The renter’s insurance policy is basically a kind of home insurance, which will protect you in case your apartment gets burnt down, or if you’re robbed. Additionally, the renter’s insurance policy comprises of liability protection. Thus, this insurance plan will cover the medical costs in case someone gets hurt inside the apartment during the incident. So, if you are thinking should I get renters insurance to get protection against fire and theft? Then YES you should!

I am saying YES to your question that “should I get renters insurance” only because this is the best way to get protection against fire and theft if you live in a rental apartment. This insurance policy helps the policyholder to replace stuffs that got stolen or damaged due to fire.

The liability insurance under the renter’s insurance plan is also pleasant because it’ll protect your assets as well as your savings that you’ve acquired so far.

What Is Renter’s Insurance?

Table of Contents

Renter’s insurance policy is something all renters should have. So, if you were wondering should I get renters insurance then my answer is, of course, you should. You should get renters insurance because it’s inexpensive yet it will provide coverage against loss from fire, theft, and robbery.

This insurance plan will shield you from paying for everything out of cost. This is one of the items you should never cut from your financial list. It won’t take long to apply for a renter’s insurance plan. It is hassle-free and very effective in protecting you against theft, robbery, and loss from fire.

Should I Get Renters Insurance For Fire & Theft Cover?

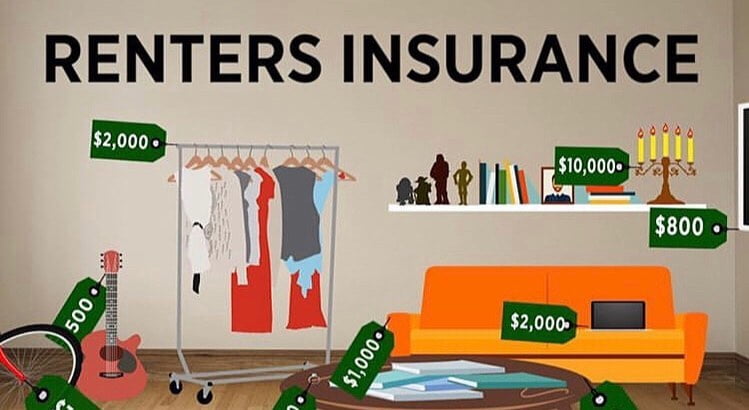

Most landlords and apartment complexes only have the homeowner’s insurance policy that covers the loss to the dwelling. This does not include your belongings such as your furniture, your electronics stuff, your clothes, and whatever vulnerable of yours.

So, in order to protect your own belongings in the case of theft, fire, or robbery, you require your personal policy, which is the renter’s insurance plan. Well, unless you’ve adequate resources to replace all by yourself! So, to your question “should I get renters insurance”, my answer is “of course” you should.

Does The Renters Insurance Worth It?

Less than half of renters have insurance inclusion. For renters who might experience issues supplanting costly family unit things in case of a disaster, renters insurance is certainly justified regardless of the minimal effort. Simply the extra everyday costs alone that money to cover your apartment in the event that a flame makes your place dreadful can be justified, despite all the trouble.

The brain research of insurance can cause purchasing insurance to appear to be a discretionary extravagance. Such a large number of us would prefer not to “squander” cash on insurance and we bank on nothing awful transpiring. However, renters insurance is so minimal effort and gives such cover assurance that it truly doesn’t bode well for any leaseholder to not have it.

Think about along these lines: if your loft gets harmed by a flame, and your renter’s insurance pays for you to remain in an inn for half a month, the $5 to $20 every month we spent on renters insurance will be absolutely, totally justified, despite all the trouble.

Recommended Articles :-

- What Is Homeowners Insurance Cover in India?

- Importance Of Fire Insurance In India

- What Is Theft Insurance & Its Types?

- What Is Fire Insurance In India?

- What Is Livestock Insurance In India

- What Is Professional Indemnity Insurance India?

Conclusion:

You likewise need risk inclusion for harms brought about by carelessness. For example, on the off chance that you inadvertently leave the kitchen sink on and it floods into your neighbors’ loft. Then you could be discovered the subject for that harm, and thus required to pay for fixes, doctor’s visit expenses identified with the mishap, etc. just as barrier costs on the off chance that they bring a suit against you. Tenant’s protection would take care of those expenses.