We all know about life insurance plans in India. But there are also other types of insurance plans available out there that are great for businessmen. We can’t deny that you’ll have greater peace of mind when you know that you are protected.

Uncertainties in our lives could crop up anytime, like a medical emergency or an unfortunate death of you or any of your employees. These situations include damage or accidents to your property, vehicle, and so many more.

Bearing the economic effect of these problems can make a hole in a businessman’s pocket. A businessman may have to dip into their savings or their family’s hard-earned funds. Thus, you need to get coverage for your business.

What Is Insurance?

Table of Contents

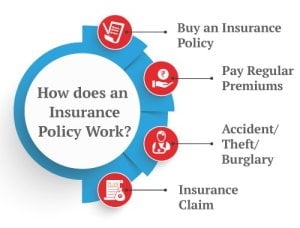

The insurer, meaning the insurance company gives financial protection to the insured in any type of insurance plan. The insurance provider guarantees to cover the insured’s damages should the insured scenario materialize.

The occurrence that results in a loss is the contingency. It may be the policyholder’s passing away or the property being harmed or destroyed. It is called a contingency because there is a chance that the event won’t occur. In exchange for the insurer’s promise, the insured pays a premium.

This could be any insurance starting from a whole life insurance policy, Unit Linked insurance plan, child insurance plan, basic life insurance policy, term life insurance policy, etc.

There are several types of life insurance policies. These life insurance policies offer death benefits, life cover, sum assured, maturity benefits, and other financial support.

What Is Business Insurance?

IMAGE: https://media.freshbooks.com/wp-content/uploads/2022/03/business-insurance.jpg

Business insurance is a type of insurance that aids a business in defending its financial resources, intellectual property, and physical location against an unanticipated event that results in significant financial losses.

It protects the insured company against any harm or loss caused by calamities, theft, vandalism, lawsuits, lost income, illnesses, accidents, or deaths of employees.

Business insurance shields organizations from any monetary loss or harm sustained as a result of normal business activities. A policyholder receives protection from risks relating to workers, property damage, and legal liabilities.

Such occurrences could seriously harm your company. It frequently results in the partial or total closure of the business, which causes a loss of revenue.

Types of Business Insurance Plans

IMAGE: https://cdn.shopify.com/s/files/1/0070/7032/files/types-of-business-insurance.jpg?v=1660597104

Parties injured by your business actions are compensated by commercial liability insurance. You must be aware that defective products might harm innocent bystanders, even though consumers are most likely to suffer injury.

Suppose that a propane tank used by your company explodes unexpectedly. Business fire and risk coverage protects your organization’s assets in case of destructive and unforeseen events.

Your state government mandates the purchase of certain forms of business insurance, such as worker’s compensation insurance, which safeguards your employees in workplace accidents, and unemployment insurance, which assists employees in surviving job losses.

Insurance Policies for a Business

IMAGE: https://cmmonline.com/wp-content/uploads/Insurance-concept-1334574095-feat-1200×627.jpg

Insurance serves as a form of financial protection or risk reduction against potential unforeseen difficulties. The insurer evaluates any potential difficulty and pays according to the established policy.

Such a sum is referred to as “Sum Assured” “Sum Insured” or “Insured Value” etc. It is crucial to understand how insurance can enhance our lives.

Small business owners require insurance to safeguard their way of life, just as individuals do to shield themselves and their possessions from harm or liability.

Similar to personal property insurance, commercial insurance can be customized to the needs of businessmen. Small businesses can be covered by a variety of business insurance products.

So, here are the different types of insurance plans for your business. Here are the types of business insurance plans.

General Liability Insurance Plans

You are liable as a business owner for your careless behaviour as well as that of your staff. Your general liability insurance shields you from lawsuits alleging negligence and covers situations like visitor injury. It also includes slander, libel, and false or deceptive advertising, as well as any property damage you do while conducting business.

Product Liability Insurance Plans

If your company produces and sells a product, then the product liability insurance will protect against a flaw that results in damage to people or property. For instance, your product liability insurance would cover losses if you own a bakery and one of your clients contracts food poisoning as a result of your carelessness.

Professional Liability Insurance Plans

Professionals including lawyers, doctors, and insurance agents are covered by a particular sort of liability insurance called professional liability. Malpractice insurance and errors and omissions (E&O) coverage are two common types of professional liability.

Professional liability insurance deals with negligence from provided services, as opposed to product liability, which insures losses brought on by tangible products. A typical instance is when a patient sues a doctor after receiving subpar care or a flawed diagnosis.

Business Property Insurance Plans

Commercial property, including a facility or tools required for operations, is covered by a typical commercial property insurance policy. For instance, property insurance frequently pays out if a fire or other natural disaster ruins a company’s premises.

Commercial Property Insurance Plans

When your company’s property is damaged, commercial property insurance offers protection. For instance, if you own a furniture store and it completely burns down by the fire, the property insurance will cover the cost of replacing both the structure with the terms of your policy.

If covered damages lead to a stoppage of your business operations, it may also assist you in replacing lost income.

Business Liability Insurance Plans

Losses sustained by customers are covered by company liability insurance. For instance, liability insurance might pay for medical expenses if a customer is injured while on the premises of the business due to a slip as well as a fall accident.

Some insurance providers combine liability, auto, and property coverage into a single policy known as a business owner’s policy (BOP).

Errors And Omissions Insurance Plans

E&O insurance, commonly known as professional liability insurance, compensates damages brought on by errors or omissions made by company professionals while performing their duties.

This kind of insurance coverage may cover the loss, for example, in case a consultant fails to advise a client of crucial information about a project, resulting in a loss of revenue. Professionals like doctors, architects, and lawyers are among those who occasionally buy this insurance.

Auto Insurance Plans

You will require auto insurance in addition to your policy if your company has a vehicle, for example, a delivery van, or in case you operate a fleet of vehicles.

If you or a member of your staff is injured in a collision or if the car is stolen or vandalized, a commercial auto insurance plan will protect you.

If the company car you are driving damages property or injures someone else, the liability element of the insurance will protect you.

Workers’ Compensation And Unemployment Insurance Plans

Businesses with employees must have worker’s compensation insurance coverage. In the event of an accident at work, this insurance will cover the lost wages.

It is typical for jobs that need physical effort or exertion. Employees must generally be covered by unemployment insurance, which is often administered by the state and paid for by an employment tax on companies.

Is It Mandatory By Law to Get A Commercial Liability Insurance Policy?

A mistake or overlook can cost your firm a lot in a litigious environment. You can be forced to cover legal bills, court charges, and any damages your company creates. A commercial liability insurance plan is a smart investment as a result, although it’s not usually required by law.

However, if your line of work entails activities that necessitate insurance, such as driving, you will be required to buy liability insurance.

Legal Requirements

It’s not needed by law for you to buy commercial liability insurance. However, where it is otherwise mandated by law, you will need to get insurance. For instance, auto insurance is a legal requirement in every state, so any company vehicles you own must be covered.

Often government needs insurance documentation as a condition of granting a business license to high-risk enterprises, while certain venues demand liability insurance.

For instance, it is not legally essential for wedding photographers to carry liability insurance. However, some wedding locations might demand that you have liability insurance before they’ll let you take pictures there.

Lawsuits

Even though liability insurance is not needed, not having it could get you into legal trouble. Defending even a minor lawsuit can cost thousands of rupees in legal fees. In case you do not have a sizable emergency fund, a single lawsuit could cause you to go bankrupt.

The judge could place a lien on the property if you lose and are unable to pay the money. A lawsuit may potentially force a company into bankruptcy.

Why Is Insurance Important For Everyone?

At a certain point in our lives, all of us aspire to financial freedom, and as soon as it comes to achieving it, we frequently think that having money is sufficient to maintain financial stability.

But if you approach life realistically, you will realize that general insurance plans are just as crucial to protecting your possessions as saving money; they are necessary to achieve financial freedom.

However, some people think they can save sufficient funds to replace their valuables in the event of an accident, thus they do not need general insurance plans.

But imagine yourself in a position where you must spend everything you have ever saved to pay for medical expenses or a car that is beyond repair.

After a traumatic event, insurance acts as a financial cushion to assist you or your family in recovering financially. Both families and businesses can gain a great deal from insurance.

Provides Financial Support

Without insurance, it’ll be very expensive for firms to recover from a significant inventory loss. The financial stability of a family or a business might be impacted by natural disasters, accidents, theft, or burglary. Businesses and households can recover rather quickly when a major portion of the losses are covered by insurance.

Distributes To Large Damages

A financial tool is an insurance. A large number of individuals exposed to the same potential in a firm bear the risk of suffering significant loss as a result of an incident. As a result, the losses are shared across a wide number of people, making them tolerable for each person.

Offers Long-Term Wealth

Insurance, especially life insurance, is frequently a long-term commitment. Plans for life insurance can last for more than 3 decades. If they survive, they will amass a sizable sum of wealth that will be returned to the investor. If not, their family inherits the money.

Helps Financial Growth

The money that insurance firms pool is considerable. A portion of this money may be invested in assisting government investment initiatives.

Insurance companies only invest in government assets due to safety concerns. Alternatively, for significant public initiatives that promote economic growth, governments can readily raise money from insurers.

What Is the Importance of Insurance To The Businessman?

You are well aware of how erratic life can be. Any unforeseen disaster, such as the passing of a spouse or the family’s sole provider, could endanger a family’s financial stability. A businessman should have life insurance since it can aid the policyholder’s loved ones in recovering financially.

A term plan offers substantial coverage at a reasonable price. Additionally, alternatives for coverage for permanent and total disability are frequently included.

However, you can add riders or covers, such as critical illness insurance, premium waivers, and accidental death riders, among others, to your current term insurance plan to complement its basic coverage.

You must make an extra payment along with all your insurance paperwork on hand to receive these benefits. These riders, though optional and chargeable extras are not required.

In the event of a horrible calamity, a life insurance cover will offer financial protection to a business owner’s family. Life insurance schemes can help with family members’ basic financial necessities as well as the repayment of any loans or other commitments accrued during the startup and ongoing operations of the business.

Thus, it is important to buy life insurance riders or whole life insurance policies. Buying a life insurance plan will provide you with financial security, death benefits, etc here are some other benefits that you will get from an insurance plan:

Family’s Financial Safety

After you have a family, insurance becomes even more important because your family depends on your financial support to maintain a respectable standard of living. It suggests that, in the event of an unexpected event, the people in your life who are most important may be protected from facing financial hardship.

Insurance records are required to demonstrate the validity of an insurance contract because an insurance plan is a legal transaction. As a result, to receive the benefits, you must have all the necessary documentation.

Stress-Free Life

Nobody can predict what will occur next. Unexpected tragedies like illness, accident, lifelong disability, or even death can leave you as well as your family feeling incredibly unhappy and stressed out.

The main benefit of an insurance plan to a businessman is that having it reduces the financial load on you or your family. You’ll be able to concentrate on recovery and life restoration.

Peace Of Mind

Your well-being, your contribution to your family, and your health cannot be replaced by money. You can rest assured, though, that insurance would help to ensure your family’s financial security in the event of your passing. You must have all the paperwork needed to get an LIC policy if you intend to purchase life insurance.

Source of Extra Income

A businessperson who purchases life insurance with maturity benefits might amass significant sums of money. They can use this cash to expand their company, which spurs the nation’s economy. Such significant investments improve employment chances.

What Are The Need for Insurance Plans?

Insurance plans are beneficial to anyone looking to protect their family, assets/property, and themselves from a financial risk/loss

- Insurance plans will assist you in paying for future medical care, hospitalization, contracting any illnesses, and treatment

- The insurance plan will assist in safeguarding your child’s educational future. Even when you’re not around, they will ensure that your kids are financially stable and can pursue their goals without restraints.

- Insurance policies can help to offset the family’s financial loss caused by the untimely demise of the family’s primary source of income. The family can even pay off any bills that the insured individual may have racked throughout of his or her lifetime, such as mortgages or other debt that you pass away in the future, the insurance coverage will assist your family in maintaining their quality of life.

- This will assist them in paying for home expenses through the lump sum insurance payout. The insurance money will provide your family with much-needed breathing room and pay all expenses in the event of the policyholder’s death, accident, or medical emergency.

- Along with basic coverage, many insurance policies also include savings and investment options. These aid in saving money and accumulating wealth through frequent investments. You routinely pay premiums, with a share going toward life insurance and the other toward either a savings or investment plan, depending on your goals and needs for the future.

- If any unforeseeable disaster or catastrophe comes, insurance can assist in securing your house. Your home insurance policy will assist you in obtaining coverage for home damages and pay for the price of repairs or reconstruction, as necessary. If you have insurance coverage for assets and goods inside the home, you can use the money to buy replacement items.

Helps With Long-Term Goals

The ability to save money and expand it is one of life insurance’s most significant advantages. You can use this sum to achieve your long-term objectives, such as purchasing a home, launching a business, and saving for your child’s school or wedding, among other things.

Good for Retirement Planning

You can maintain your financial independence even after you retire by purchasing life insurance. Plans for life insurance and annuities give you annuity payments for the rest of your days. They are low-risk strategies that assist you in sustaining your way of life, covering medical costs, and achieving your post-retirement objectives.

Provides Tax Benefits

You can save on taxes* now and in the future by planning with life insurance. Under the terms of Section 80C of the Income Tax Act of 1961, the policy’s premium payments are eligible for tax deductions of up to 1.5 lahks annually.

You can avoid paying taxes up to 46,800 each year. Additionally, the sums received under the policy are exempt* as long as they comply with the requirements of Section 10(10D) of the Income Tax Act of 1961.

- Section 80C allows for the tax-saving deduction of life insurance premiums up to 1.5 lakhs.

- Section 80D allows you to deduct up to 25,000 in medical insurance premiums paid for you, your family, and your parents while also saving money on taxes.

SUMMARY

The total of these justifications is sufficient to support the need for insurance. Financial freedom and peace of mind are mostly attainable thanks to the ease of purchasing insurance online from an all-around insurance provider to protect you, your family, as well as your valuables.

You can purchase insurance coverage offline as well as online, whether it be for life insurance, health insurance, or general insurance. There are websites where you can purchase a policy, just like there are insurance brokers who can assist you in doing so.

Be careful to conduct thorough research before deciding on and purchasing insurance coverage.

Check Related Articles:-

- LIC Agent Commission Chart 2023

- Role Of Insurance Agents | Importance | Responsibilities

- Honest Review of Bima Kiran Policy no 111

- First Insurance Company In India And Its History

- What Are The Basic Functions Of Insurance?

- How Keyman Insurance Policy Works: Know About Its Benefits

- See The Procedure To Mudra Bank Loan Apply Online

- Importance Of Fire Insurance In India

- Progressive Business Insurance Plan Detail

- Know How Insurance Company Makes Money