10,00,000 | INR 10,00,000 | INR 10,00,000 |

| Maximum Basic Sum Assured | No Limit | No Limit | No Limit | No Limit |

| Minimum Age at entry | 8 years | 8 years | 8 years | 8 years |

| Maximum Age at entry | 55 years (nearer birthday) | 51 years (nearer birthday) | 48 years (nearer birthday) | 45 years (nearer birthday) |

| Maximum Age at Maturity | 69 years (nearer birthday) | 67 years (nearer birthday) | 66 years (nearer birthday) | 65 years (nearer birthday) |

| Payment of Premiums | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly |

| Sum Assured on Maturity | 40% of Basic Sum Assured | 30% of Basic Sum Assured | 20% of Basic Sum Assured | 10% of Basic Sum Assured |

| Survival Benefit | 30% of Basic Sum Assured on each of 10th and 12th policy anniversary | 35% of Basic Sum Assured on each of 10th and 12th policy anniversary | 40% of Basic Sum Assured on each of 10th and 12th policy anniversary | 45% of Basic Sum Assured on each of 10th and 12th policy anniversary |

Death Benefits:

On death through the first 5 years: The benefit is distinct as sum of the total Sum Assured on the Death of the policyholder as well as accrued addition will be paid.

On the death at the end of 5 years: completing 5 years but beforehand the date of the maturity, the policyholder will get the total sum assured and accrued Loyalty Addition and Guaranteed Addition will be payable.

NOTE:

New Money Back Plan – 20 Years

LIC’s New Money Back Plan-20 years is a contributing non-linked protection cum savings plan, where the policy premium is funded in a lump sum. It’s a money-back policy that offers monetary security against death all through the policy tenure with the facility of payment for survival benefits at stated durations for the period of the policy tenure.

Furthermore, on maturity, the particular premium (if any) will be repaid along with the Loyalty Addition. This LIC’s New Money Back Plan-20 years also pays attention to the liquidity requirements through the loan facility. LIC Money Back Policy For 9 Years

Survival Benefit: At the end of the 5th, 10th and 15th Year the policyholder will get 20% of the total Sum Assured

Maturity Benefit: On the maturity of the policy the policyholder will get 40% of the total Sum Assured as well as Additional benefit LIC Money Back Policy For 9 Years

Death Benefit: The Nominee will get total Sum Assured as well as Bonus

Minimum Entry Age: 13 years

Maximum Entry Age: 50 years

Minimum Sum Assured: 50000

Maximum Sum Assured: No Limit

Premium Paying Mode: Yearly, half-yearly, quarter yearly or single

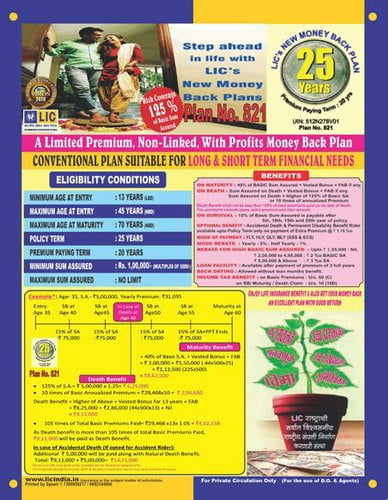

New Money Back Plan – 25 Years

LIC’s New Money Back Plan-25 years is a contributing non-linked protection cum savings plan, where the policy premium is funded in a lump sum. It’s a money-back policy that offers monetary security against death all through the policy tenure with the facility of payment for survival benefits at stated durations for the period of the policy tenure.

Furthermore, on maturity, the particular premium (if any) will be repaid along with the Loyalty Addition. This LIC’s New Money Back Plan-20 years also pays attention to the liquidity requirements through the loan facility.

Survival Benefit: At the end of the 5th, 10th, 15th and 20th Year the policyholder will get 15% of the total Sum Assured

Maturity Benefit: On the maturity of the policy the policyholder will get 40% of the total Sum Assured as well as Additional benefit

Death Benefit: The Nominee will get total Sum Assured as well as Bonus

Minimum Entry Age: 13 years

Maximum Entry Age: 45 years

Minimum Sum Assured: 50000

Maximum Sum Assured: No Limit

Premium Paying Mode: Yearly, half-yearly, quarter yearly or single

Jeevan Shiromani Money Back Plan

LIC’s Jeevan Shiromani Money Back plan provides a combination of security and savings. It is specially planned for High Net-worth Persons. This plan offers monetary provision for the family in the event of the disastrous death of the policyholders throughout the policy period. LIC Money Back Policy For 9 Years

Occasional installments will likewise be made on the endurance of the policyholder at indicated spans during the approach term and a single amount installment to the enduring policyholder at the hour of development. Furthermore, this arrangement likewise accommodates the installment of a singular amount sum equivalent to 10% of the picked Basic Sum Assured on the finding of any of the predetermined Critical Illnesses.

| Conditions & Restriction | 14 years | 16 years | 18 years | 20 years |

|---|---|---|---|---|

| Minimum Basic Sum Assured | INR 100,00,000 | INR 100,00,000 | INR 100,00,000 | INR 100,00,000 |

| Maximum Basic Sum Assured | No Limit | No Limit | No Limit | No Limit |

| Minimum Age at entry | 18 years (completed) | 18 years (completed) | 18 years (completed) | 18 years (completed) |

| Maximum Age at entry | 55 years (nearer birthday) | 51 years (nearer birthday) | 48 years (nearer birthday) | 45 years (nearer birthday) |

| Maximum Age at Maturity | 69 years (nearer birthday) | 67 years (nearer birthday) | 66 years (nearer birthday) | 65 years (nearer birthday) |

| Payment of Premiums | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly | yearly, half-yearly, quarterly or monthly |

| Survival Benefit | 30% of Basic Sum Assured on each of the 10th and 12th policy anniversary. | 35% of Basic Sum Assured on each of the 12th and 14th policy anniversary. | 40% of Basic Sum Assured on each of the 14th and 16th policy anniversary. | 45% of Basic Sum Assured on each of the 14th and 16th policy anniversary. |

| Maturity Benefit | 40% of Basic Sum Assured | 30% of Basic Sum Assured | 20% of Basic Sum Assured | 10% of Basic Sum Assured |

Inbuilt Critical Illness Benefit:

This plan covers critical illness such as Benign Brain Tumor, Open Heart Replacement Or Repair Of Heart Valves, Third Degree Burns, Blindness, Alzheimer’s Disease/ Dementia, Primary (Idiopathic) Pulmonary Hypertension, Aortic Surgery, Multiple Sclerosis With Persisting Symptoms, Permanent Paralysis Of Limbs, Stroke Resulting In Permanent Symptoms, Major Organ /Bone Marrow Transplant, Kidney Failure Requiring Regular Dialysis, Myocardial Infarction, Open Chest Cabg, Cancer Of Specified Severity, etc.

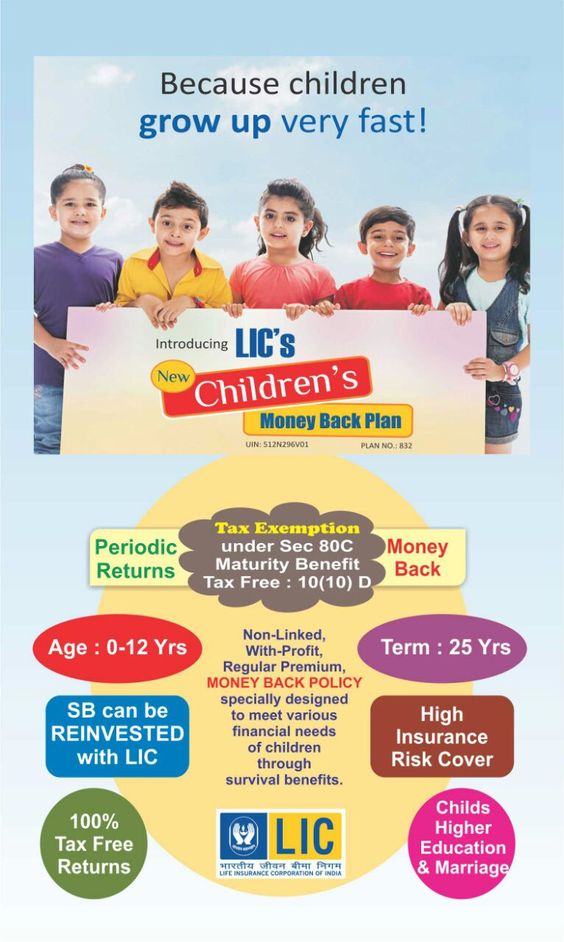

New Children’s Money Back Plan

LIC’s New Children’s Money Back Plan is taking part in a non-connected Money-back arrangement. This arrangement is uniquely intended to meet the instructive, marriage and different needs of developing youngsters through Survival Benefits. Furthermore, it accommodates the hazard spread on the life of kid during the strategy term and for the number of endurance benefits on getting by to the finish of the predetermined lengths.

You can purchase by any of the grandparents or parents for a child aged between 0-12 years. LIC Money Back Policy For 9 Years

Survival Benefit:

On the Life Assured enduring the arrangement commemoration concurring with or promptly following the consummation of ages 18 years, 20 years and 22 years, 20% of the Basic Sum Assured on each event will be payable, given the approach is in full power.

Maturity Benefit:

On the Life guaranteed enduring the stipulated date of development, given the approach is in full power, Sum Assured on Maturity ( which is 40% of the Basic Sum Assured) alongside vested Simple Reversionary Bonuses and Final Additional Bonus, assuming any, will be payable. LIC Money Back Policy For 9 Years

Death benefit:

On the death of the Life Assured before the stipulated Date of Maturity gave the strategy is in full power, at that point on the death of the Life Assured before the date of the beginning of hazard: Return of premium/s barring charges, additional premium, and rider premium, assuming any.

Jeevan Tarun Money Back Plan

LIC’s Jeevan Tarun is a taking an interest non-connected restricted premium installment plan which offers an alluring mix of insurance and sparing highlights for youngsters.

This arrangement is uniquely intended to meet the instructive and different needs of developing kids through yearly Survival Benefit installments from ages 20 to 24 years and Maturity Benefit at 25 years old years.

It is an adaptable arrangement wherein at proposition organizes the proposer can pick the extent of Survival Benefits to be profited during the term of the approach according to the accompanying four alternatives:

| Conditions & Restriction | Option 1 | Option 2 | Option 3 | Option 4 |

|---|---|---|---|---|

| Policy Anniversary following the end of ages (20 to 24) | Nil | 5% each year | 10% each year | 15% each year |

| Maturity Age | 100% | 75% | 50% | 25% |

| Survival Benefit | No survival benefit | 5% of Sum Assured every year for 5 years | 10% of Sum Assured every year for 5 years | 15% of Sum Assured every year for 5 years |

| Maturity Benefit | 100% of the total Sum Assured | 75% of the total Sum Assured | 50% of the total Sum Assured | 25% of the total Sum Assured |

FAQ Regarding LIC’s Money Back Plans:

Q. Is LIC money back policy good?

A. If you need protection as well as an investment then the LIC money back plan is definitely a good plan for you.

Q. What is the maturity amount of money back policy?

A. The maturity amount of money back policy depends on the type of money back plan from LIC. To check the maturity amount of different money back plans click here.

Q. Which is the best money back policy in LIC?

A. There are several money-back policies in LIC. But which one is the best that depends on the buyer’s requirements. So to know to check out all the details of the money back plan here.

Q. What is new money back policy 25 years?

A. LIC’s New Money Back Plan-25 years is a contributing non-linked protection cum savings plan, where the policy premium is funded in a lump sum. Know more here.

Q. How is LIC money back policy?

A. Unlike regular endowment insurance policies where you get survival benefits only at the completion of your endowment term, the LIC money back policy provides periodic payments of the incomplete survival benefits in this manner during the tenure of your policy. However, of course, as long as the policyholder is alive.

Q. What is LIC survival benefits?

A. LIC’s Survival Benefit means it pays to the policyholder, on the terms and conditions of the insurance policy, on the policyholder’s survival at an interval, calculated from the date of the beginning of the policy.

Related Articles:-

- What Is Venture Capital Fund In India?

- How To Claim PF Online | Hassle-Free Method

- Senior Citizen Concessions & Facilities in India

- Benefits Of Personal Accident Insurance Policy

- What Is ECGC Policy In India?

- A Brief Idea On ESI, TDS & PF Payment Due Dates

- HDFC Term Insurance Plan: Here Is All You Need To Know

- Know About Best Money Back Policy In India

- What Is Endowment Policy & The Types Of Endowment Policy